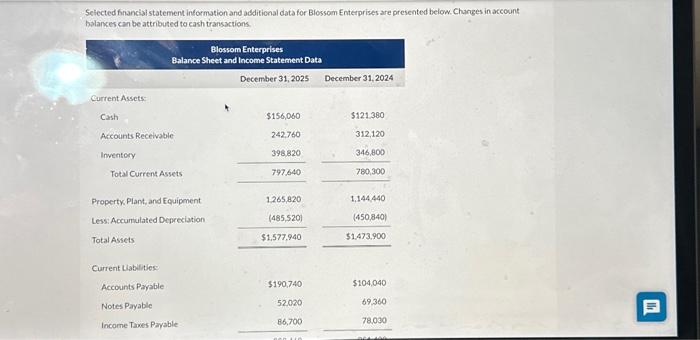

Question: Selected financial statement informution and additional data for Blossom Enterprises are presented below. Changes in account balarxes can be attributed to cash transactions. begin{tabular}{lrrr} Income

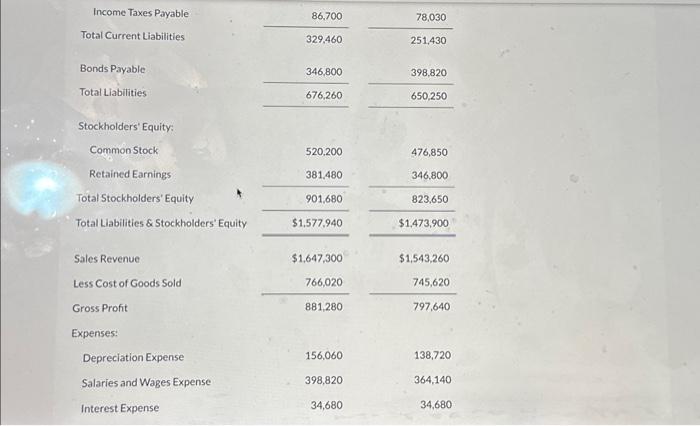

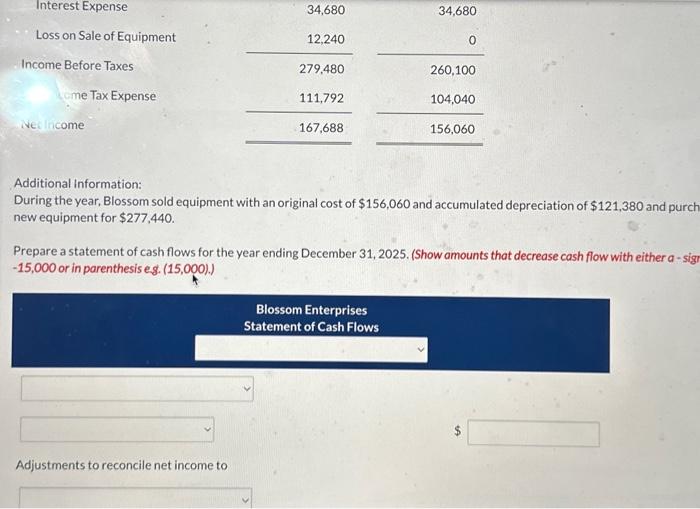

Selected financial statement informution and additional data for Blossom Enterprises are presented below. Changes in account balarxes can be attributed to cash transactions. \begin{tabular}{lrrr} Income Taxes Payable & 86,700 & & 78,030 \\ Total Current Liabilities & 329,460 & & 251,430 \\ Bonds Payable & 346,800 & & 398,820 \\ \hline Total Liabilities & 676,260 & & 650,250 \\ \hline \end{tabular} Stockholders' Equity: \begin{tabular}{|c|c|c|} \hline Common Stock & 520,200 & 476,850 \\ \hline Retained Earnings & 381,480 & 346,800 \\ \hline Total Stockholders' Equity & 901.680 & 823,650 \\ \hline Total Liabilities \& Stockholders' Equity & $1,577,940 & $1,473,900 \\ \hline Sales Revenue & $1,647,300 & $1,543,260 \\ \hline Less Cost of Goods Sold & 766,020 & 745,620 \\ \hline Gross Profit & 881,280 & 797,640 \\ \hline Expenses: & & \\ \hline Depreciation Expense & 156,060 & 138,720 \\ \hline Salaries and Wages Expense & 398,820 & 364,140 \\ \hline Interest Expense & 34,680 & 34,680 \\ \hline \end{tabular} Additional information: During the year, Blossom sold equipment with an original cost of $156,060 and accumulated depreciation of $121,380 and purch new equipment for $277,440. Prepare a statement of cash flows for the year ending December 31, 2025. (Show amounts that decrease cash flow with either asig 15,000 or in parenthesis es. (15,000).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts