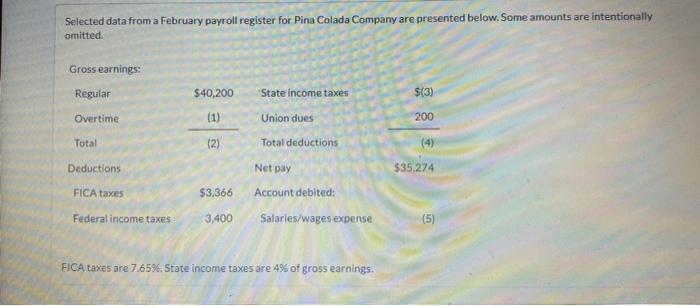

Question: Selected data from a February payroll register for Pina Colada Company are presented below. Some amounts are intentionally omitted. Gross earnings: Regular $40,200 State income

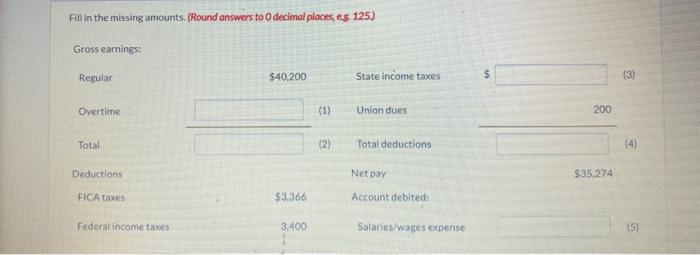

Selected data from a February payroll register for Pina Colada Company are presented below. Some amounts are intentionally omitted. Gross earnings: Regular $40,200 State income taxes $(3) Overtime (1) Union dues 200 Total (2) Total deductions (4) $35,274 Deductions Net pay FICA taxes $3,366 Account debited: Federal income taxes 3,400 Salaries/wages expense (5) FICA taxes are 7.65%. State income taxes are 4% of gross earnings. Fill in the missing amounts. (Round answers to decimal places, eg. 125.) Gross earnings: Regular $40.200 State income taxes $ ( 3) Overtime (1) Union dues 200 Total (2) Total deductions 4 Deductions Net pay $35.274 FICA taxes $3.366 Account debited Federal income taxes 3,400 Salaries/wages expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts