Question: Select the correct answer from each drop-down menu. Ella is planning to buy a home in six years. She'll need to make a down payment

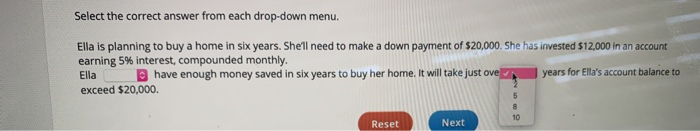

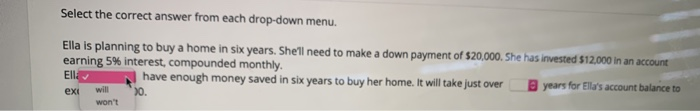

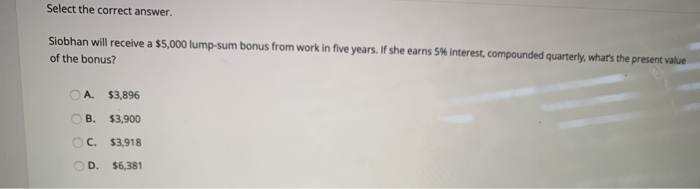

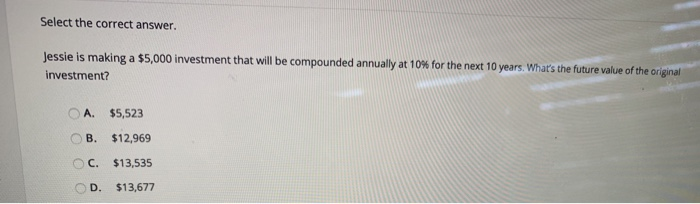

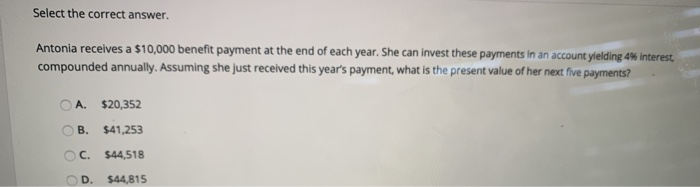

Select the correct answer from each drop-down menu. Ella is planning to buy a home in six years. She'll need to make a down payment of $20,000. She has invested $12,000 in an account earning 5% interest, compounded monthly. Ella have enough money saved in six years to buy her home. It will take just ove years for Ella's account balance to exceed $20,000. 10 Reset Next Select the correct answer from each drop-down menu. Ella is planning to buy a home in six years. She'll need to make a down payment of $20,000. She has invested $12,000 in an account earning 5% interest, compounded monthly. Ella have enough money saved in six years to buy her home. It will take just over years for Ella's account balance to 90. ext will won't Select the correct answer. Siobhan will receive a $5,000 lump-sum bonus from work in five years. If she earns 5% interest, compounded quarterly, what's the present value of the bonus? A. $3,896 OB $3,900 C. $3,918 OD. $6,381 Select the correct answer. Jessie is making a $5,000 investment that will be compounded annually at 10% for the next 10 years. What's the future value of the original investment? A. $5,523 B. $12,969 C. $13,535 D. $13,677 Select the correct answer. Antonia receives a $10,000 benefit payment at the end of each year. She can invest these payments in an account yielding 4% interest compounded annually. Assuming she just received this year's payment, what is the present value of her next five payments? A. $20,352 B. $41,253 C. $44,518 D. $44,815

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts