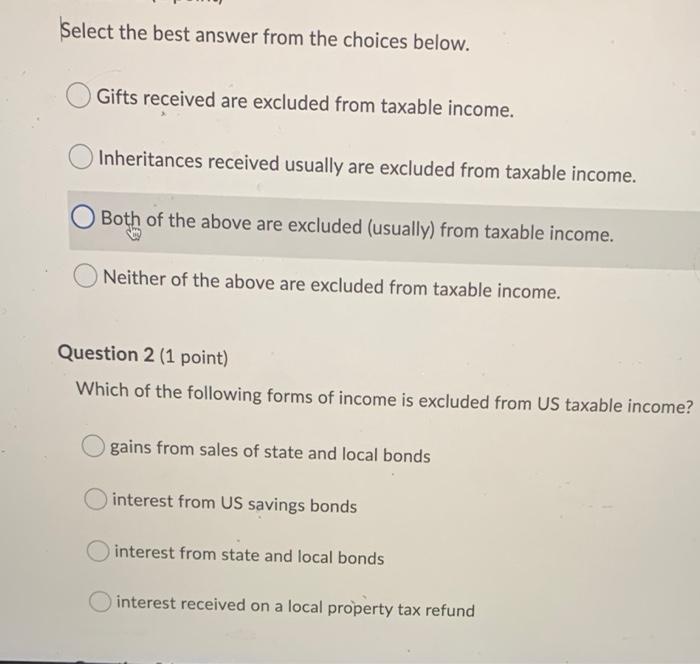

Question: Select the best answer from the choices below. Gifts received are excluded from taxable income. Inheritances received usually are excluded from taxable income. Both

Select the best answer from the choices below. Gifts received are excluded from taxable income. Inheritances received usually are excluded from taxable income. Both of the above are excluded (usually) from taxable income. O Neither of the above are excluded from taxable income. Question 2 (1 point) Which of the following forms of income is excluded from US taxable income? gains from sales of state and local bonds interest from US savings bonds interest from state and local bonds interest received on a local property tax refund

Step by Step Solution

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Although they have no stated coupon rate zero coupon investors must report a prorated port... View full answer

Get step-by-step solutions from verified subject matter experts