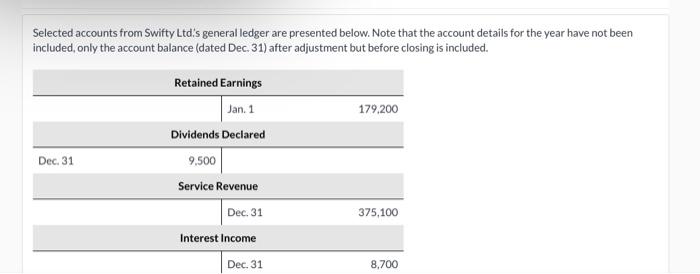

Question: Selected accounts from Swifty Ltd's general ledger are presented below. Note that the account details for the year have not been included, only the account

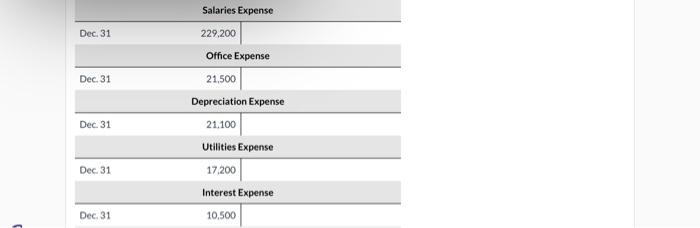

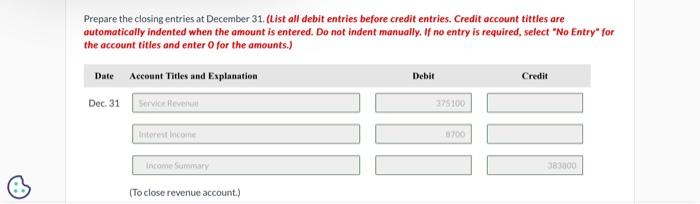

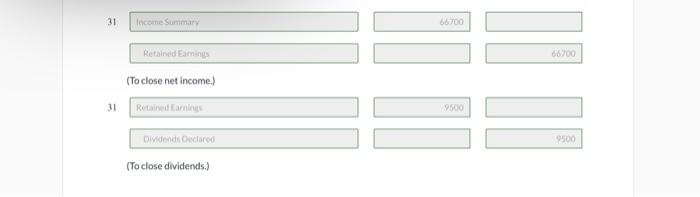

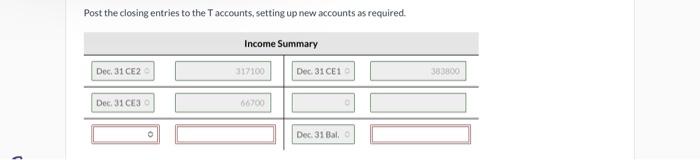

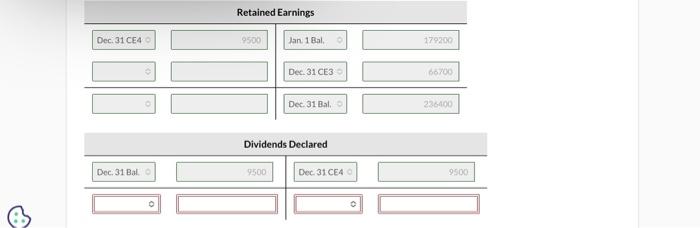

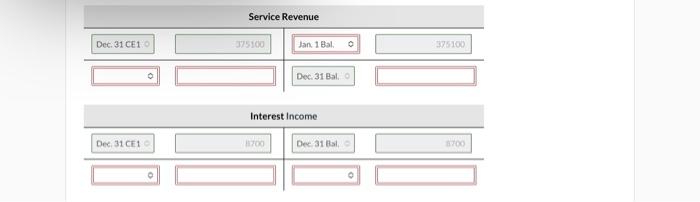

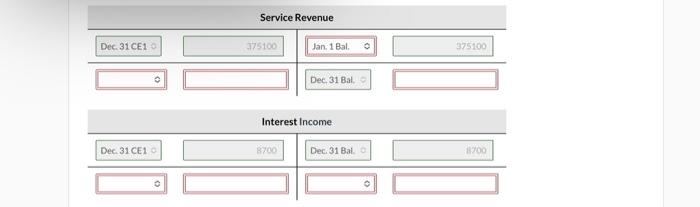

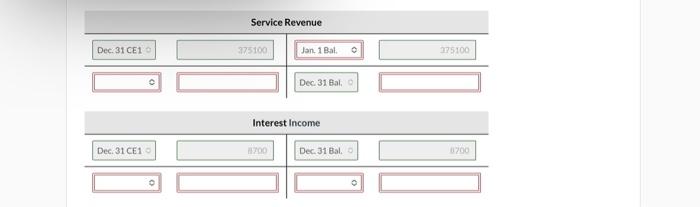

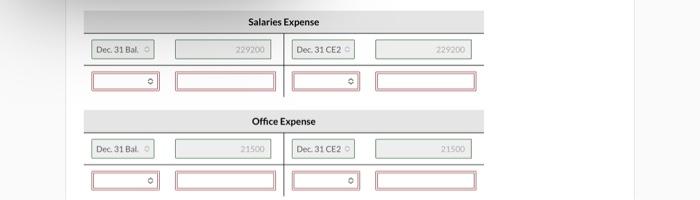

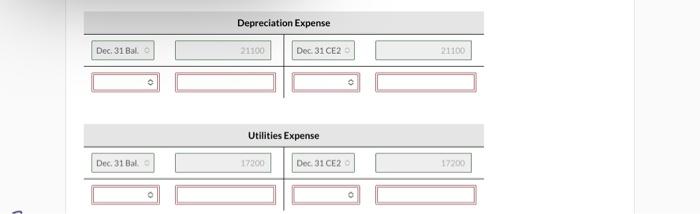

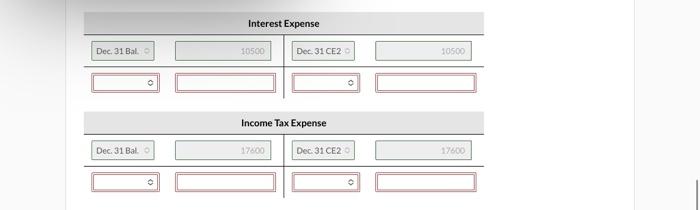

Selected accounts from Swifty Ltd's general ledger are presented below. Note that the account details for the year have not been included, only the account balance (dated Dec. 31) after adjustment but before closing is included. Salaries Expense Dec. 31 21.100 Utilities Expense \begin{tabular}{cc|} \hline Dec.31 & 17,200 \\ \hline Dec.31 & Interest Expens \\ \hline & 10,500 \end{tabular} Utilities Expense \begin{tabular}{rr|} \hline Dec, 31 & 17,200 \\ \hline Interest Expense \\ \hline Dec,31 & 10,500 \\ \hline \end{tabular} Income Tax Expense Dec, 31 17,600 Prepare the closing entries at December 31. (List all debit entries before credit entries. Credit account tittles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) 31 income Summary Salaries fipense Othice Empense Deprectation Eyperse Uulities Exyenot Interest Expone Irioine Tix LYpense (To close expense accounts.) 31 Income Summary 66700 Retained Eamings (To close net income.) 31 Retained farmings Divdends Desdared (To close dividends.) Post the closing entries to the T accounts, setting up new accounts as required. Retained Earnings Dec. 31 CE4 Dec. 31CE3 Dec. 31 Bal. Dividends Declared \begin{tabular}{|} \hline Dec, 31 Bal. 0 \\ \hline \hline \end{tabular} Service Revenue Interest Income Dec, 31 CE1 Dec-31 fal, Service Revenue Interest Income Dec. 31 CE1 Dec. 31Bal Service Revenue Interest Income Dec. 31 CE 1 Dec. 31 Bal. Salaries Expense Dec, 31CE2 Office Expense \begin{tabular}{l} \hline Dec.31 Bat. 0 \\ \hline 0 \\ \hline \end{tabular} Depreciation Expense Dec, 31 Bal ? Utilities Expense Interest Expense Income Tax Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts