Question: See the cash flow statement below Reported in form 10-K for Kraft Heinz Corp. as of and for the year ended December 25, 2021. Use

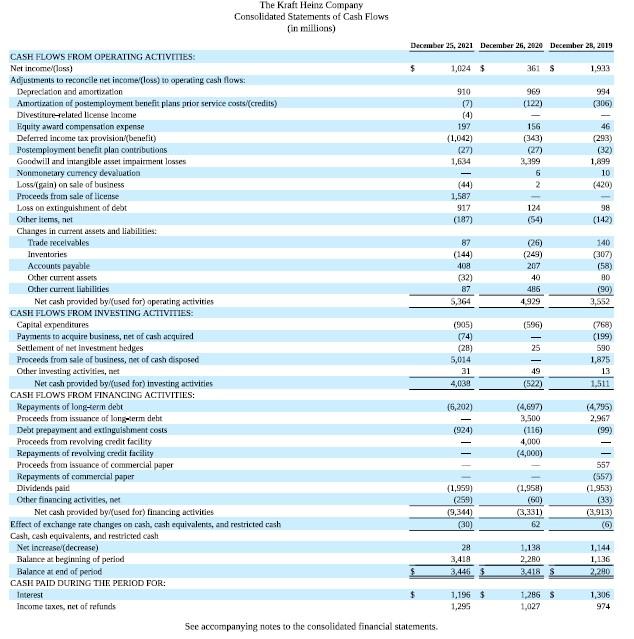

See the cash flow statement below Reported in form 10-K for Kraft Heinz Corp. as of and for the year ended December 25, 2021. Use it for the following questions.

1 What was the net cash provided by or used by financing activities for each of the two most recent fiscal year ends (12/25/21 and 12/26/20)? Make sure to state whether the amounts are in thousands or millions and whether they are net inflows or outflows.

2 What is the main reason the net financing cash flow changed so much during the past year?

The Kraft Heinz Company Consolidated Statements of Cash Flows (in millions) CASH FLOWS FROM OPERATING ACTIVITIES: Net income (loss) Adjustments to reconcile net income (loss) to operating cash flows: Depreciation and amortization Amortization of postemployment benefit plans prior service costs/(credits) Divestiture-related license income Equity award compensation expense Deferred income tax provision/(benefit) Postemployment benefit plan contributions Goodwill and intangible asset impairment losses Nonmonetary currency devaluation Loss/(gain) on sale of business Proceeds from sale of license Loss on extinguishment of debt Other items, net Changes in current assets and liabilities: Trade receivables Inventories Accounts payable Other current assets Other current liabilities Net cash provided by/(used for) operating activities CASH FLOWS FROM INVESTING ACTIVITIES: Capital expenditures Payments to acquire business, net of cash acquired Settlement of net investment hedges Proceeds from sale of business, net of cash disposed Other investing activities, net Net cash provided by/(used for) investing activities CASH FLOWS FROM FINANCING ACTIVITIES: Repayments of long-term debt Proceeds from issuance of long-term debt Debt prepayment and extinguishment costs Proceeds from revolving credit facility Repayments of revolving credit facility Proceeds from issuance of commercial paper Repayments of commercial paper Dividends paid Other financing activities, net Net cash provided by/(used for) financing activities. Effect of exchange rate changes on cash, cash equivalents, and restricted cash Cash, cash equivalents, and restricted cash Net increase/(decrease) Balance at beginning of period Balance at end of period CASH PAID DURING THE PERIOD FOR: Interest Income taxes, net of refunds December 25, 2021 December 26, 2020 December 28, 2019 1,024 $ 361 S 1,933 910 969 994 (122) (306) 156 (343) (27) See accompanying notes to the consolidated financial statements. (7) (4) 197 (1,042) (27) 1,634 (44) 1,587 917 (187) 87 (144) 408 (32) 87 5,364 (905) (74) (28) 5,014 31 4,038 (6,202) (924) (1,959) (259) (9,344) (30) 28 3,418 3,446 $ 1,196 $ 1,295 3,399 6 2 - 124 (26) (249) 207 40 486 4,929 (596) 25 - 49 (522) (4,697) 3,500 (116) 4,000 (4,000) (1,958) (60) (3,331) 62 1,138 2,280 3.418 S 1,286 $ 1,027 | 45 46 (293) (32) 1,899 10 (420) 98 (142) 140 (307) (58) 80 (90) 3,552 (768) (199) 590 1,875 13 1,511 (4,795) 2,967 (99) 557 (557) (1,953) (33) (3,913) (6) 1,144 1,136 2,280 1,306 974

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts