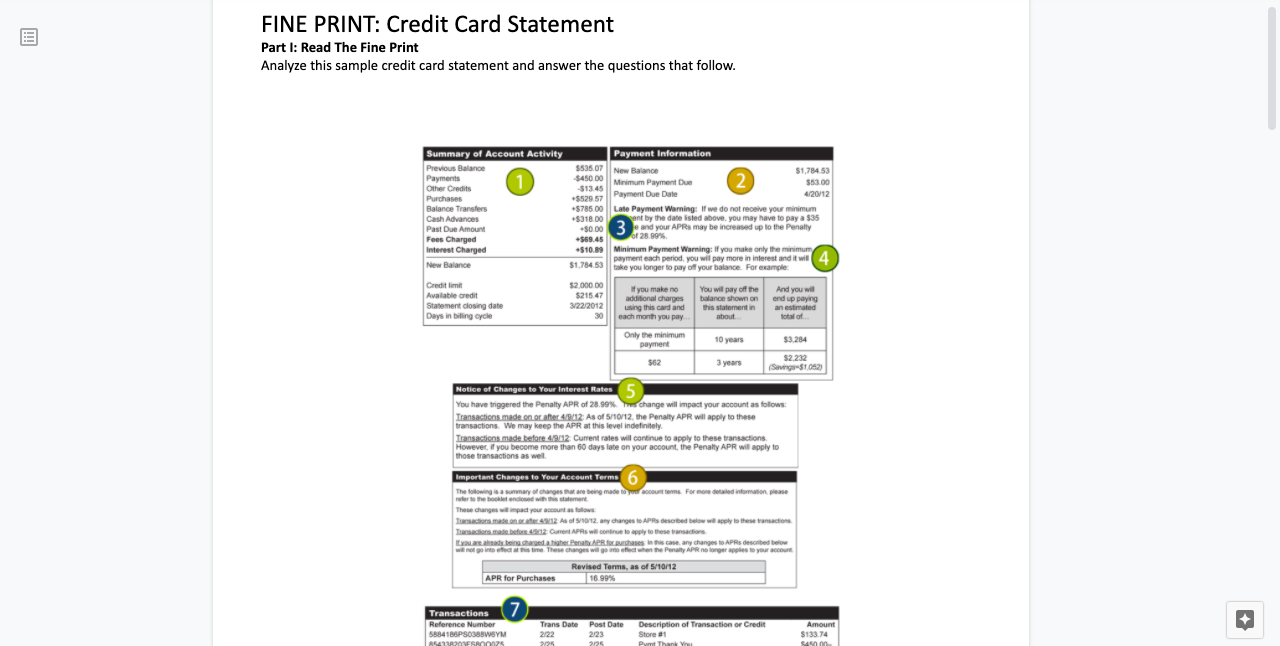

Question: Select the correct answer in the sheet? FINE PRINT: Credit Card Statement E Part I: Read The Fine Print Analyze this sample credit card statement

Select the correct answer in the sheet?

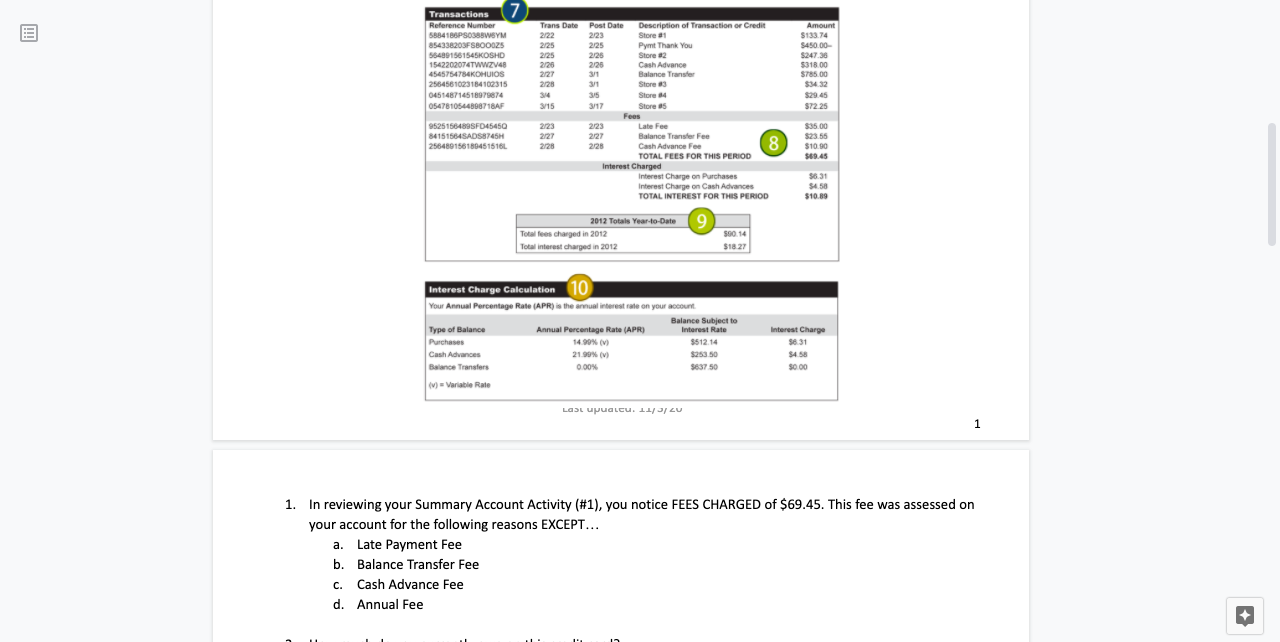

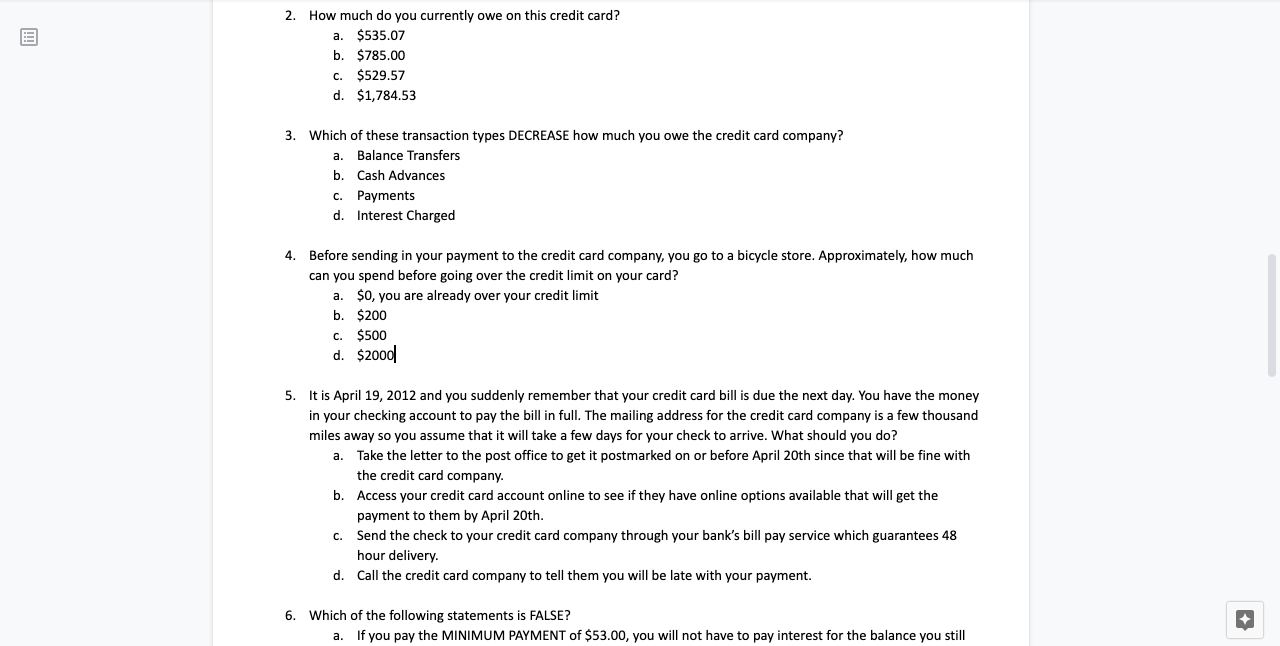

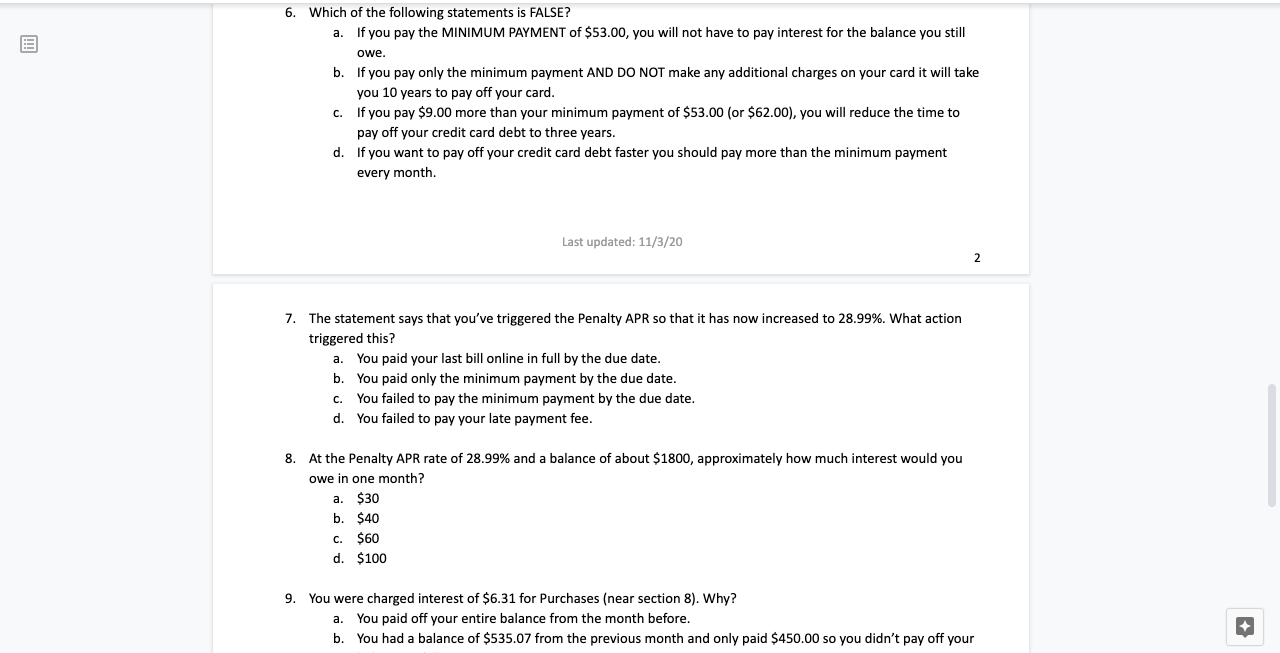

FINE PRINT: Credit Card Statement E Part I: Read The Fine Print Analyze this sample credit card statement and answer the questions that follow. Summary of Account Activity Payment Information Previous Balance $535.07 New Balance $1,784.53 Payments $450.00 Other Credits -$13.45 Minimum Payment Due $53.00 Purchases +$529 57 Payment Due Date 4/20/12 Balance Transfers +$785.00 Late Payment Warning: If we do not receive your minimum Cash Advances $318.00 nt by the date listed above, you may have to pay a 535 Past Due Amount #$0.00 3 e and your APRs may be increased up to the Penalty Fees Charged #$69.45 1 26.89. Interest Charged #$10.89 Minimum Payment Warning: If you make only the minimu yment each period, you will pay more in interest and it w New Balance $1.784.53 e you longer to pay off your balance. For example Credit limit $2,000.DO $215 47 If you make no You will pay off the And you wil Available credit additional charges balance shown on end up paying Statement closing date 3/22/2012 Living this card and this statement in an estimated Days in billing cycle each month you pay about. total of.. Only the minimum payment 10 years $3.284 $62 3 years $2.232 (Savings-$1.062) Notice of Changes to You 5 You have triggered the Penalty APR of 28.99% us change will impact your account as follows: Transactions made on or after 4/9/12; As of 5/10/12. the Penalty APR will apply to these transactions. We may keep the APR at this level indefinitely. Transactions made Before 4/9/12; Current rates will continue to apply to these transactions. However if you become more than 60 days late on your account, the Penalty APR will apply to those transactions as well. Important Changes to Your Account Terms 6 The following is a summary of changes that are being made ocount terms. For more detailed information, please refer to the booklet enclosed with this statement These changes will impact your no ount an follow albert made on or after 453012 As of 5/90/12. any changes to APPs described below Transactions made before 49012 Curent APRs wil true to apply to these bansactions. you are already being charged a higher Penalty APR for purchases In this case. any changes to APRs described below will not go into effect of this time. These changes wil go into effect when the Penalty APR no longer applies to your account Revised Terms, as of 5/10/12 APR for Purchases 16.99% Transactions Reference Number Trans Date Post Date Description of Transaction or Credit Amount + 5984180P-50385WSYM 2/22 2/23 Store #1 $133.74Transactions ce Number Trans Date Post Date Description of Transaction or Credit Amount 5884180P-50385WSYM 2/22 2/23 Store #1 $133.74 854338203FS800025 2/25 2/25 Pymt Thank You $450.00 564891861545KOSHD 225 Store #2 $247.36 1542202074TWWZV48 Cash Advance $318.00 4545754784KOHUIOS ART Balance Transfer $785.00 2564561023184102315 2/28 Store #3 $34.32 045148714518979874 JUS Store 84 $29.45 05478105445987 18AF 3/15 3/17 Store #5 872 25 Fees 95251564895FD45450 2/23 2/23 Late Fee $35.00 841515645AD58745H 2/27 2/27 Balance Transfer Fee $23.55 256480156180451516L 2/28 2/28 Cash Advance Fee $10.90 TOTAL FEES FOR THIS PERIOD $69.45 Interest Charged Interest Charge on Purchases $6.31 nterest Charge on Cash Advances $4.58 TOTAL INTEREST FOR THIS PERIOD $10.89 2012 Totals Year-to-Date Total fees charged in 2012 690.14 Total interest charged in 2012 $18 27 Interest Charge Calculation 10 Your Annual Percentage Rate (APR) is the annual interest rate on your account Balance Subject to Type of Balance Annual Percentage Rats (APR) Interest Rate Interest Charge Purchases 14:99% () $512.14 $8.31 Cash Advances 21.99% (V) $253.50 $4.58 Balance Transfers 0:00% $637 .50 50 00 (v) = Variable Rate LOSE UpuaLEU. 11/ 3/ 20 1. In reviewing your Summary Account Activity (#1), you notice FEES CHARGED of $69.45. This fee was assessed on your account for the following reasons EXCEPT... a. Late Payment Fee b. Balance Transfer Fee c. Cash Advance Fee d. Annual Fee +2. How much do you currently owe on this credit card? E a. $535.07 b. $785.00 c. $529.57 d. $1,784.53 3. Which of these transaction types DECREASE how much you owe the credit card company? a. Balance Transfers b. Cash Advances c. Payments d. Interest Charged 4. Before sending in your payment to the credit card company, you go to a bicycle store. Approximately, how much can you spend before going over the credit limit on your card? a. $0, you are already over your credit limit b. $200 c. $500 d. $2000 5. It is April 19, 2012 and you suddenly remember that your credit card bill is due the next day. You have the money in your checking account to pay the bill in full. The mailing address for the credit card company is a few thousand miles away so you assume that it will take a few days for your check to arrive. What should you do? a. Take the letter to the post office to get it postmarked on or before April 20th since that will be fine with the credit card company. b. Access your credit card account online to see if they have online options available that will get the payment to them by April 20th. C. Send the check to your credit card company through your bank's bill pay service which guarantees 48 hour delivery. d. Call the credit card company to tell them you will be late with your payment. 6. Which of the following statements is FALSE? + a. If you pay the MINIMUM PAYMENT of $53.00, you will not have to pay interest for the balance you still6. Which of the following statements is FALSE? a. If you pay the MINIMUM PAYMENT of $53.00, you will not have to pay interest for the balance you still owe. b. If you pay only the minimum payment AND DO NOT make any additional charges on your card it will take you 10 years to pay off your card. c. If you pay $9.00 more than your minimum payment of $53.00 (or $62.00), you will reduce the time to pay off your credit card debt to three years. d. If you want to pay off your credit card debt faster you should pay more than the minimum payment every month. Last updated: 11/3/20 2 7. The statement says that you've triggered the Penalty APR so that it has now increased to 28.99%. What action triggered this? a. You paid your last bill online in full by the due date. b. You paid only the minimum payment by the due date. c. You failed to pay the minimum payment by the due date. d. You failed to pay your late payment fee. 8. At the Penalty APR rate of 28.99% and a balance of about $1800, approximately how much interest would you owe in one month? a. $30 b. $40 c. $60 d. $100 9. You were charged interest of $6.31 for Purchases (near section 8). Why? a. You paid off your entire balance from the month before. + b. You had a balance of $535.07 from the previous month and only paid $450.00 so you didn't pay off your9. You were charged interest of $6.31 for Purchases (near section 8]. Why? a. You paid off your entire balance from the month before. b. You had a balance of $535.07 from the previous month and only paid $450.00 so you didn't pay oftyour balance in full. c. You borrowed more than your credit limit and were charged interest on the amount you borrowed over your limit. d. The credit card company paid you interest for the purchases you made on their credit card. 10. A general rule of thumb isto keep your credit utilization rate at 30% or lower. What is your approximate credit utilization rate for this current billing cycle? (Hint: Credit Utilization Rate = Balance ,l' Credit limit) a. 30% h. 50% c. 70% d 90% Part II: What Did You learn? Use what you learned from analyzing the credit card statement to answer this question. 11. Your friend, Caittyn, does not think it is important to reviewI her monthly credit card statement. Instead, she just sets up an automatic minimum payment on the 18th of each month. Convince Caitlyn that this is a bad idea. Gaitlyn, it is important that you review your account statement monthly to he informed about the changes that are made to your card as well so to keep your credit situation healthy