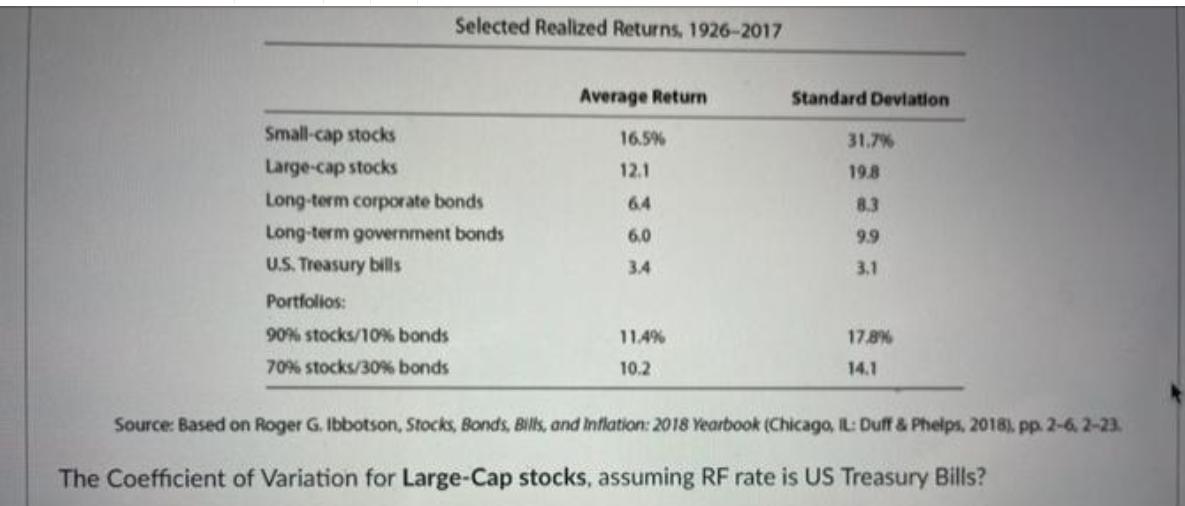

Question: Selected Realized Returns, 1926-2017 Average Return Standard Deviation Small-cap stocks 16.5% 31.7% Large-cap stocks 12.1 19.8 Long-term corporate bonds 64 8.3 Long-term government bonds

Selected Realized Returns, 1926-2017 Average Return Standard Deviation Small-cap stocks 16.5% 31.7% Large-cap stocks 12.1 19.8 Long-term corporate bonds 64 8.3 Long-term government bonds 6.0 9.9 U.S. Treasury bills 3.4 3.1 Portfolios: 90% stocks/10% bonds 70% stocks/30% bonds 11.4% 10.2 17.8% 14.1 Source: Based on Roger G. Ibbotson, Stocks, Bonds, Bills, and Inflation: 2018 Yearbook (Chicago, IL: Duff & Phelps, 2018), pp. 2-6, 2-23. The Coefficient of Variation for Large-Cap stocks, assuming RF rate is US Treasury Bills?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts