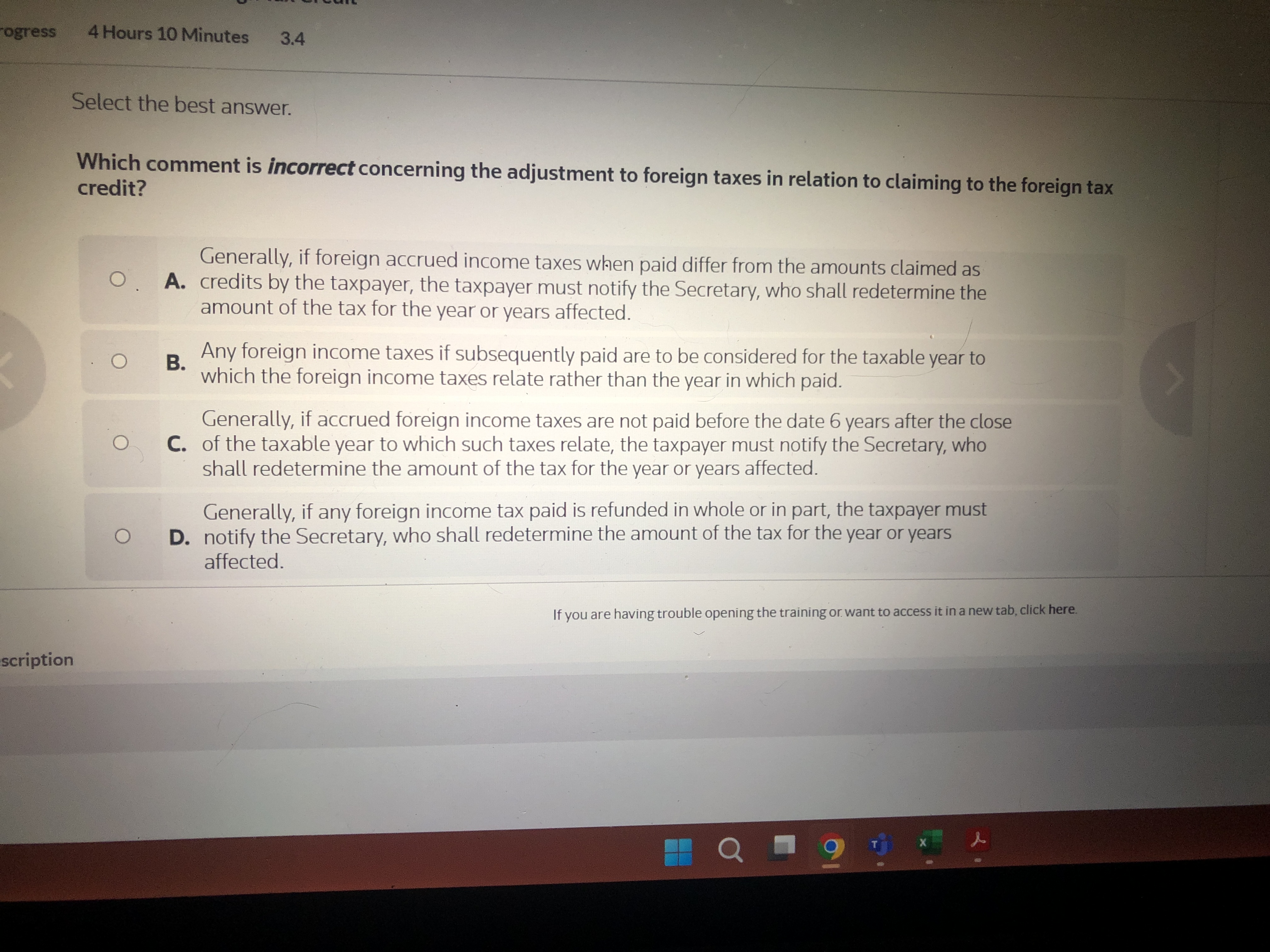

Question: Select the best answer. Which comment is incorrect concerning the adjustment to foreign taxes in relation to claiming to the foreign tax credit?Generally, if foreign

Select the best answer.

Which comment is incorrect concerning the adjustment to foreign taxes in relation to claiming to the foreign tax credit?Generally, if foreign accrued income taxes when paid differ from the amounts claimed as

A credits by the taxpayer, the taxpayer must notify the Secretary, who shall redetermine the amount of the tax for the year or years affected.B

Any foreign income taxes if subsequently paid are to be considered for the taxable year to which the foreign income taxes relate rather than the year in which paid.

Generally, if accrued foreign income taxes are not paid before the date years after the close

C of the taxable year to which such taxes relate, the taxpayer must notify the Secretary, who shall redetermine the amount of the tax for the year or years affected.

Generally, if any foreign income tax paid is refunded in whole or in part, the taxpayer must

D notify the Secretary, who shall redetermine the amount of the tax for the year or years affected.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock