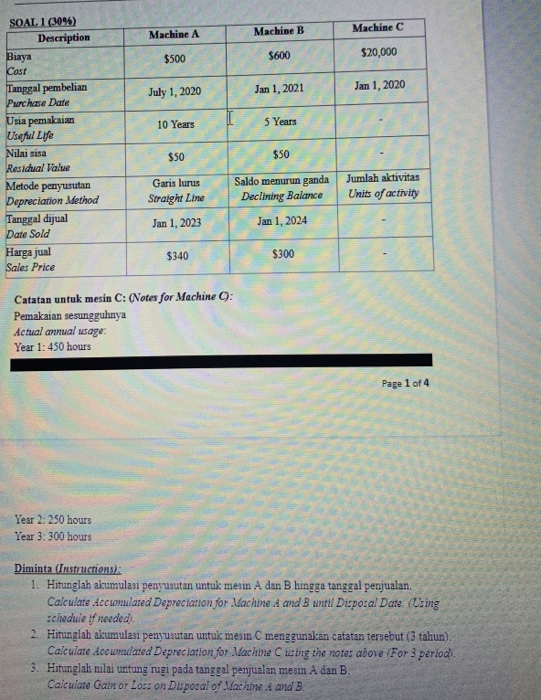

Question: See the english question Machine B Machine C Machine A $500 $600 $20,000 July 1, 2020 Jan 1, 2021 Jan 1, 2020 10 Years 5

Machine B Machine C Machine A $500 $600 $20,000 July 1, 2020 Jan 1, 2021 Jan 1, 2020 10 Years 5 Years SOAL 1 (1095) Description Biaya Cost Tanggal pembelian Purchase Date Usia pemakaian Useful Life Nilai sisa Residual Value Metode penyusutan Depreciation Method Tanggal dijual Date Sold Harga jual Sales Price $50 $50 Garis lurus Straight Line Saldo menurun ganda Declining Balance Jan 1, 2024 Jumlah aktivitas Units of activity Jan 1, 2023 $340 $300 Catatan untuk mesin C: (Notes for Machine C): Pemakaian sesungguhnya Actual annual usage: Year 1: 450 hours Page 1 of 4 Year 2: 250 hours Year 3: 300 hours Diminta (Instructions): 1. Hitunglah akumulasi penyusutan untuk mesin A dan B hingga tanggal penjualan. Calculate Accumulated Depreciation for Machine A and B until Disposal Date. (Using schedule if needed) 2. Hitunglah akumulasi penyusutan untuk mesin C menggunakan catatan tersebut (5 tahun) Calculate Accumulated Depreciation for Machine Cashg the notes above (For 3 period. 3. Hitunglah nilai untung rugi pada tanggal penjualan mesin A dan B. Calculate Gain or Lors on Disposal of Vachine A and B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts