Question: Select one answer: a) $24,000,000 b) $24,550,000 c) $24,700,000 d) $24,150,000 On January 1, 2022, Pronto Company acquired all of Speedy Inc.'s voting stock for

Select one answer:

a) $24,000,000

b) $24,550,000

c) $24,700,000

d) $24,150,000

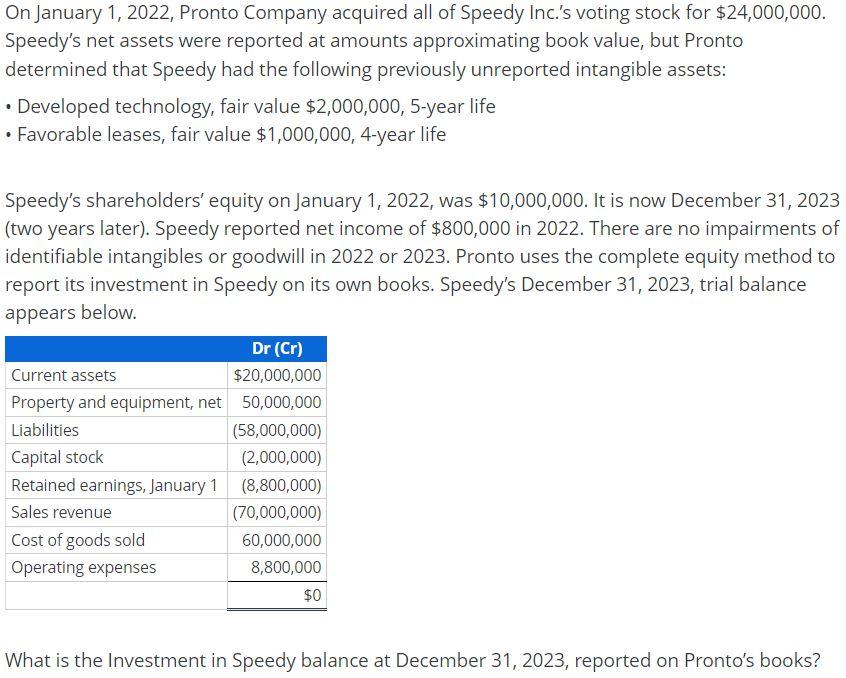

On January 1, 2022, Pronto Company acquired all of Speedy Inc.'s voting stock for $24,000,000. Speedy's net assets were reported at amounts approximating book value, but Pronto determined that Speedy had the following previously unreported intangible assets: - Developed technology, fair value $2,000,000,5-year life - Favorable leases, fair value \$1,000,000, 4-year life Speedy's shareholders' equity on January 1, 2022, was $10,000,000. It is now December 31, 2023 (two years later). Speedy reported net income of $800,000 in 2022 . There are no impairments of identifiable intangibles or goodwill in 2022 or 2023 . Pronto uses the complete equity method to report its investment in Speedy on its own books. Speedy's December 31, 2023, trial balance appears below. What is the Investment in Speedy balance at December 31, 2023, reported on Pronto's books

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts