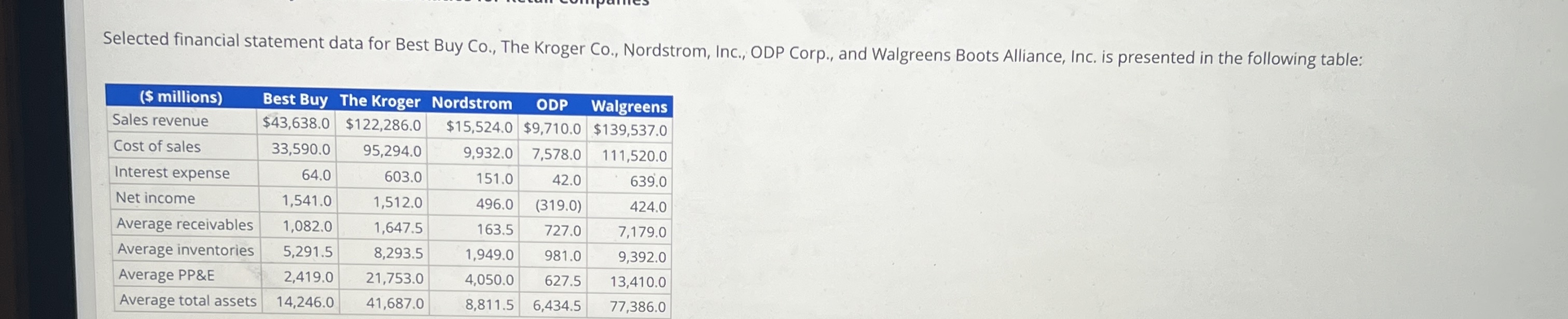

Question: Selected financial statement data for Best Buy Co., The Kroger Co., Nordstrom, Inc., ODP Corp., and Walgreens Boots Alliance, Inc. is presented in the following

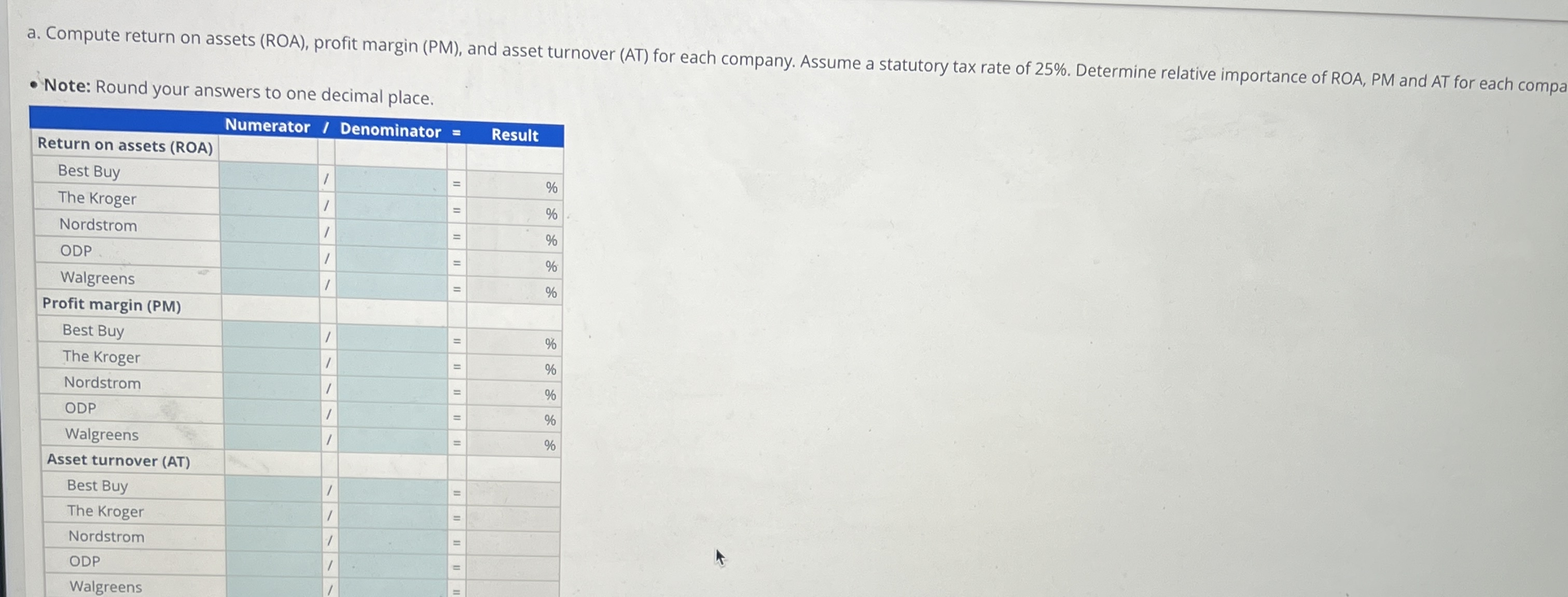

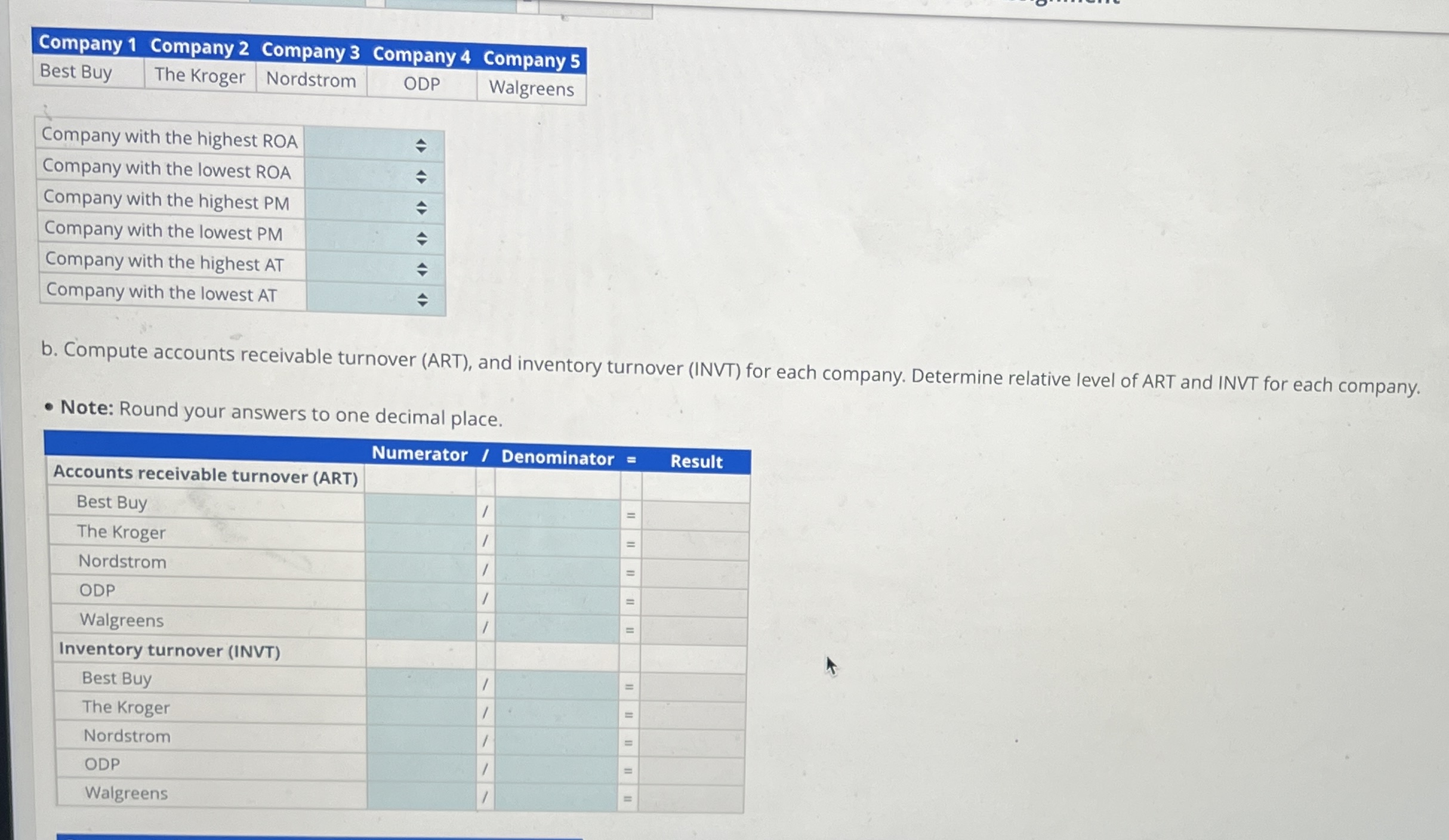

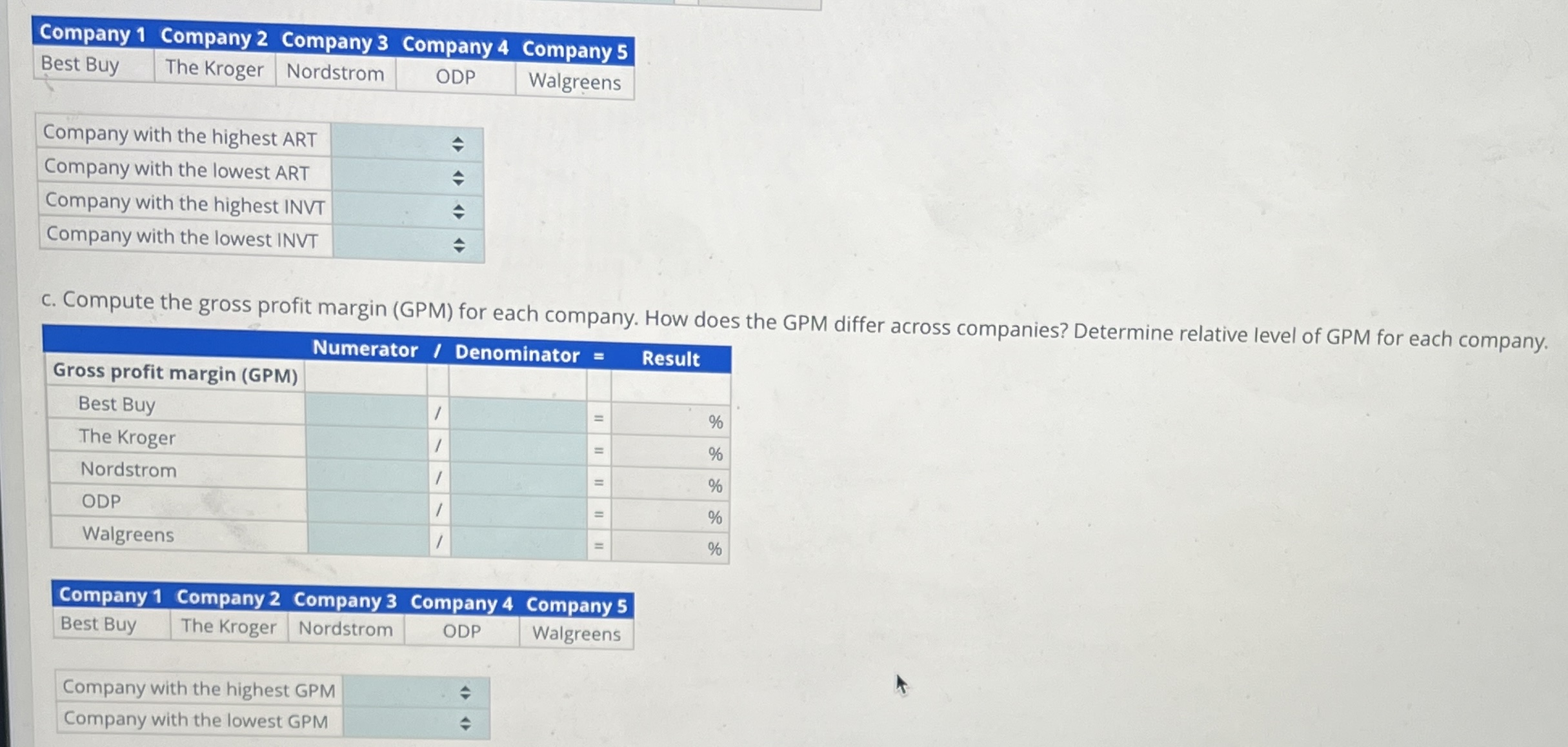

Selected financial statement data for Best Buy Co., The Kroger Co., Nordstrom, Inc., ODP Corp., and Walgreens Boots Alliance, Inc. is presented in the following table: \begin{tabular}{|l|c|c|c|c|} \hline Company 1 & Company 2 & Company 3 & Company 4 & Company 5 \\ \hline Best Buy & The Kroger & Nordstrom & ODP & Walgreens \\ \hline \end{tabular} \begin{tabular}{|l|} \hline Company with the highest ART \\ \hline Company with the lowest ART \\ \hline Company with the highest INVT \\ \hline Company with the lowest INVT \end{tabular} c. Compute the gross profit margin (GPM) for each company. How does the GPM differ across companies? Determine relative level of GPM for each company. \begin{tabular}{|c|c|c|c|c|} \hline & Numerator I & Denominator & = & Result \\ \hline Gross profit margin (GPM) & & & & \\ \hline Best Buy & 1 & & = & % \\ \hline The Kroger & 1 & & = & % \\ \hline Nordstrom & 1 & & = & % \\ \hline ODP & 1 & & = & % \\ \hline Walgreens & 1 & & = & % \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline Company 1 & Company 2 & Company 3 & Company 4 & Company 5 \\ \hline Best Buy & The Kroger & Nordstrom & ODP & Walgreens \\ \hline \end{tabular} Company with the highest GPM Company with the lowest GPM a. Compute return on assets (ROA), profit margin (PM), and asset turnover (AT) for each company. Assume a statutory tax rate of 25%. Determine relative importance of ROA, PM and AT for each comp. - Note: Round your answers to one decimal place b. Compute accounts receivable turnover (ART), and inventory turnover (INVT) for each company. Determine relative level of ART and INVT for each company. - Note: Round your answers to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts