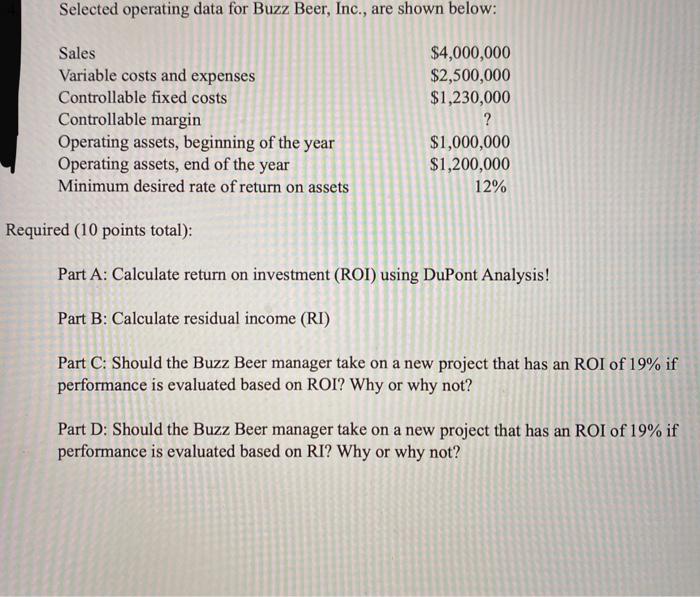

Question: Selected operating data for Buzz Beer, Inc., are shown below: Sales Variable costs and expenses Controllable fixed costs Controllable margin Operating assets, beginning of the

Selected operating data for Buzz Beer, Inc., are shown below: Sales Variable costs and expenses Controllable fixed costs Controllable margin Operating assets, beginning of the year Operating assets, end of the year Minimum desired rate of return on assets $4,000,000 $2,500,000 $1,230,000 ? $1,000,000 $1,200,000 12% Required (10 points total): Part A: Calculate return on investment (ROI) using DuPont Analysis! Part B: Calculate residual income (RI) Part C: Should the Buzz Beer manager take on a new project that has an ROI of 19% if performance is evaluated based on ROI? Why or why not? Part D: Should the Buzz Beer manager take on a new project that has an ROI of 19% if performance is evaluated based on RI? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts