Question: Selected answer is not necessarily correct- just my best guess. Thank you! Which of the following rules is CORRECT for capital budgeting analysis? Only incremental

Selected answer is not necessarily correct- just my best guess. Thank you!

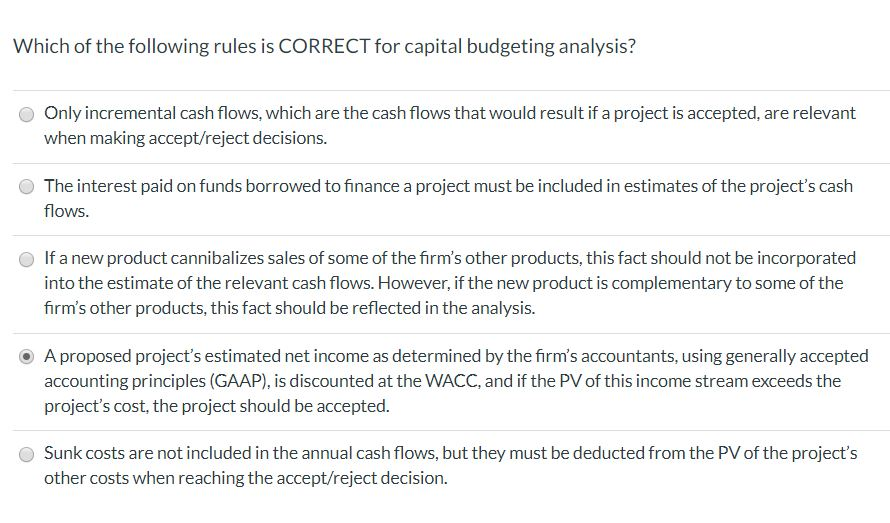

Which of the following rules is CORRECT for capital budgeting analysis? Only incremental cash flows, which are the cash flows that would result if a project is accepted, are relevant when making accept/reject decisions. The interest paid on funds borrowed to finance a project must be included in estimates of the project's cash flows. If a new product cannibalizes sales of some of the firm's other products, this fact should not be incorporated into the estimate of the relevant cash flows. However, if the new product is complementary to some of the frm's other products, this fact should be reflected in the analysis. A proposed project's estimated net income as determined by the firm's accountants, using generally accepted accounting principles (GAAP), is discounted at the WACC, and if the PV of this income stream exceeds the project's cost, the project should be accepted. Sunk costs are not included in the annual cash flows, but they must be deducted from the PV of the project's other costs when reaching the accept/reject decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts