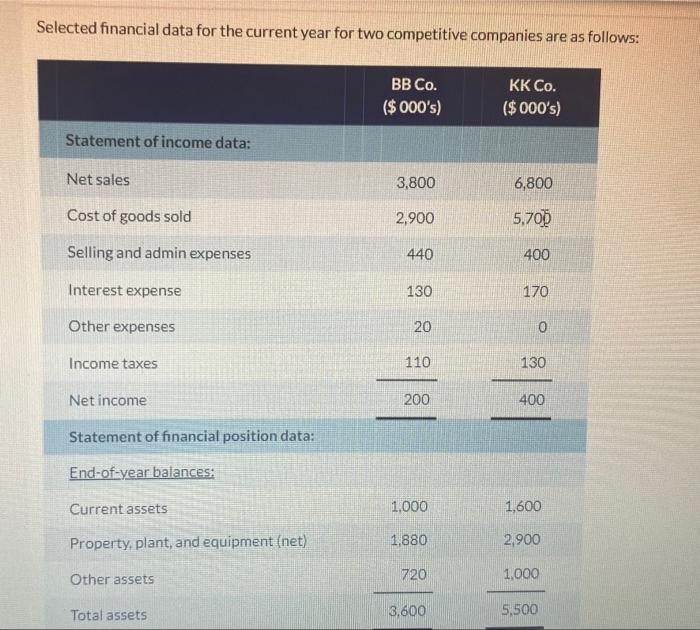

Question: Selected financial data for the current year for two competitive companies are as follows: BB Co. ($ 000's) KK Co. ($ 000's) Statement of income

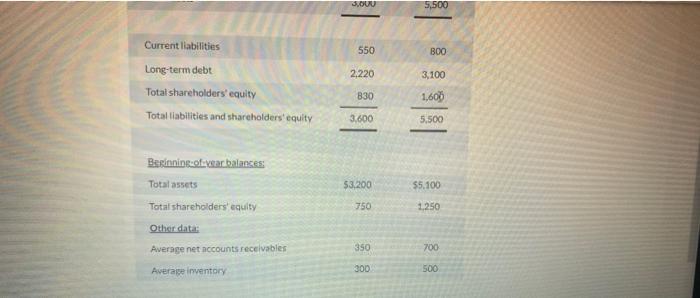

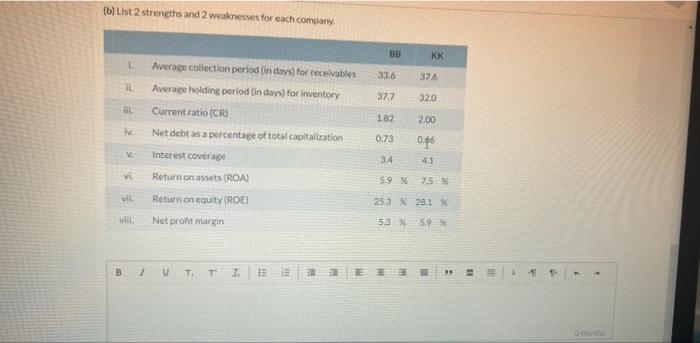

Selected financial data for the current year for two competitive companies are as follows: BB Co. ($ 000's) KK Co. ($ 000's) Statement of income data: Net sales 3,800 6,800 Cost of goods sold 2,900 5,700 Selling and admin expenses 440 400 Interest expense 130 170 Other expenses 20 0 Income taxes 110 130 Net income 200 400 Statement of financial position data: End-of-year balances: Current assets 1,000 1,600 Property, plant, and equipment (net) 1,880 2,900 720 1,000 Other assets Total assets 3,600 5,500 3,000 5,500 Current liabilities 550 BOO Long-term debt 2,220 3,100 Total shareholders' equity 830 1,600 Total liabilities and shareholders' equity 3,600 5,500 Beginning of year balances: Total assets $3,200 $5.100 Total shareholders' equity 750 1,250 Other data: Average net accounts receivables 350 700 Average inventory 300 500 (b) List 2 strengths and 2 weaknesses for each company. BB KK L Average collection period (in days) for receivables 33.6 37.6 IL Average holding period (in days) for inventory 37.7 32.0 BL Current ratio (CR) 182 2.00 iv. Net debt as a percentage of total capitalization 0.73 0.46 V Interest coverage 3.4 4.1 vi. Return on assets (ROA) VIL Return on equity (ROE) viil. Net profit margin 5.9 % 7.5 % 25.3 % 28.1 % 5.3 % 5.9 % BIU T TI OW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts