Question: Seether wants to Issue new 12-year bonds for some much-needed expansion projecis. The company currently has 7.8 percent coupon bonds on the market that sell

Seether wants to Issue new 12-year bonds for some much-needed expansion projecis. The company currently has 7.8 percent coupon bonds on the market that sell for $ make semiannual payments , and mature in 12 years. What coupon rate (as a APR) should the company set on its new bonds if it wants them to sell at par? (Note: the yield to maturity of the old bonds can be used as the coupon rate for the new bonds. )

please help !!

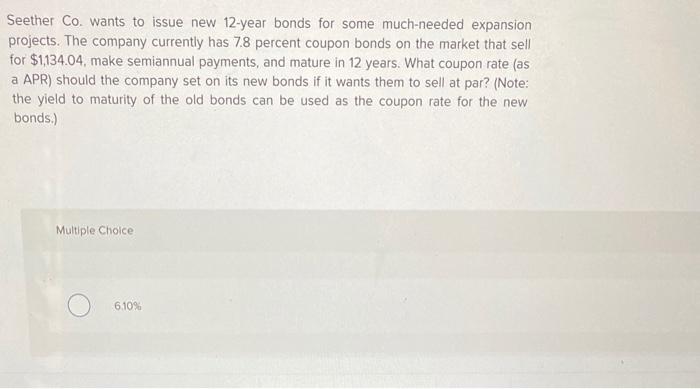

Seether Co. wants to issue new 12-year bonds for some much-needed expansion projects. The company currently has 7.8 percent coupon bonds on the market that sell for $1134.04, make semiannual payments, and mature in 12 years. What coupon rate (as a APR) should the company set on its new bonds if it wants them to sell at par? (Note: the yield to maturity of the old bonds can be used as the coupon rate for the new bonds.) Multiple Choice 6.10% O 6.10% () 6.50% (0) 6.20% ( ) O 3.10% O 5.90%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock