Question: Select one A the real rate, a default risk premium and expected inflation question B. the real rate, expected inflation and a default risk premium

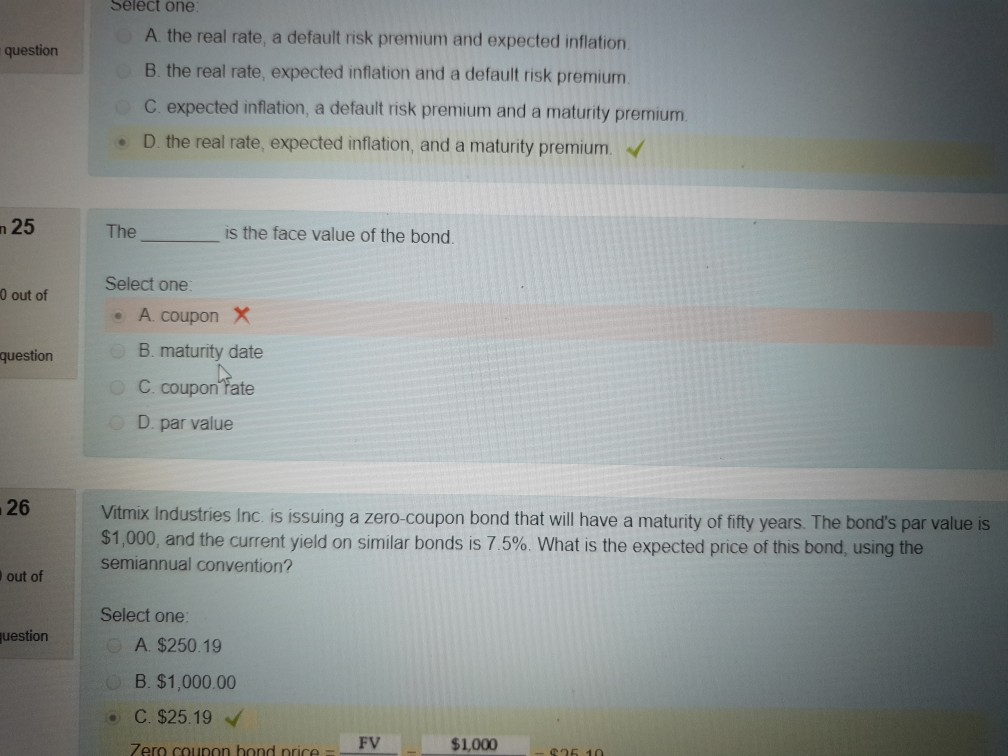

Select one A the real rate, a default risk premium and expected inflation question B. the real rate, expected inflation and a default risk premium C. expected inflation, a default risk premium and a maturity premium D. the real rate, expected inflation, and a maturity premium. 25 The is the face value of the bond. Select one 0 out of A coupon X B. maturity date question C. coupon tate D. par value 26 Vitmix Industries Inc. is issuing a zero-coupon bond that will have a maturity of fifty years. The bond's par value is $1,000, and the current yield on similar bonds is 7.5%. What is the expected price of this bond, using the semiannual convention? out of Select one uestion A $250.19 B. $1,000.00 C. $25.19 FV $1,000 Zero counon hond nrice : e26 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts