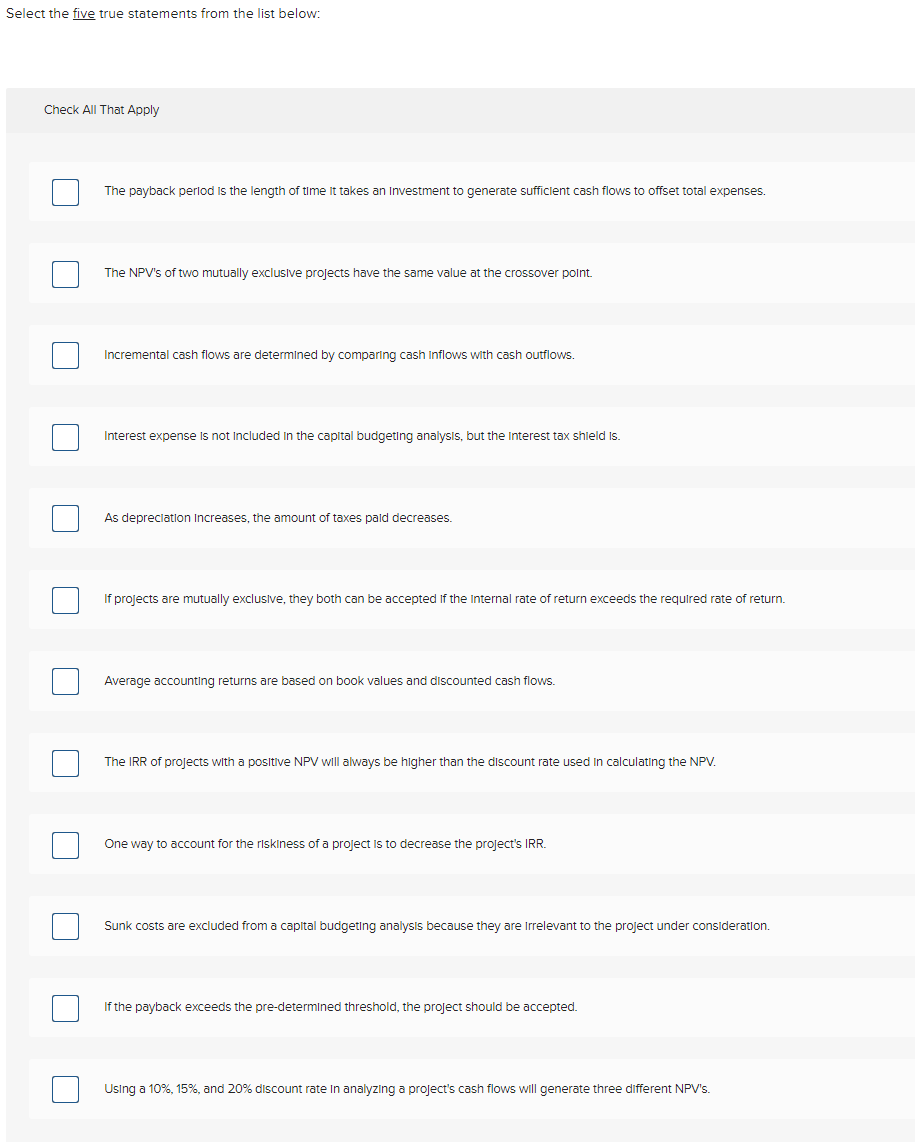

Question: Select the five true statements from the list below: Check All That Apply The payback period is the length of time it takes an Investment

Select the five true statements from the list below: Check All That Apply The payback period is the length of time it takes an Investment to generate sufficient cash flows to offset total expenses. The NPV's of two mutually exclusive projects have the same value at the crossover point. Incremental cash flows are determined by comparing cash inflows with cash outflows. Interest expense is not included in the capital budgeting analysis, but the interest tax shield is. As depreciation Increases, the amount of taxes pald decreases. If projects are mutually exclusive, they both can be accepted if the Internal rate of return exceeds the required rate of return. Average accounting returns are based on book values and discounted cash flows. The IRR of projects with a positive NPV will always be higher than the discount rate used in calculating the NPV. One way to account for the riskiness of a project is to decrease the project's IRR. Sunk costs are excluded from a capital budgeting analysis because they are Irrelevant to the project under consideration. If the payback exceeds the pre-determined threshold, the project should be accepted. Using a 10%, 15%, and 20% discount rate in analyzing a project's cash flows will generate three different NPV's

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts