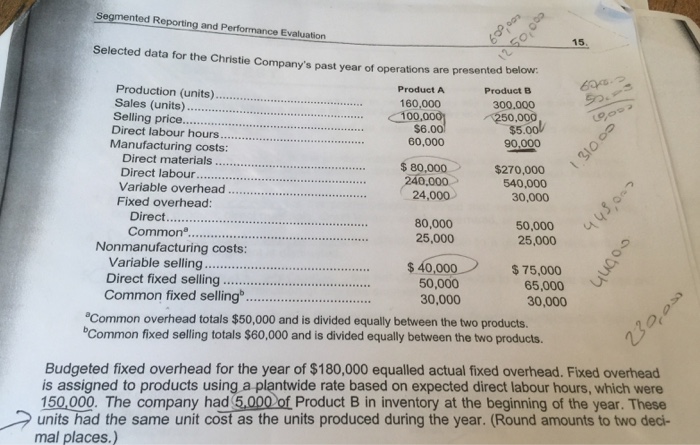

Question: Segmented Reporting and Performance Evaluation 15 Selected data for the Christie Company's past year of operations are presented below: Production (units). Sales (units.. Selling price

Segmented Reporting and Performance Evaluation 15 Selected data for the Christie Company's past year of operations are presented below: Production (units). Sales (units.. Selling price Product A 160,000 Product B . 100 300.000 250,000 $6.00 60,000 $5.00 90,000 Manufacturing costs Direct materials $ 80,000 $270,000 540,000 30,000 240.000$270 Variable overhead... Fixed overhead: 24,000 80,000 25,000 50,000 Common 25,000 Nonmanufacturing costs: 40,000 Variable selling Direct fixed selling.. Common fixed selling $75,000 65,000 30,000 50,000 30,000 Common overhead totals $50,000 and is divided equally between the two products. Common fixed selling totals $60,000 and is divided equally between the two products. Budgeted fixed overhead for the year of $180,000 equalled actual fixed overhead. Fixed overhead is assigned to products using a plantwide rate based on expected direct labour hours, which were 150,000. The company had units had the same unit cost as the units produced during the year. (Round amounts to two deci- Product B in inventory at the beginning of the year. These mal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts