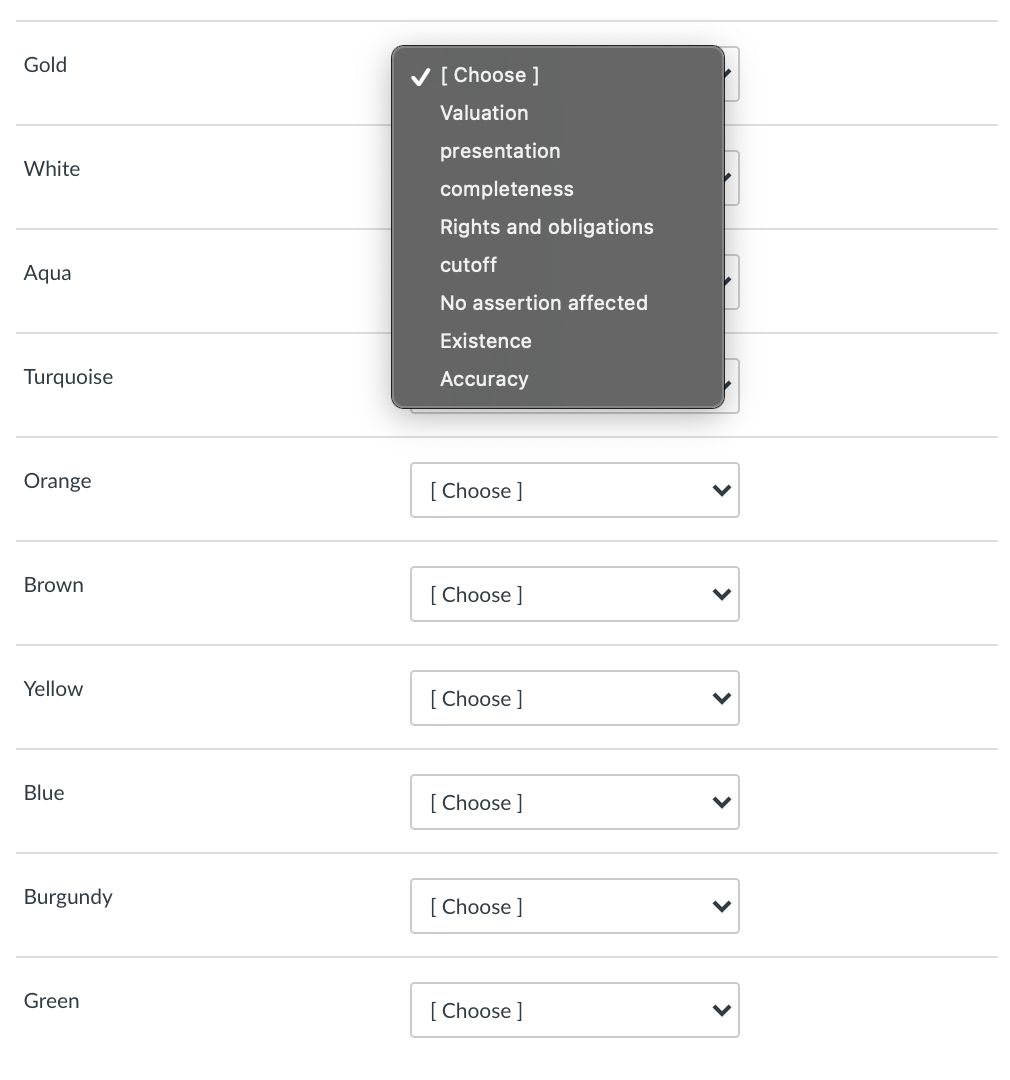

Question: Select the appropriate assertion that has been affected for each vehicle, where there is no misstatement. no assertion has been affected, so select 'No assertion

Select the appropriate assertion that has been affected for each vehicle, where there is no misstatement. no assertion has been affected, so select 'No assertion affected.'

![J [Choose] Valuation presentation completeness Rights and obligations cutoff No assertion affected](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/11/673613be466c9_246673613be09b49.jpg)

![Existence [ Choose] [ Choose] [ Choose] [ Choose] [ Choose] [](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/11/673613bf8823e_247673613bf5345f.jpg)

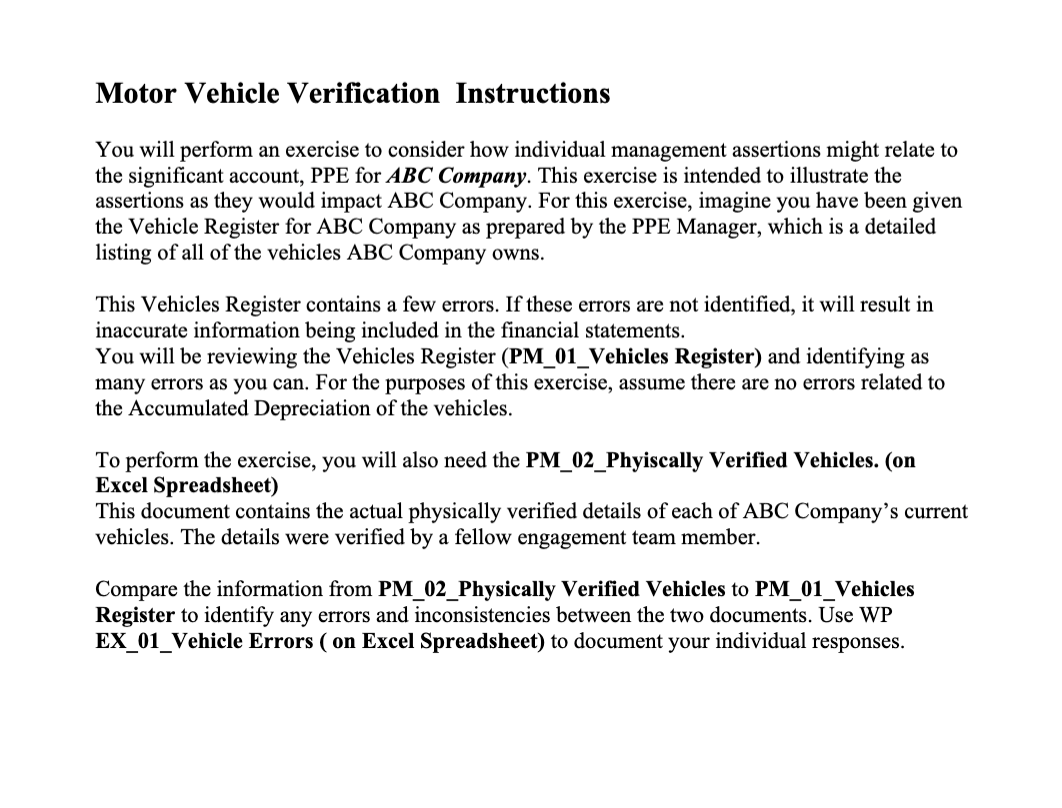

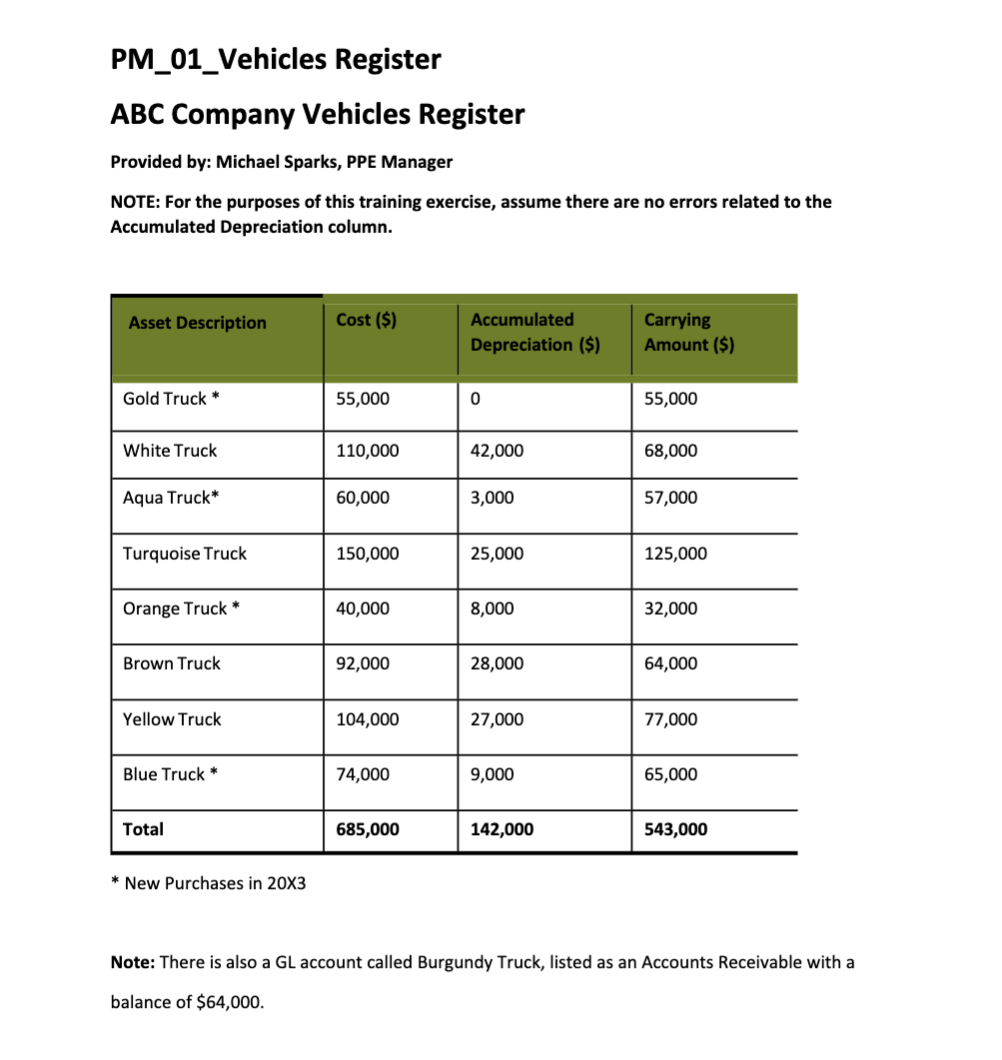

Gold White Aqua Turquoise Orange Brown Yellow Blue Burgundy Green J [Choose] Valuation presentation completeness Rights and obligations cutoff No assertion affected Existence [ Choose] [ Choose] [ Choose] [ Choose] [ Choose] [ Choose] Motor Vehicle Verification Instructions You will perform an exercise to consider how individual management assertions might relate to the significant account, PPE for ABC Company. This exercise is intended to illustrate the assertions as they would impact ABC Company. For this exercise, imagine you have been given the Vehicle Register for ABC Company as prepared by the PPE Manager, which is a detailed listing of all of the vehicles ABC Company owns. This Vehicles Register contains a few errors. If these errors are not identified, it will result in inaccurate information being included in the financial statements. You will be reviewing the Vehicles Register (PM_01_Vehicles Register) and identifying as many errors as you can. For the purposes of this exercise, assume there are no errors related to the Accumulated Depreciation of the vehicles. To perform the exercise, you will also need the PM_02_Phyiscally Verified Vehicles. (on Excel Spreadsheet) This document contains the actual physically verified details of each of ABC Company's current vehicles. The details were verified by a fellow engagement team member. Compare the information from PM_02_Physically Verified Vehicles to PM_01_Vehicles Register to identify any errors and inconsistencies between the two documents. Use WP EX_01_Vehicle Errors ( on Excel Spreadsheet) to document your individual responses.PM_01_Vehicles Register ABC Company Vehicles Register Provided by: Michael Sparks, PPE Manager NOTE: For the purposes of this training exercise, assume there are no errors related to the Accumulated Depreciation column. Asset Description Cost ($) Accumulated Carrying Depreciation ($) Amount ($) Gold Truck * 55,000 0 55,000 White Truck 110,000 42,000 68,000 Aqua Truck* 60,000 3,000 57,000 Turquoise Truck 150,000 25,000 125,000 Orange Truck * 40,000 8,000 32,000 Brown Truck 92,000 28,000 64,000 Yellow Truck 104,000 27,000 77,000 Blue Truck * 74,000 9,000 65,000 Total 685,000 142,000 543,000 * New Purchases in 20X3 Note: There is also a GL account called Burgundy Truck, listed as an Accounts Receivable with a balance of $64,000.PM_02_Phyiscally Verified Vehicles. User Car Type Purchase date Notes Delivery Driver #1 Green Truck February 23, 20X2 . The truck was purchased for $102,000. . It was driven 34,000 miles during the year. . It has been serviced regularly and is in good condition. Delivery Driver #2 White Truck September 23, 20X0 . The truck was purchased for $118,000. . It has driven 16,000 miles. . It has been serviced regularly. Delivery Driver #3 Aqua Truck November 23, 20X3 . The truck was purchased for $60,000. . It has driven 15,000 miles. . It has been serviced regularly. Delivery Driver #4 Turquoise Truck February 24, 20X2 . This truck was purchased for $150,000. . Delivery Driver #4 has driven 32,000 miles during the year. It has been serviced 3 times. . The truck was involved in an accident two weeks prior to year end, and has been valued at $110,000 by the insurers. Delivery Driver #5 Orange Truck January 23, 20X3 . The truck is rented from Rent Me A Truck Ltd. It will be returned after 3 years. . ABC Company does not have an option to buy the truck at the end of the rental agreement. . The truck is currently worth $40,000 per Truck Guide. Delivery Driver #6 Brown Truck April 13, 20X1 . The truck was purchased for $92,000. . It has driven 5,000 miles during the year. Delivery Driver #7 Yellow Truck February 23, 20X1 . The truck was purchased for $104,000. . It has driven 34,000 miles in total. . It has been serviced regularly and is in good condition. Delivery Driver #8 Burgundy Truck April 4, 20X3 . The truck was purchased for $64,000. . It has driven 5,000 miles in total. Delivery Driver #9 Blue Truck April 13, 20X3 . The truck was purchased for $74,000. . It has driven 5,000 miles in total.EX 01_Vehicle Errors - Worksheet vehicle Errors/Inconsistencies Affected Assertion Gold White Aqua Turquoise Orange Brown Yellow Blue Burgundy Green

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts