Question: Select all the correct answers A) If the crossover rate is 15% and at a WACC of 10% project A has higher NPV than project

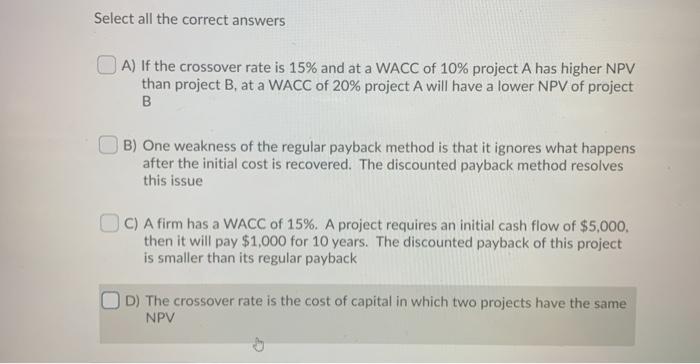

Select all the correct answers A) If the crossover rate is 15% and at a WACC of 10% project A has higher NPV than project B, at a WACC of 20% project A will have a lower NPV of project B B) One weakness of the regular payback method is that it ignores what happens after the initial cost is recovered. The discounted payback method resolves this issue C) A firm has a WACC of 15%. A project requires an initial cash flow of $5,000. then it will pay $1,000 for 10 years. The discounted payback of this project is smaller than its regular payback D) The crossover rate is the cost of capital in which two projects have the same NPV

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock