Question: Select five mutual funds, each with a different objective. DO NOT use money market or tax-exempt funds. A mutual fund can specify whatever objective

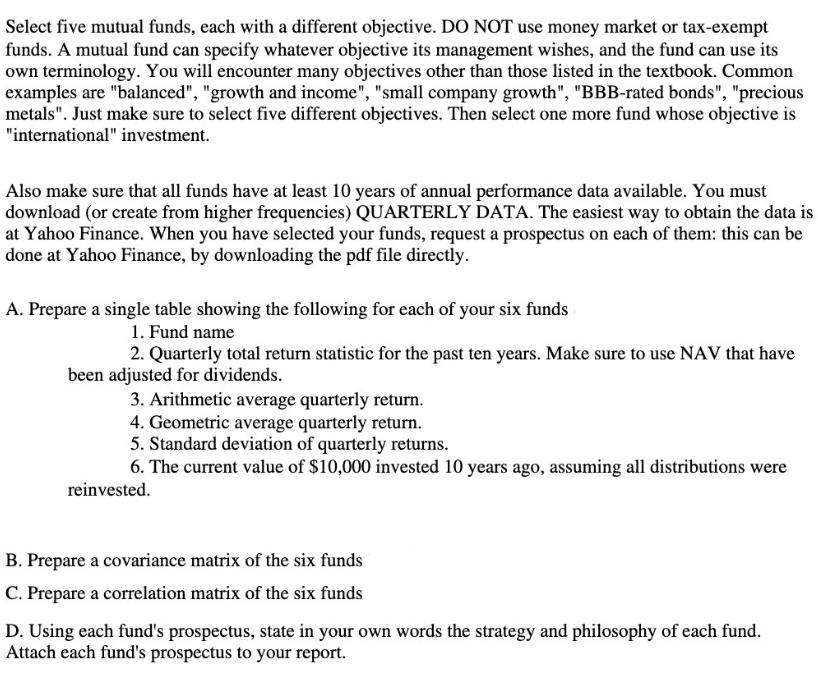

Select five mutual funds, each with a different objective. DO NOT use money market or tax-exempt funds. A mutual fund can specify whatever objective its management wishes, and the fund can use its own terminology. You will encounter many objectives other than those listed in the textbook. Common examples are "balanced", "growth and income", "small company growth", "BBB-rated bonds", "precious metals". Just make sure to select five different objectives. Then select one more fund whose objective is "international" investment. Also make sure that all funds have at least 10 years of annual performance data available. You must download (or create from higher frequencies) QUARTERLY DATA. The easiest way to obtain the data is at Yahoo Finance. When you have selected your funds, request a prospectus on each of them: this can be done at Yahoo Finance, by downloading the pdf file directly. A. Prepare a single table showing the following for each of your six funds 1. Fund name 2. Quarterly total return statistic for the past ten years. Make sure to use NAV that have been adjusted for dividends. 3. Arithmetic average quarterly return. 4. Geometric average quarterly return. 5. Standard deviation of quarterly returns. 6. The current value of $10,000 invested 10 years ago, assuming all distributions were reinvested. B. Prepare a covariance matrix of the six funds C. Prepare a correlation matrix of the six funds D. Using each fund's prospectus, state in your own words the strategy and philosophy of each fund. Attach each fund's prospectus to your report.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts