Question: Security Selection Project FIN 310, Fall 2018 Due Oct. 21, 2018 on eCampus This is a group project. Please make sure all names in your

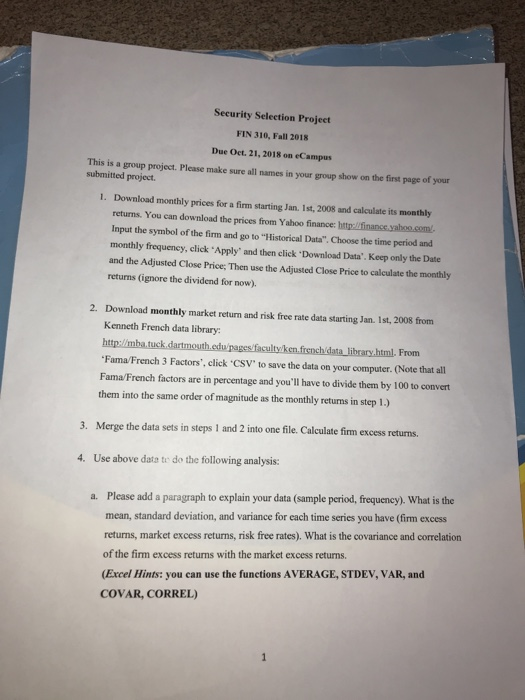

Security Selection Project FIN 310, Fall 2018 Due Oct. 21, 2018 on eCampus This is a group project. Please make sure all names in your group show on the first page of your submitted project 1. Download monthly prices for a firm starting Jan. 1st, 2008 and calculate its monthly returns. You can download the prices from Yahoo finance: btt:/ifinance.yahoo.som Input the symbol of the firm and go to "Historical Data". Choose the time period and monthly frequency, click 'Apply' and then click 'Download Data". Keep only the Date and the Adjusted Close Price:; Then use the Adjusted Close Price to calculate the monthly returns (ignore the dividend for now). Download monthly market return and risk free rate data starting Jan. 1st, 2008 from Kenneth French data library: http://mba.tuck.dartmouth.ed Fama/French 3 Factors', click 'CSV" to save the data on your computer. (Note that all Fama/French factors are in percentage and you'll have to divide them by 100 to convert them into the same order of magnitude as the monthly returns in step 1.) 2. From 3. Merge the data sets in steps 1 and 2 into one file. Calculate firm excess returns. 4. Use above data te do the following analysis: Please add a paragraph to explain your data (sample period, frequency). What is the mean, standard deviation, and variance for each time series you have (firm excess returns, market excess returns, risk free rates). What is the covariance and correlation of the firm excess returns with the market excess returns. (Excel Hins: you can use the functions AVERAGE, STDEV, VAR, and COVAR, CORREL) a. Security Selection Project FIN 310, Fall 2018 Due Oct. 21, 2018 on eCampus This is a group project. Please make sure all names in your group show on the first page of your submitted project 1. Download monthly prices for a firm starting Jan. 1st, 2008 and calculate its monthly returns. You can download the prices from Yahoo finance: btt:/ifinance.yahoo.som Input the symbol of the firm and go to "Historical Data". Choose the time period and monthly frequency, click 'Apply' and then click 'Download Data". Keep only the Date and the Adjusted Close Price:; Then use the Adjusted Close Price to calculate the monthly returns (ignore the dividend for now). Download monthly market return and risk free rate data starting Jan. 1st, 2008 from Kenneth French data library: http://mba.tuck.dartmouth.ed Fama/French 3 Factors', click 'CSV" to save the data on your computer. (Note that all Fama/French factors are in percentage and you'll have to divide them by 100 to convert them into the same order of magnitude as the monthly returns in step 1.) 2. From 3. Merge the data sets in steps 1 and 2 into one file. Calculate firm excess returns. 4. Use above data te do the following analysis: Please add a paragraph to explain your data (sample period, frequency). What is the mean, standard deviation, and variance for each time series you have (firm excess returns, market excess returns, risk free rates). What is the covariance and correlation of the firm excess returns with the market excess returns. (Excel Hins: you can use the functions AVERAGE, STDEV, VAR, and COVAR, CORREL) a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts