Question: SEEM 2 5 2 0 Tutorial 3 SUN Kangxuan October 7 th , 2 0 2 4 Suppose $ 1 were invested in 1 7

SEEM Tutorial

SUN Kangxuan

October th

Suppose $ were invested in at interest compounded yearly.

Approximately how much would that investment be worth today?

What if the interest rate were

An bond with years to maturity has a yield of the coupon is

paid annually and the face value is $ What is the price of this bond?

A bond has a face value of $ a current market price of $ an annual

interest payment of $ and will mature in years. Calculate the Yield to

Maturity YTM of this bond.

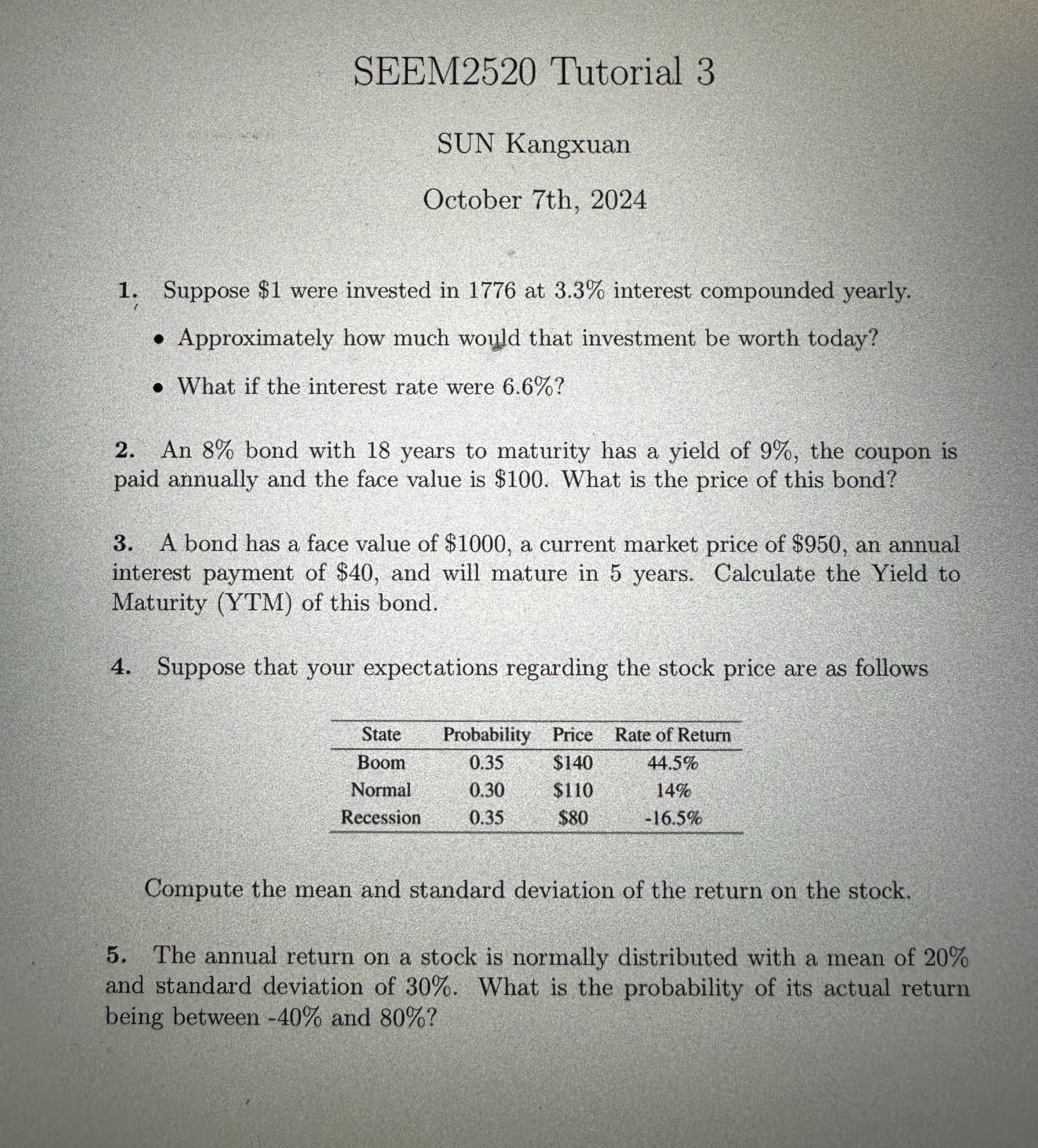

Suppose that your expectations regarding the stock price are as follows

Compute the mean and standard deviation of the return on the stock.

The annual return on a stock is normally distributed with a mean of

and standard deviation of What is the probability of its actual return

being between and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock