Question: Seeing Red has a new project that will require fixed assets of $919,000, which will be depreciated on a 5-year MACRS schedule. The annual depreciation

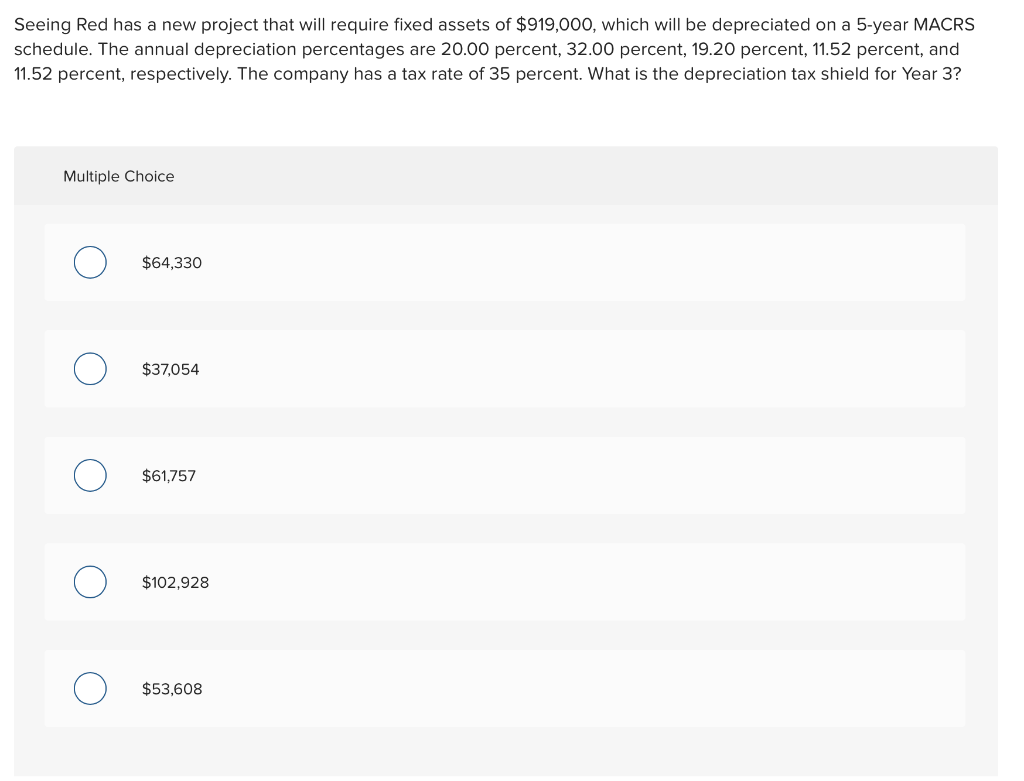

Seeing Red has a new project that will require fixed assets of $919,000, which will be depreciated on a 5-year MACRS schedule. The annual depreciation percentages are 20.00 percent, 32.00 percent, 19.20 percent, 11.52 percent, and 11.52 percent, respectively. The company has a tax rate of 35 percent. What is the depreciation tax shield for Year 3? Multiple Choice $64,330 $37,054 $61,757 $102,928 $53,608

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts