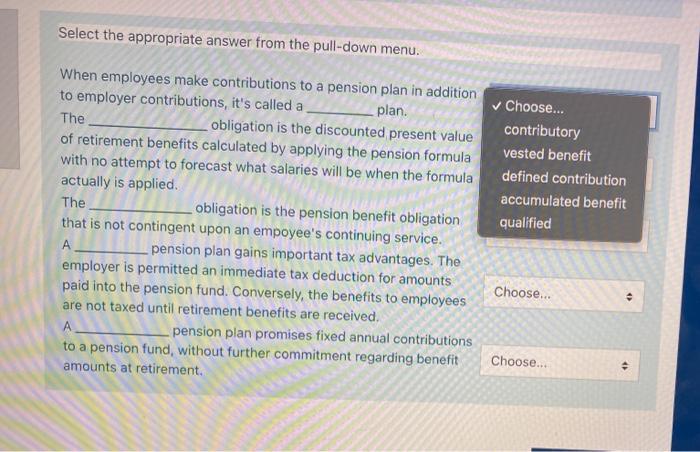

Question: Select the appropriate answer from the pull-down menu. When employees make contributions to a pension plan in addition to employer contributions, it's called a plan.

Select the appropriate answer from the pull-down menu. When employees make contributions to a pension plan in addition to employer contributions, it's called a plan. The obligation is the discounted present value of retirement benefits calculated by applying the pension formula with no attempt to forecast what salaries will be when the formula actually is applied The obligation is the pension benefit obligation that is not contingent upon an empoyee's continuing service. A pension plan gains important tax advantages. The employer is permitted an immediate tax deduction for amounts paid into the pension fund. Conversely, the benefits to employees are not taxed until retirement benefits are received. A pension plan promises fixed annual contributions to a pension fund, without further commitment regarding benefit amounts at retirement. Choose... contributory vested benefit defined contribution accumulated benefit qualified Choose... e Choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts