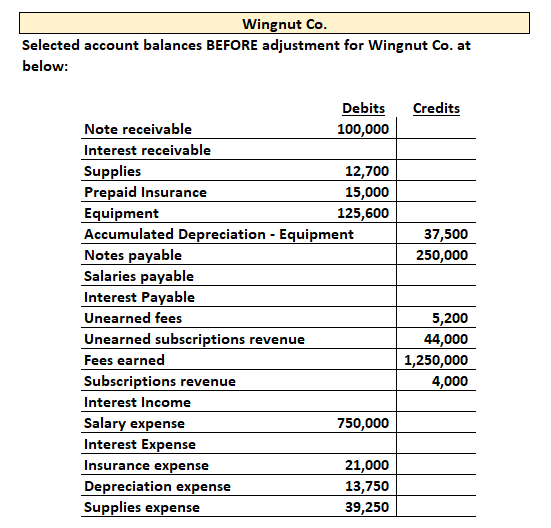

Question: Selected account balances BEFORE adjustment for Wingnut Co. at below: Information regarding December 2022 adjusting entries: a. Wingnut borrowed $250,000@12% issuing a 120 -day note

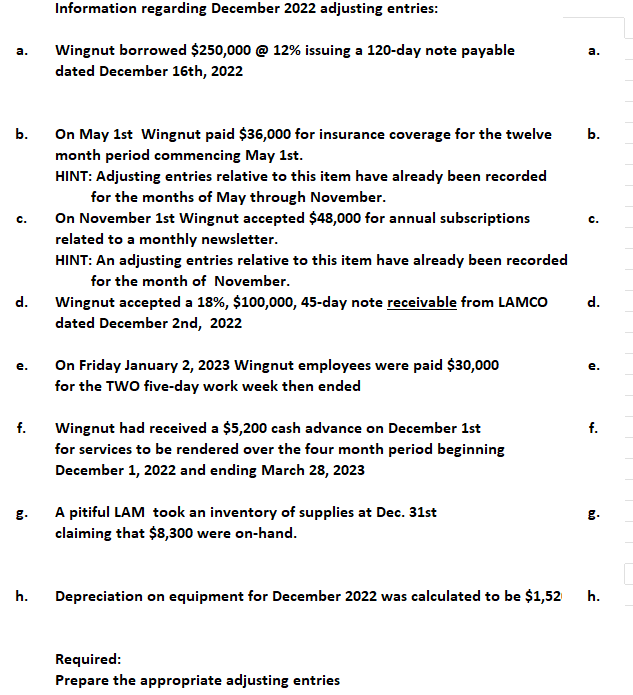

Selected account balances BEFORE adjustment for Wingnut Co. at below: Information regarding December 2022 adjusting entries: a. Wingnut borrowed $250,000@12% issuing a 120 -day note payable a. dated December 16th, 2022 b. On May 1st Wingnut paid $36,000 for insurance coverage for the twelve month period commencing May 1st. HINT: Adjusting entries relative to this item have already been recorded for the months of May through November. c. On November 1 st Wingnut accepted $48,000 for annual subscriptions related to a monthly newsletter. HINT: An adjusting entries relative to this item have already been recorded for the month of November. d. Wingnut accepted a 18%,$100,000,45-day note receivable from LAMCO dated December 2nd, 2022 e. On Friday January 2, 2023 Wingnut employees were paid $30,000 for the TWO five-day work week then ended f. Wingnut had received a $5,200 cash advance on December 1 st for services to be rendered over the four month period beginning December 1, 2022 and ending March 28, 2023 g. A pitiful LAM took an inventory of supplies at Dec. 31st claiming that $8,300 were on-hand. h. Depreciation on equipment for December 2022 was calculated to be $1,52 h. Required: Prepare the appropriate adjusting entries Please type your adjusting journal entries below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts