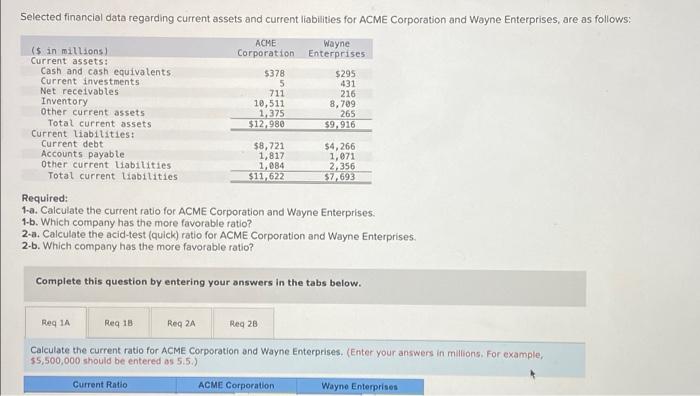

Question: Selected financial data regarding current assets and current liabilities for ACME Corporation and Wayne Enterprises, are as follows: ACME Corporation Wayne Enterprises ($ in millions)

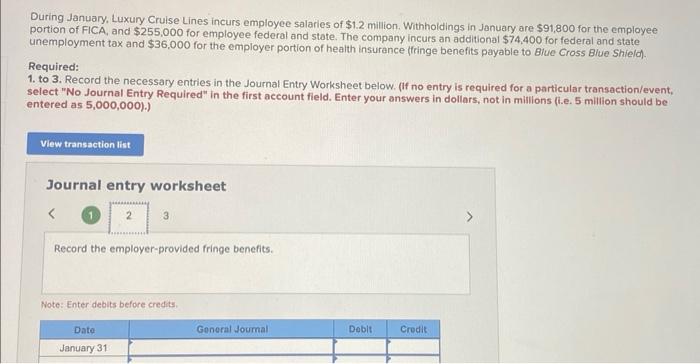

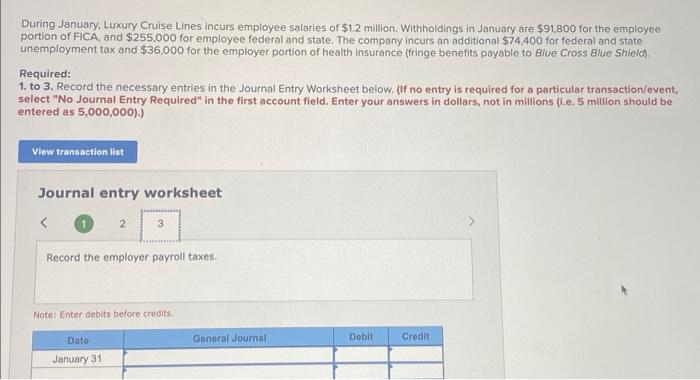

Selected financial data regarding current assets and current liabilities for ACME Corporation and Wayne Enterprises, are as follows: Required: 1-a. Calculate the current ratio for ACME Corporation and Woyne Enterprises. 1-b. Which company has the more favorable ratio? 2-a. Calculate the acid-test (quick) ratio for ACME Corporation and Wayne Enterprises 2-b. Which company has the more favorable ratio? Complete this question by entering your onswers in the tabs below. Calculate the current ratio for ACME Corporation and Wayne Enterprises. (Enter your answers in millions. For example, 55,500,000 should be entered os 5.5.) During January, Luxury Cruise Lines incurs employee salaries of $1.2 million. Withholdings in January are $91,800 for the employee portion of FICA, and $255,000 for employee federal and state. The company incurs an additional $74,400 for federal and state unemployment tax and $36,000 for the employer portion of health insurance (tringe benefits payable to Blue Cross Blue Shield). Required: 1. to 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be entered as 5,000,000).) Journal entry worksheet During January, Luxury Cruise Lines incurs employee salaries of $1.2 million. Withholdings in January are $91,800 for the employee portion of FICA, and $255,000 for employee federal and state. The company incurs an additional $74,400 for federal and state unemployment tax and $36,000 for the employer portion of health insurance (fringe benefits payable to Blue Cross Blue Shie/d). Required: 1. to 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event. select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be entered as 5,000,000).) Journal entry worksheet Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts