Question: See Practice Homework 12-48, IRR portion and Example 12.4 on page 657 Use the present value tables on pages 670 & 671 Exhibits 12B.1 &

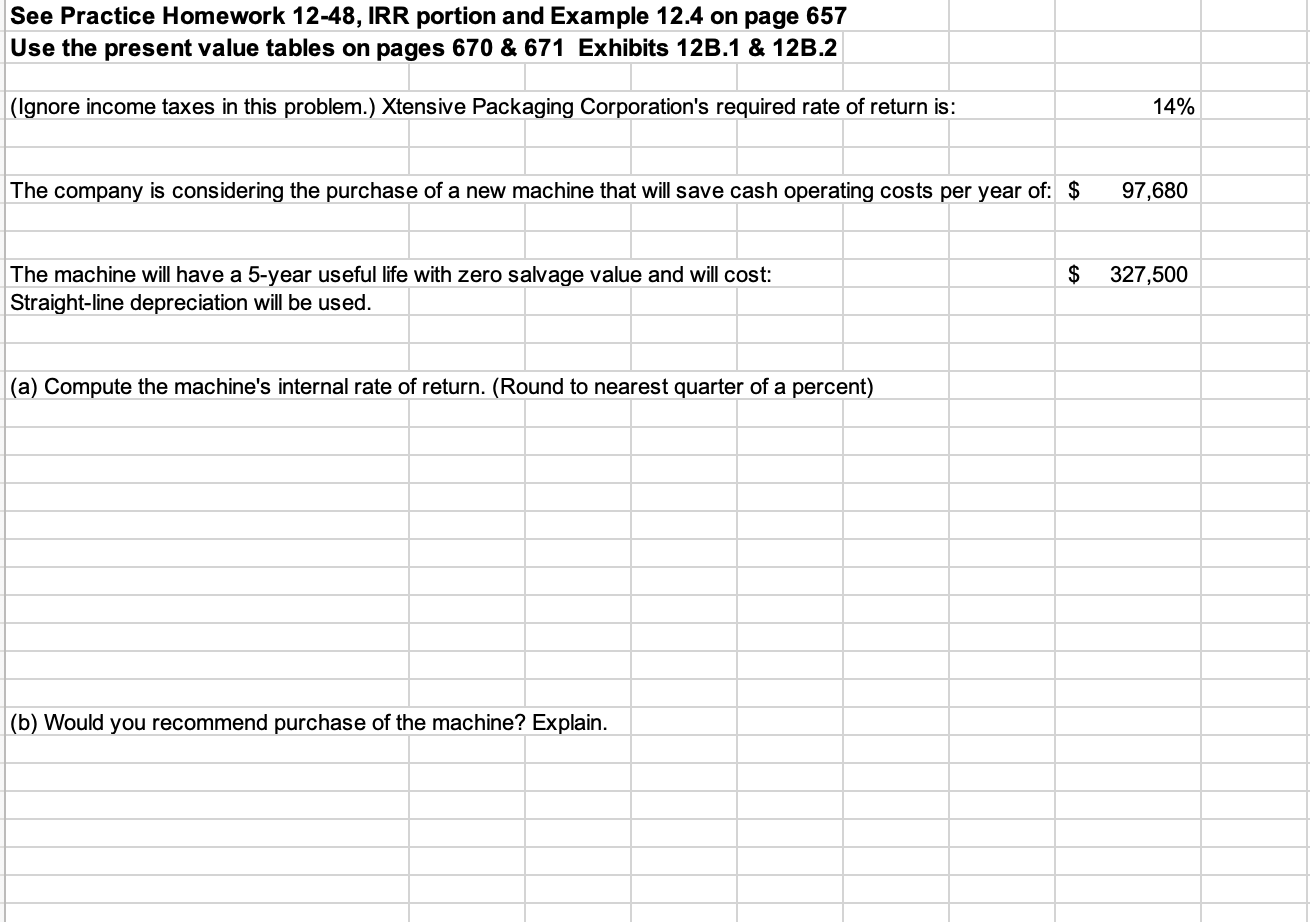

See Practice Homework 12-48, IRR portion and Example 12.4 on page 657 Use the present value tables on pages 670 & 671 Exhibits 12B.1 & 12B.2 (Ignore income taxes in this problem.) Xtensive Packaging Corporation's required rate of return is: 14% The company is considering the purchase of a new machine that will save cash operating costs per year of: $ 97,680 $ 327,500 The machine will have a 5-year useful life with zero salvage value and will cost: Straight-line depreciation will be used. (a) Compute the machine's internal rate of return. (Round to nearest quarter of a percent) (b) Would you recommend purchase of the machine? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts