Question: See Table 2.5 - showing financial statement data and stock price data for Mydeco Corp. Suppose Mydeco had purchased additional equipment for $12 million at

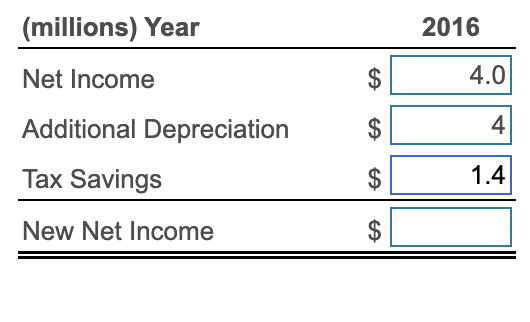

See Table 2.5 - showing financial statement data and stock price data for Mydeco Corp. Suppose Mydeco had purchased additional equipment for $12 million at the end of 2016, and this equipment was depreciated by $4 million per year in 2017, 2018, and 2019. Given Mydeco's tax rate of 35%, what impact would this additional purchase have had on Mydeco's net income in years 2016-2019? (Assume the equipment is paid for out of cash and that Mydeco earns no interest on its cash balances.)

Calculate the new net income below: (Round to one decimal place.)

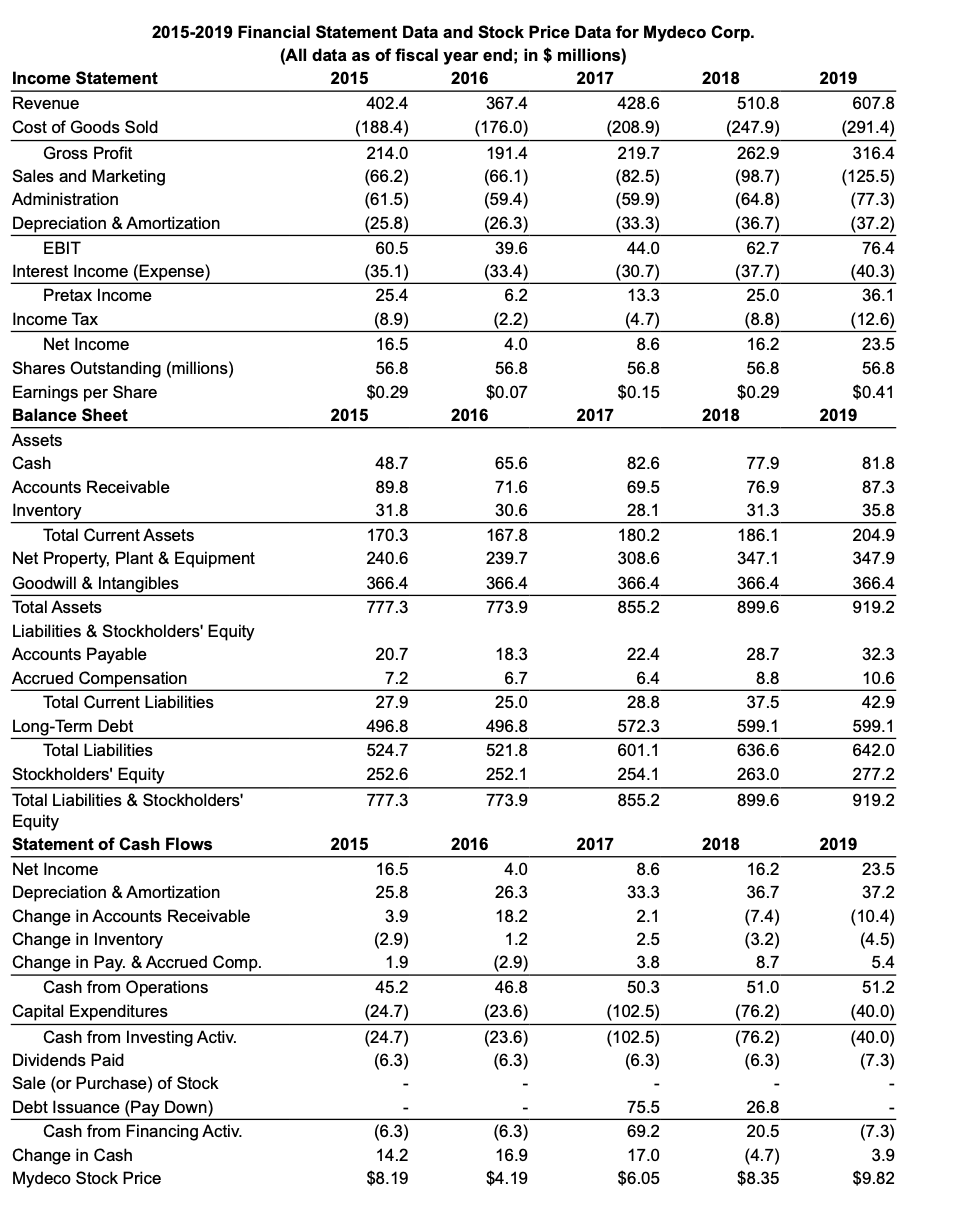

2015-2019 Financial Statement Data and Stock Price Data for Mydeco Corp. (All data as of fiscal year end; in \$ millions) 2015-2019 Financial Statement Data and Stock Price Data for Mydeco Corp. (All data as of fiscal year end; in \$ millions)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts