Question: Select EITHER Part A or Part B. If you answer both parts, only the FIRST PART WILL BE MARKED. Part A: Your client owns a

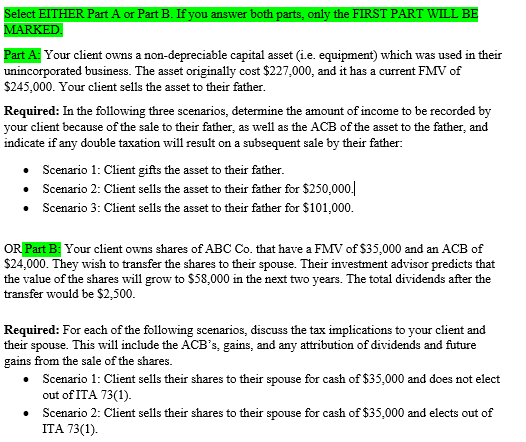

Select EITHER Part A or Part B. If you answer both parts, only the FIRST PART WILL BE MARKED. Part A: Your client owns a non-depreciable capital asset (ie. equipment) which was used in their unincorporated business. The asset originally cost $227,000, and it has a current FMV of $245,000. Your client sells the asset to their father. Required: In the following three scenarios, determine the amount of income to be recorded by your client because of the sale to their father, as well as the ACB of the asset to the father, and indicate if any double taxation will result on a subsequent sale by their father: Scenario 1: Client gifts the asset to their father. . Scenario 2: Client sells the asset to their father for $250,000. Scenario 3: Client sells the asset to their father for $101,000. OR Part B: Your client owns shares of ABC Co. that have a FMV of $35,000 and an ACB of $24,000. They wish to transfer the shares to their spouse. Their investment advisor predicts that the value of the shares will grow to $58,000 in the next two years. The total dividends after the transfer would be $2,500. Required: For each of the following scenarios, discuss the tax implications to your client and their spouse. This will include the ACB's, gains, and any attribution of dividends and future gains from the sale of the shares. Scenario 1: Client sells their shares to their spouse for cash of $35,000 and does not elect out of ITA 73(1). Scenario 2: Client sells their shares to their spouse for cash of $35,000 and elects out of ITA 73(1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts