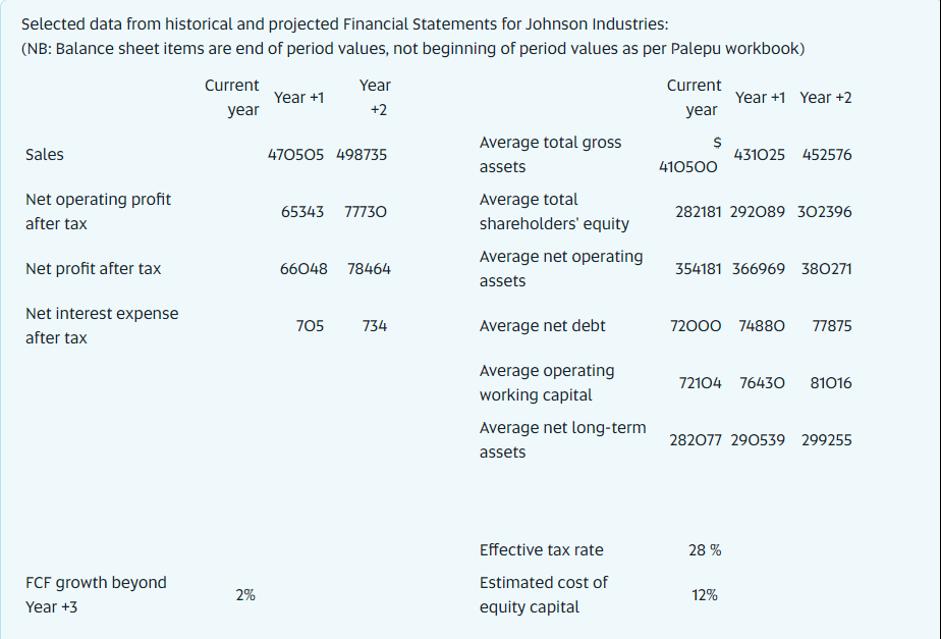

Question: Selected data from historical and projected Financial Statements for Johnson Industries: (NB: Balance sheet items are end of period values, not beginning of period

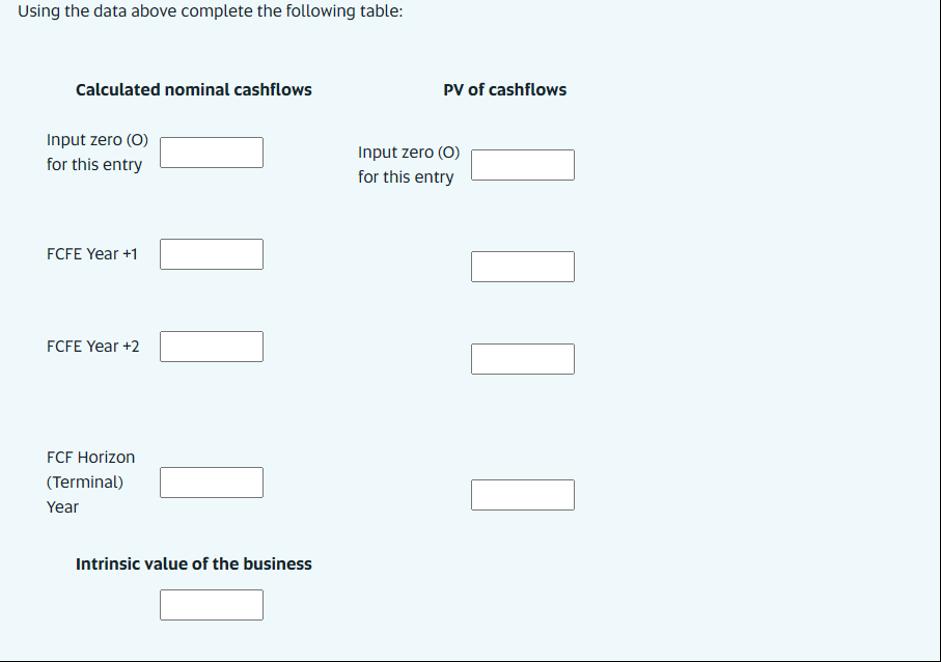

Selected data from historical and projected Financial Statements for Johnson Industries: (NB: Balance sheet items are end of period values, not beginning of period values as per Palepu workbook) Sales Net operating profit after tax Net profit after tax Net interest expense after tax FCF growth beyond Year +3 Current year 2% Year +1 Year +2 470505 498735 65343 77730 66048 78464 705 734 Average total gross assets Average total shareholders' equity Average net operating assets Average net debt Average operating working capital Average net long-term assets Effective tax rate Estimated cost of equity capital Current year $ 410500 Year +1 Year +2 282181 292089 302396 431025 452576 354181 366969 380271 72000 74880 77875 72104 76430 81016 28 % 282077 290539 299255 12% Using the data above complete the following table: Calculated nominal cashflows Input zero (0) for this entry FCFE Year +1 FCFE Year +2 FCF Horizon (Terminal) Year Intrinsic value of the business PV of cashflows Input zero (O) for this entry

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Johnson Industries Calculation of Nominal Cashflows Year FCFE Current 65343 Year 1 77730 Year 2 6604... View full answer

Get step-by-step solutions from verified subject matter experts