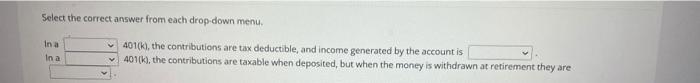

Question: Select the correct answer from each drop-down menu. in a In a 401(k), the contributions are tax deductible, and income generated by the account is

Select the correct answer from each drop-down menu. in a In a 401(k), the contributions are tax deductible, and income generated by the account is 401(k), the contributions are taxable when deposited, but when the money is withdrawn at retirement they are Select the correct answer from each drop-down menu. in a In a 401(k), the contributions are tax deductible, and income generated by the account is 401(k), the contributions are taxable when deposited, but when the money is withdrawn at retirement they are

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts