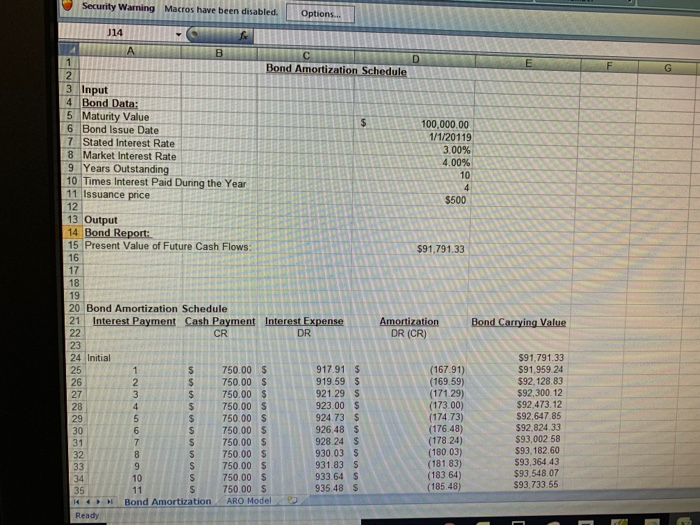

Question: Security Warning Macros have been disabled. Options. Bond Amortization Schedule 3 Input 4 Bond Data: 5 Maturity Value 6 Bond Issue Date 7 Stated Interest

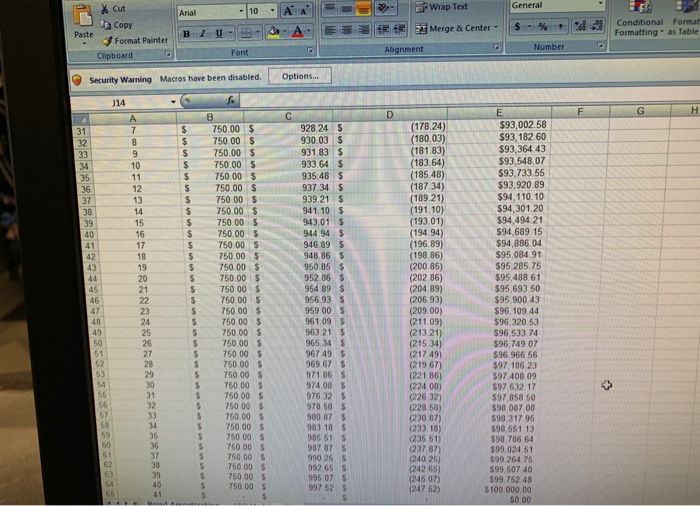

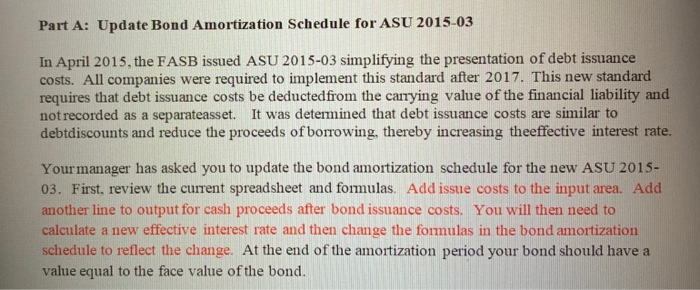

Security Warning Macros have been disabled. Options. Bond Amortization Schedule 3 Input 4 Bond Data: 5 Maturity Value 6 Bond Issue Date 7 Stated Interest Rate 8 Market Interest Rate 9 Years Outstanding 10 Times Interest Paid During the Year 11 Issuance price 12 13 Output 14 Bond Report: 15 Present Value of Future Cash Flows 100,000.00 1/1/20119 3.00% 4.00% 10 $500 $91,791,331 Bond Carrying Value 20 Bond Amortization Schedule 21 Interest Payment Cash Payment Interest Expense DR Amortization DR (CR) CR 24 Initial 750.00 5 750.00 $ 750.00 $ 750.00 S 750.00 $ 750.00 S 750.00 $ 750.00 $ 750.00 5 750.00 $ 750.00 $ ARO Model 917.91 $ 919.59 $ 921.29 S 923.00 $ 924.73 $ 926.48 $ 928 24 5 930.03 $ 931 83 933 64 $ 935 48 S (167.91) (169.59) (171 29) (173.00) (17473) (176.48) (178.24) (180.03) (181.83) (183.64 (185.48) $91,791.33 $91,959 24 592,128.83 $92,300.12 $92.473.12 $92,647.85 $92,824.33 $93.002.58 $93.182.60 $93,364 43 $93.548 07 $93.733 55 Bond Amortization & cut Copy Format Painter Clipboard Paste Arial 10A BIURO A Font E33 E R Wrap Ted E E Merge & Center Alignment General $ Number 828 Conditional Forma On Formatting as Table Security Warning Macros have been disabled Options.. J14 - f 834 750.00 $ 750 00 S 750.00 $ 750.00 $ 750.00 $ 750.00 $ 750 00 $ 750.00 $ 750.00 $ 750.00 5 750.00 $ 750.00 $ 75000 $ 750.00 $ 750 00$ 750.00 5 750.00 $ 750.00 $ 750 00 S 750 00 S 750 00 S 750.00 $ 75000 $ 750 00 75000 $ 750.00 5 750.00 $ 750 00 $ 750 00 750 00 750 DO 5 750 00 750.00 750 00 2382838988989888 928 24 5 930.03 $ 931.83 $ 933 645 935.48 $ 937.34 $ 939.21 $ 941 10 $ 943 01 5 944.94 $ 946 39 $ 948 36 $ 950 85 S 952 86 $ 954 89 $ 956 93 $ 959 00 S 961 09 $ 963 21 S 965.34 $ 96749 $ 969.67 $ 971 36 S 974 085 976 325 978585 900 875 983 18 $ 905 515 987875 950 255 992 65 5 995 075 99752S (178.24) (180.03) (181.83) (183.64) (185.48) (18734) (189.21) (191.10) (193.01) (19494) (196.89) (198.86) (200 85) (202 86) (20489) (206.93) (209.00) (211.09) (213 21) (21534) (21749) (21967 (22186) (22408) (226 32) (22853) (2008) (233 18) 235 51) 237 07) 10 25 2.12 65) 1245 07) 12:47 523 $93.002.58 $93, 182.60 $93,364.43 $93,548.07 $93.733.55 $93,920.89 $94.110.10 $94,301.20 $94.494 21 $94.689.15 $94.886.04 $95.084.91 $95 285 75 $95.488 61 $95 593 50 $95.900.43 $96. 109 44 596 320.53 596,533.74 $96 749 07 S96.966 56 $97.186 23 $97 408 09 597 612 17 397 358 50 598 087 08 $98.317.95 398 551 13 598.786 64 $99 024 51 $99.26475 599 507.40 $99.752 48 $100.000.00 $0 00 28 Part A: Update Bond Amortization Schedule for ASU 2015-03 In April 2015, the FASB issued ASU 2015-03 simplifying the presentation of debt issuance costs. All companies were required to implement this standard after 2017. This new standard requires that debt issuance costs be deducted from the carrying value of the financial liability and not recorded as a separateasset. It was determined that debt issuance costs are similar to debtdiscounts and reduce the proceeds of borrowing, thereby increasing theeffective interest rate. Your manager has asked you to update the bond amortization schedule for the new ASU 2015- 03. First, review the current spreadsheet and formulas. Add issue costs to the input area. Add another line to output for cash proceeds after bond issuance costs. You will then need to calculate a new effective interest rate and then change the formulas in the bond amortization schedule to reflect the change. At the end of the amortization period your bond should have a value equal to the face value of the bond. Security Warning Macros have been disabled. Options. Bond Amortization Schedule 3 Input 4 Bond Data: 5 Maturity Value 6 Bond Issue Date 7 Stated Interest Rate 8 Market Interest Rate 9 Years Outstanding 10 Times Interest Paid During the Year 11 Issuance price 12 13 Output 14 Bond Report: 15 Present Value of Future Cash Flows 100,000.00 1/1/20119 3.00% 4.00% 10 $500 $91,791,331 Bond Carrying Value 20 Bond Amortization Schedule 21 Interest Payment Cash Payment Interest Expense DR Amortization DR (CR) CR 24 Initial 750.00 5 750.00 $ 750.00 $ 750.00 S 750.00 $ 750.00 S 750.00 $ 750.00 $ 750.00 5 750.00 $ 750.00 $ ARO Model 917.91 $ 919.59 $ 921.29 S 923.00 $ 924.73 $ 926.48 $ 928 24 5 930.03 $ 931 83 933 64 $ 935 48 S (167.91) (169.59) (171 29) (173.00) (17473) (176.48) (178.24) (180.03) (181.83) (183.64 (185.48) $91,791.33 $91,959 24 592,128.83 $92,300.12 $92.473.12 $92,647.85 $92,824.33 $93.002.58 $93.182.60 $93,364 43 $93.548 07 $93.733 55 Bond Amortization & cut Copy Format Painter Clipboard Paste Arial 10A BIURO A Font E33 E R Wrap Ted E E Merge & Center Alignment General $ Number 828 Conditional Forma On Formatting as Table Security Warning Macros have been disabled Options.. J14 - f 834 750.00 $ 750 00 S 750.00 $ 750.00 $ 750.00 $ 750.00 $ 750 00 $ 750.00 $ 750.00 $ 750.00 5 750.00 $ 750.00 $ 75000 $ 750.00 $ 750 00$ 750.00 5 750.00 $ 750.00 $ 750 00 S 750 00 S 750 00 S 750.00 $ 75000 $ 750 00 75000 $ 750.00 5 750.00 $ 750 00 $ 750 00 750 00 750 DO 5 750 00 750.00 750 00 2382838988989888 928 24 5 930.03 $ 931.83 $ 933 645 935.48 $ 937.34 $ 939.21 $ 941 10 $ 943 01 5 944.94 $ 946 39 $ 948 36 $ 950 85 S 952 86 $ 954 89 $ 956 93 $ 959 00 S 961 09 $ 963 21 S 965.34 $ 96749 $ 969.67 $ 971 36 S 974 085 976 325 978585 900 875 983 18 $ 905 515 987875 950 255 992 65 5 995 075 99752S (178.24) (180.03) (181.83) (183.64) (185.48) (18734) (189.21) (191.10) (193.01) (19494) (196.89) (198.86) (200 85) (202 86) (20489) (206.93) (209.00) (211.09) (213 21) (21534) (21749) (21967 (22186) (22408) (226 32) (22853) (2008) (233 18) 235 51) 237 07) 10 25 2.12 65) 1245 07) 12:47 523 $93.002.58 $93, 182.60 $93,364.43 $93,548.07 $93.733.55 $93,920.89 $94.110.10 $94,301.20 $94.494 21 $94.689.15 $94.886.04 $95.084.91 $95 285 75 $95.488 61 $95 593 50 $95.900.43 $96. 109 44 596 320.53 596,533.74 $96 749 07 S96.966 56 $97.186 23 $97 408 09 597 612 17 397 358 50 598 087 08 $98.317.95 398 551 13 598.786 64 $99 024 51 $99.26475 599 507.40 $99.752 48 $100.000.00 $0 00 28 Part A: Update Bond Amortization Schedule for ASU 2015-03 In April 2015, the FASB issued ASU 2015-03 simplifying the presentation of debt issuance costs. All companies were required to implement this standard after 2017. This new standard requires that debt issuance costs be deducted from the carrying value of the financial liability and not recorded as a separateasset. It was determined that debt issuance costs are similar to debtdiscounts and reduce the proceeds of borrowing, thereby increasing theeffective interest rate. Your manager has asked you to update the bond amortization schedule for the new ASU 2015- 03. First, review the current spreadsheet and formulas. Add issue costs to the input area. Add another line to output for cash proceeds after bond issuance costs. You will then need to calculate a new effective interest rate and then change the formulas in the bond amortization schedule to reflect the change. At the end of the amortization period your bond should have a value equal to the face value of the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts