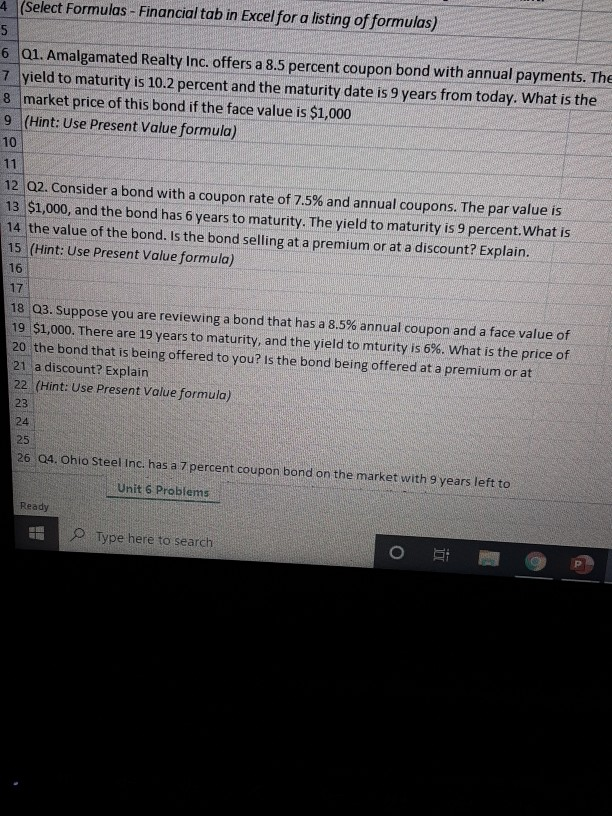

Question: (Select Formulas - Financial tab in Excel for a listing of formulas) Q1. Amalgamated Realty Inc. offers a 8.5 percent coupon bond with annual payments.

(Select Formulas - Financial tab in Excel for a listing of formulas) Q1. Amalgamated Realty Inc. offers a 8.5 percent coupon bond with annual payments. The yield to maturity is 10.2 percent and the maturity date is 9 years from today. What is the market price of this bond if the face value is $1,000 (Hint: Use Present Value formula) 2 Q2. Consider a bond with a coupon rate of 7.5% and annual coupons. The par value is 13 $1,000, and the bond has 6 years to maturity. The yield to maturity is 9 percent.What is 14 the value of the bond. Is the bond selling at a premium or at a discount? Explain. 15 (Hint: Use Present Value formula) 16 18 Q3. Suppose you are reviewing a bond that has a 8.5% annual coupon and a face value of 19 $1,000. There are 19 years to maturity, and the yield to mturity is 6%. What is the price of 20 the bond that is being offered to you? is the bond being offered at a premium or at 21 a discount? Explain 22 (Hint: Use Present Value formula) 23 24 26 Q4. Ohio Steel Inc. has a 7 percent coupon bond on the market with 9 years left to Unit 6 Problems Ready Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts