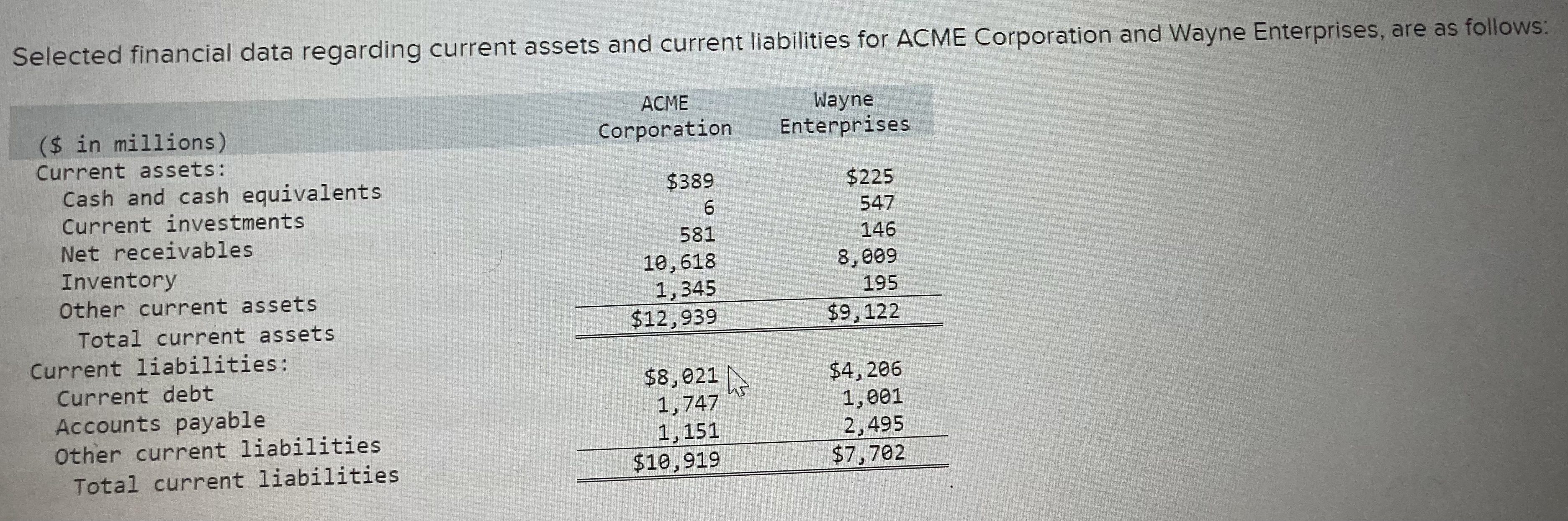

Question: Selected financial data regarding current assets and current liabilities for ACME Corporation and Wayne Enterprises, are as follows: Required: 1-a. Calculate the current ratio for

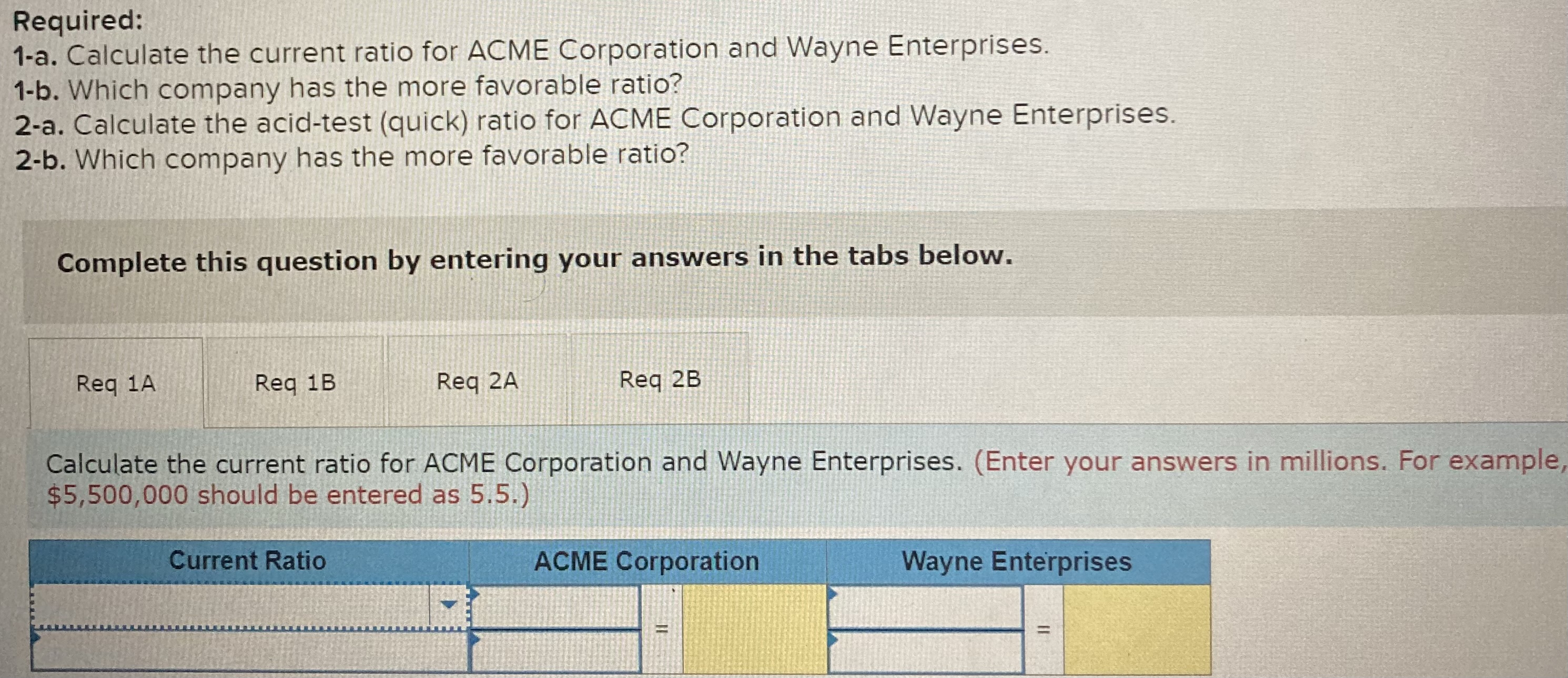

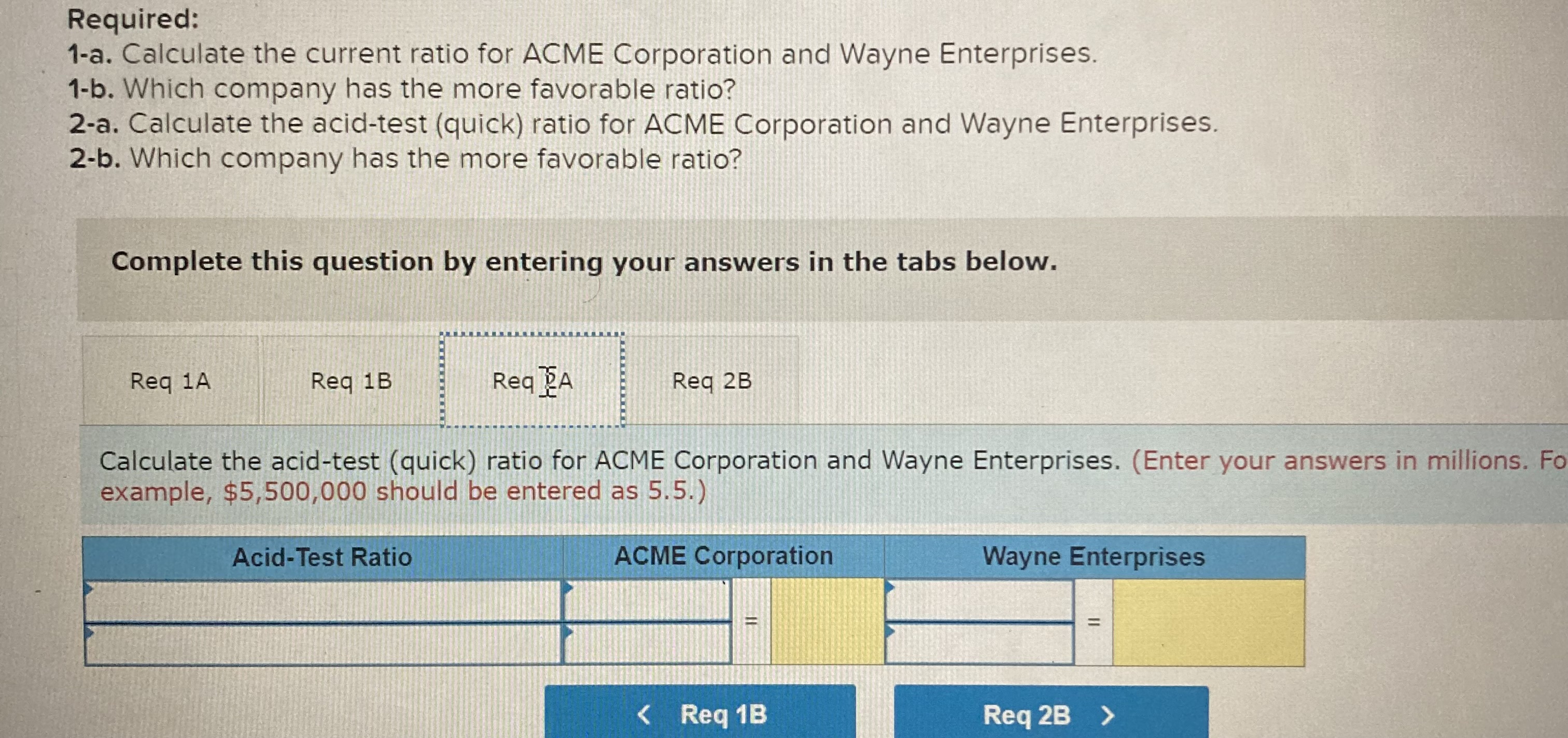

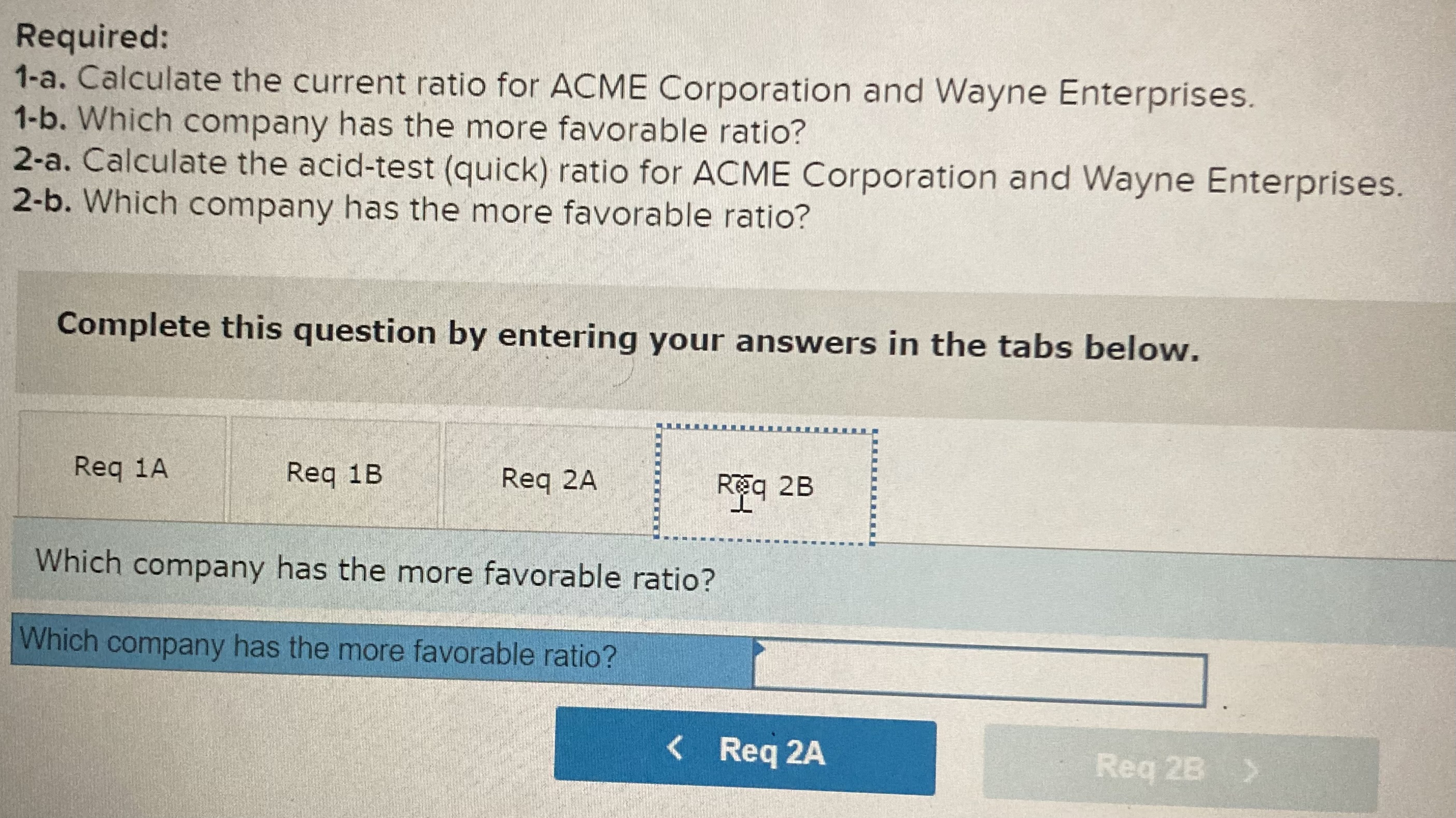

Selected financial data regarding current assets and current liabilities for ACME Corporation and Wayne Enterprises, are as follows: Required: 1-a. Calculate the current ratio for ACME Corporation and Wayne Enterprises. 1-b. Which company has the more favorable ratio? 2-a. Calculate the acid-test (quick) ratio for ACME Corporation and Wayne Enterprises. 2-b. Which company has the more favorable ratio? Complete this question by entering your answers in the tabs below. Calculate the current ratio for ACME Corporation and Wayne Enterprises. (Enter your answers in millions. For example $5,500,000 should be entered as 5.5 .) Required: 1-a. Calculate the current ratio for ACME Corporation and Wayne Enterprises. 1-b. Which company has the more favorable ratio? 2-a. Calculate the acid-test (quick) ratio for ACME Corporation and Wayne Enterprises. 2-b. Which company has the more favorable ratio? Complete this question by entering your answers in the tabs below. Which company has the more favorable ratio? Required: 1-a. Calculate the current ratio for ACME Corporation and Wayne Enterprises. 1-b. Which company has the more favorable ratio? 2-a. Calculate the acid-test (quick) ratio for ACME Corporation and Wayne Enterprises. 2-b. Which company has the more favorable ratio? Complete this question by entering your answers in the tabs below. Calculate the acid-test (quick) ratio for ACME Corporation and Wayne Enterprises. (Enter your answers in millions. Fo example, $5,500,000 should be entered as 5.5.) Required: 1-a. Calculate the current ratio for ACME Corporation and Wayne Enterprises. 1-b. Which company has the more favorable ratio? 2-a. Calculate the acid-test (quick) ratio for ACME Corporation and Wayne Enterprises. 2-b. Which company has the more favorable ratio? Complete this question by entering your answers in the tabs below. Which company has the more favorable ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts