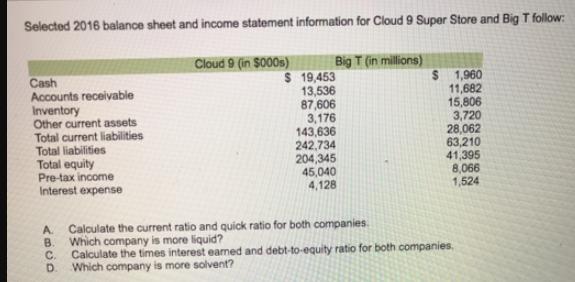

Question: Selected 2016 balance sheet and income statement information for Cloud 9 Super Store and Big T follow: Cloud 9 (in $000s) Big T (in

Selected 2016 balance sheet and income statement information for Cloud 9 Super Store and Big T follow: Cloud 9 (in $000s) Big T (in millions) $ Cash Accounts receivable Inventory Other current assets Total current liabilities Total liabilities Total equity Pre-tax income Interest expense A. B. C. D 19,453 13,536 87,606 3,176 143,636 242,734 204,345 45,040 4,128 $ 1,960 11,682 15,806 3,720 28,062 63,210 41,395 8,066 1,524 Calculate the current ratio and quick ratio for both companies. Which company is more liquid? Calculate the times interest earned and debt-to-equity ratio for both companies. Which company is more solvent?

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

The image youve provided contains financial data of two companies Cloud 9 and Big T including assets liabilities equity income and expenses To answer ... View full answer

Get step-by-step solutions from verified subject matter experts