Question: Select the incorrect statement regarding the Market Portfolio M in the Modern Portfolio Theory. O Market Portfolio M is a well-diversified portfolio, and if the

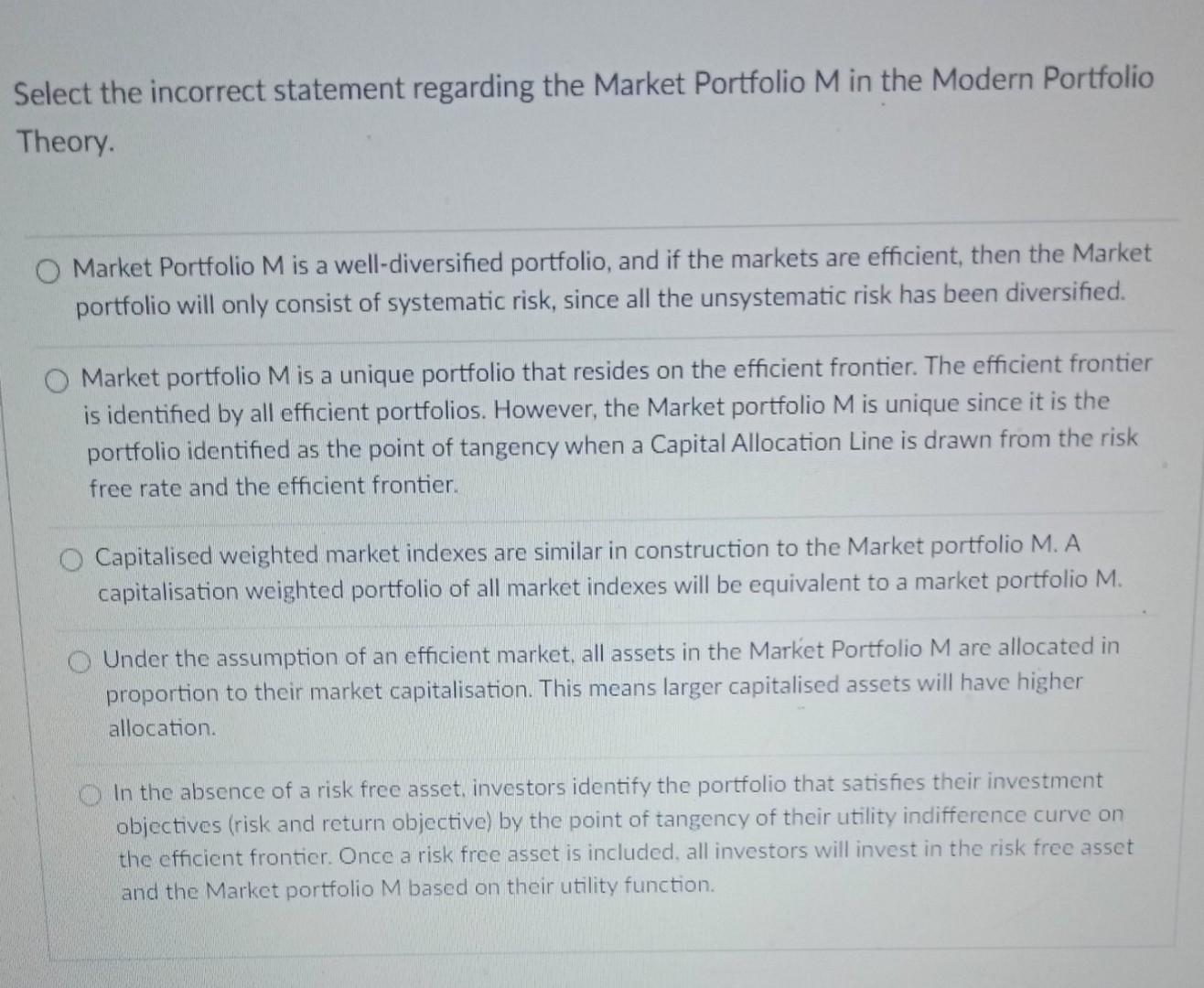

Select the incorrect statement regarding the Market Portfolio M in the Modern Portfolio Theory. O Market Portfolio M is a well-diversified portfolio, and if the markets are efficient, then the Market portfolio will only consist of systematic risk, since all the unsystematic risk has been diversified. Market portfolio M is a unique portfolio that resides on the efficient frontier. The efficient frontier is identified by all efficient portfolios. However, the Market portfolio M is unique since it is the portfolio identified as the point of tangency when a Capital Allocation Line is drawn from the risk free rate and the efficient frontier. O Capitalised weighted market indexes are similar in construction to the Market portfolio M. A capitalisation weighted portfolio of all market indexes will be equivalent to a market portfolio M. O Under the assumption of an efficient market, all assets in the Market Portfolio M are allocated in proportion to their market capitalisation. This means larger capitalised assets will have higher allocation. In the absence of a risk free asset, investors identify the portfolio that satisfies their investment objectives (risk and return objective) by the point of tangency of their utility indifference curve on the efficient frontier. Once a risk free asset is included, all investors will invest in the risk free asset and the Market portfolio M based on their utility function

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts