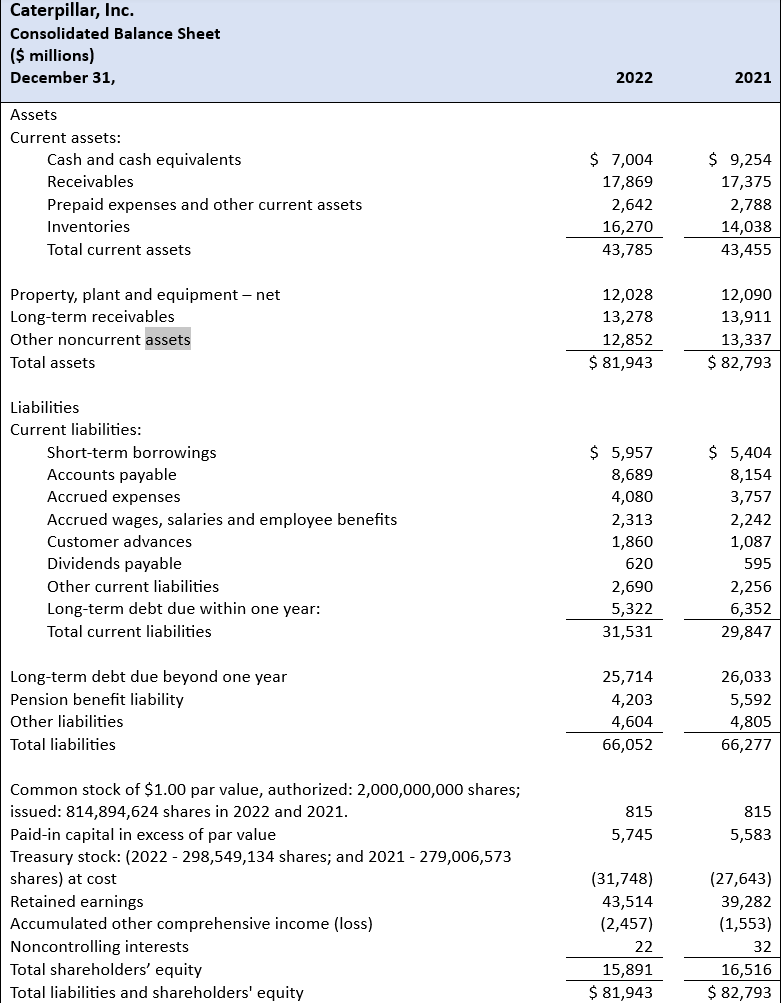

Question: Selected income statement information ( $ millions ) Selected notes: Note B . Receivables Receivables are reported net of allowances for credit losses of

Selected income statement information $ millions

Selected notes:

Note B Receivables

Receivables are reported net of allowances for credit losses of $ million and $ million in and respectively. The provision for credit losses, included in Selling, general and administrative expenses, was $ million in and $ million in

Note C Inventories

We state inventories at the lower of cost or net realizable value. We principally determine cost using the lastin firstout LIFO method. The value of inventories on the LIFO basis represented about percent and percent of total inventories at December and respectively. If the FIFO firstin firstout method had been in use, inventories would have been $ million and $ million higher than reported at December and respectively.

Note D Property, plant and equipment

We compute depreciation of plant and equipment principally using accelerated methods. We compute depreciation on equipment leased to others using the straightline method over the term of the lease. The depreciable basis is the original cost of the equipment less the estimated residual value of the equipment at the end of the lease term. In and consolidated depreciation expense was $ million and $ million, respectively. Required:

Note that CAT has receivables listed as current assets and as noncurrent assets. Compute the amount of cash CAT collected from customers in Be sure to take into account its credit losses.

CAT uses LIFO. What amount of profit before income taxes would have been reported in if CAT used FIFO to value its inventories?

Compute the inventory turnover in days for assuming CAT had used FIFO to value its inventories.

During CAT sold property, plant and equipment for $ million in cash. The PP&E had an original cost of $ million. Calculate the gain or loss on the sale of this PP&E

CAT reported no asset impairments in What amount of PP&E did CAT purchase in

Calculate the percent depreciated ratio for CAT at the end of

In early CAT issued $ million of year, bonds with a yield of The bonds pay interest semiannually. Were these bonds issued at a discount or a premium?

Calculate the interest expense that CAT reported in on the bonds described in question Round your answer to the nearest thousand dollars.

Note that CAT reports a liability for dividends payable in its balance sheet. Calculate the amount of dividends CAT paid in cash in

CAT has a restricted stock compensation plan. During CAT purchased treasury stock costing $ million for future restricted stock grants. When the restricted stock is granted to employees, it is recorded as unearned compensation. What amount of unearned compensation did CAT record in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock