Question: Select all that apply In order to avoid a penalty for failure to receive a minimum distribution from a defined contribution plan in 2 0

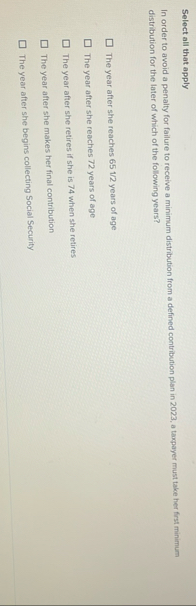

Select all that apply

In order to avoid a penalty for failure to receive a minimum distribution from a defined contribution plan in a taxpayer must take her frst minimum distribution for the later of which of the following years?

The year after she reaches years of age

The year after she reaches years of age

The year after she retires if she is when she retires

The year after she makes her final contribution

The yeer after she begins collecting Social Security

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock