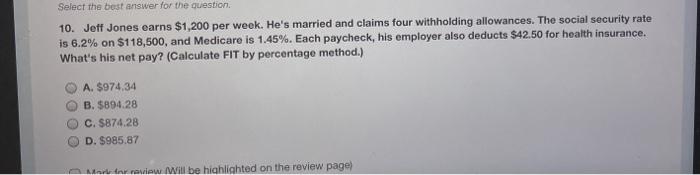

Question: Select the best answer for the question 10. Jeff Jones earns $1,200 per week. He's married and claims four withholding allowances. The social security rate

Select the best answer for the question 10. Jeff Jones earns $1,200 per week. He's married and claims four withholding allowances. The social security rate is 6.2% on $118,500, and Medicare is 1.45%. Each paycheck, his employer also deducts $42.50 for health insurance. What's his net pay? (Calculate FIT by percentage method.) A. $974.34 B. $894.28 C. $874.28 OD. $985.87 nawiew Will be highlighted on the review page)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts