Question: Select one topic from the Module Two Adjusted Gross Income List in the Supporting Materials section. Use the Tax Research Guide found in the Supporting

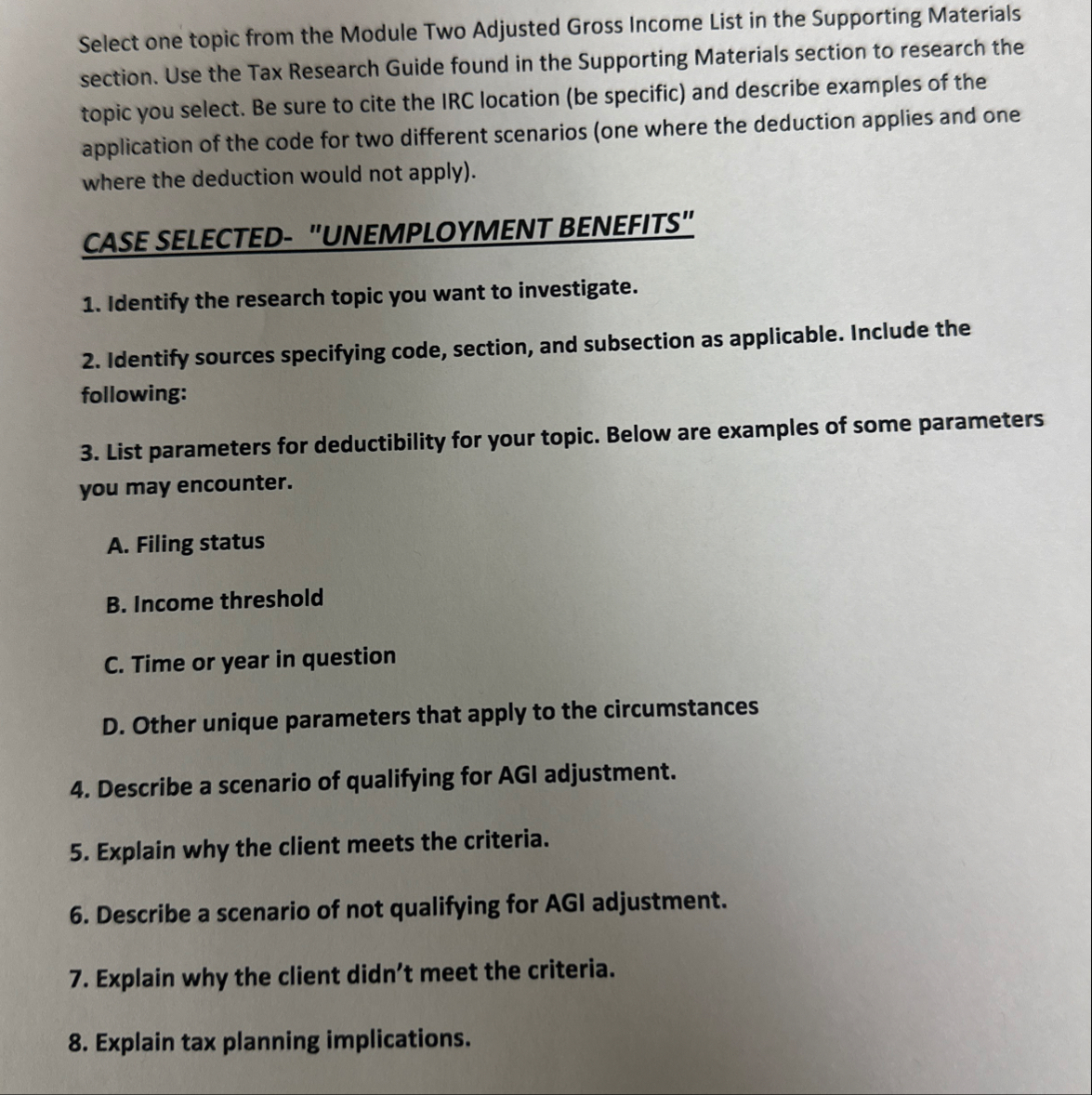

Select one topic from the Module Two Adjusted Gross Income List in the Supporting Materials section. Use the Tax Research Guide found in the Supporting Materials section to research the topic you select. Be sure to cite the IRC location be specific and describe examples of the application of the code for two different scenarios one where the deduction applies and one where the deduction would not apply

CASE SELECTED "UNEMPLOYMENT BENEFITS"

Identify the research topic you want to investigate.

Identify sources specifying code, section, and subsection as applicable. Include the following:

List parameters for deductibility for your topic. Below are examples of some parameters you may encounter.

A Filing status

B Income threshold

C Time or year in question

D Other unique parameters that apply to the circumstances

Describe a scenario of qualifying for AGI adjustment.

Explain why the client meets the criteria.

Describe a scenario of not qualifying for AGI adjustment.

Explain why the client didn't meet the criteria.

Explain tax planning implications.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock