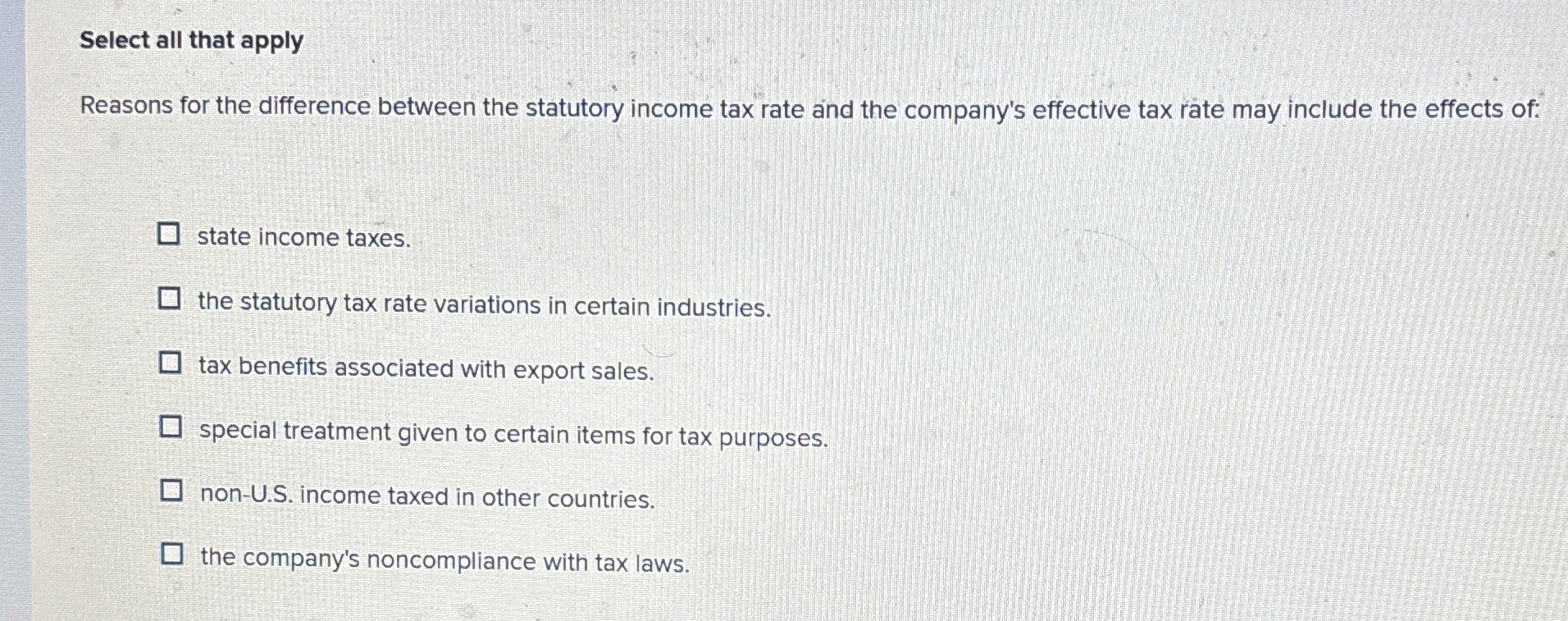

Question: Select all that apply Reasons for the difference between the statutory income tax rate and the company's effective tax rate may include the effects of:

Select all that apply

Reasons for the difference between the statutory income tax rate and the company's effective tax rate may include the effects of:

state income taxes.

the statutory tax rate variations in certain industries.

tax benefits associated with export sales.

special treatment given to certain items for tax purposes.

nonUS income taxed in other countries.

the company's noncompliance with tax laws.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock