Question: Select the best answer. When determining whether it would be advisable to convert a sole proprietorship into a C corporation, all except which of the

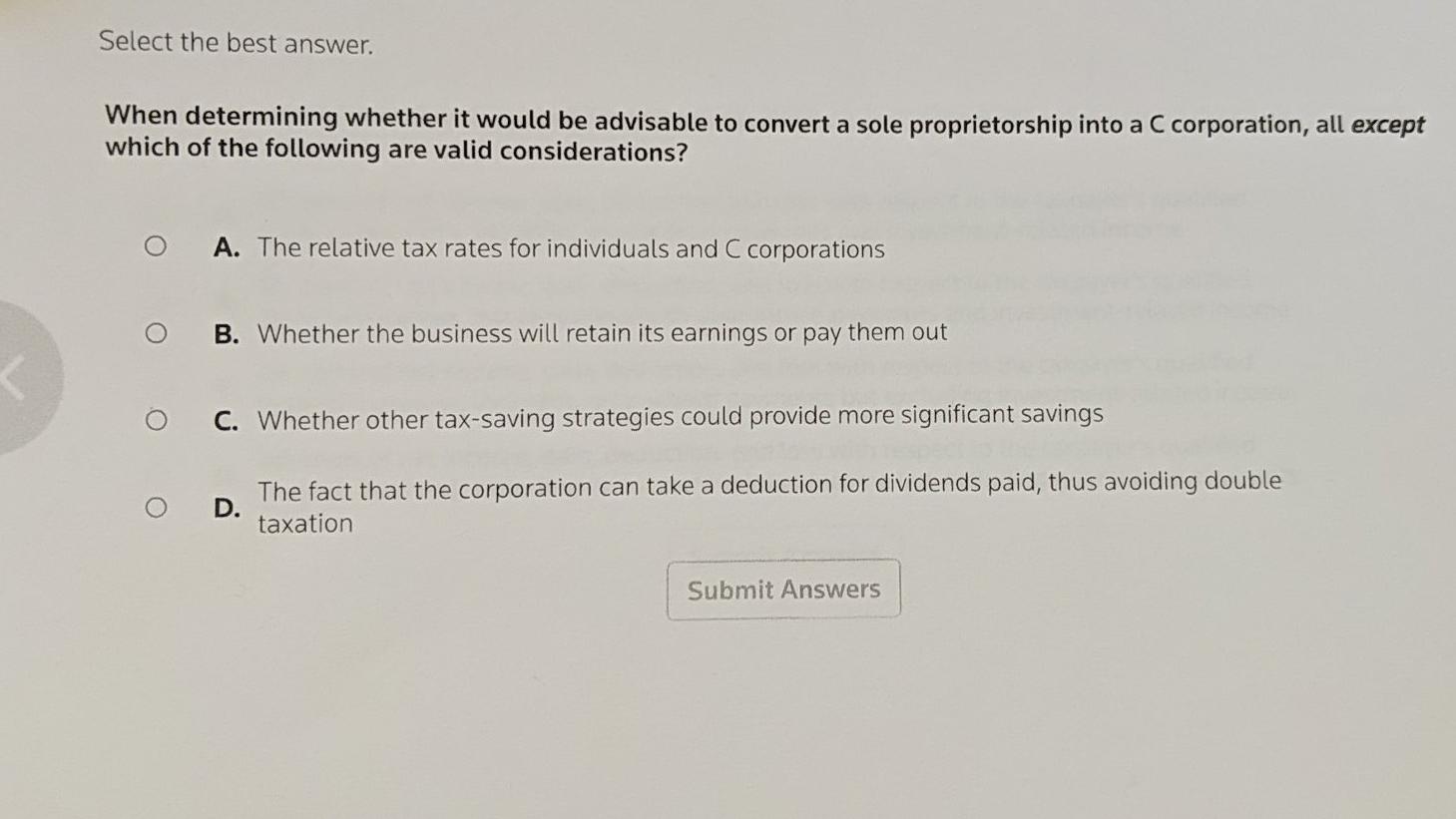

Select the best answer. When determining whether it would be advisable to convert a sole proprietorship into a C corporation, all except which of the following are valid considerations? A. The relative tax rates for individuals and C corporations B. Whether the business will retain its earnings or pay them out C. Whether other tax-saving strategies could provide more significant savings D. The fact that the corporation can take a deduction for dividends paid, thus avoiding double taxation Submit Answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts