Question: Select the most appropriate item from the dropdown to match each of the following terms and phrases associated with current liabilities. 1. Interest expense is

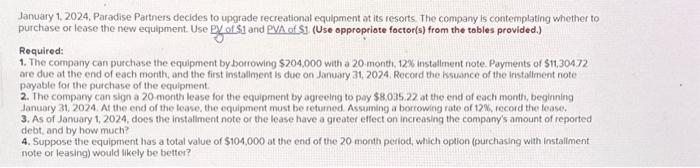

January 1, 2024, Paradise Partners decides to upgrade recreational equipment at its resorts. The company is contemplating whether to purchase or lease the new equipment. Use BY of \$1 and PVA of $1. (Use oppropriote foctor(s) from the tables provided.) Required: 1. The company can purchase the equipment by borrowing $204,000 with a 20 month, 12% installment note. Payments of $11,304,72 are due at the end of each morith, and the first installment is due on January 31,2024 . Record the hsuance of the iristallment note paryable for the purchase of the equipment. 2. The company can sign a 20 -month lease for the equipment by acgeeing to pay $8.035.22 at the end of each month, begining January 31, 2024. Ar the end of the lease, the equipment must be returned Assuming a borrowing rate of 12%, record the lease. 3. As of Jamuary 1,2024, does the installment note or the lease have a greater effect on increasing the company's amount of reported debt, and by how much? 4. Suppose the equipment has a total value of $104,000 at the end of the 20 month period, which option (purchasing with installment note or leasing) would likely be better

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts