Question: Select all true statements the dividend discount model is ideal to value stocks that do not pay dividends the dividend discount model is likely to

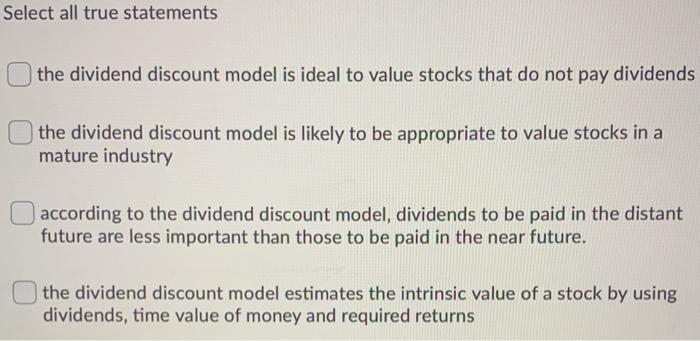

Select all true statements the dividend discount model is ideal to value stocks that do not pay dividends the dividend discount model is likely to be appropriate to value stocks in a mature industry according to the dividend discount model, dividends to be paid in the distant future are less important than those to be paid in the near future. the dividend discount model estimates the intrinsic value of a stock by using dividends, time value of money and required returns

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock