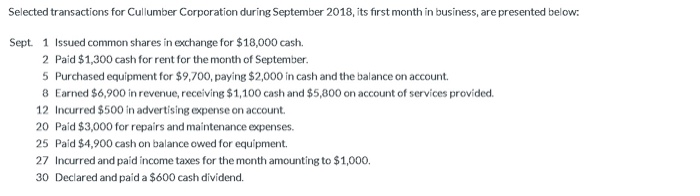

Question: Selected transactions for Cullumber Corporation during September 2018, its first month in business, are presented below: Sept. 1 Issued common shares in exchange for $18,000

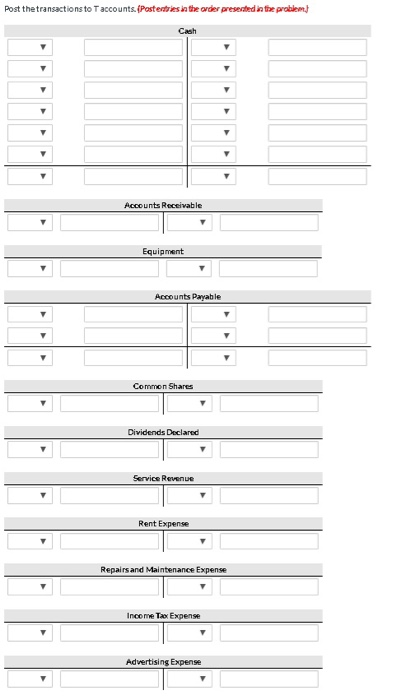

Selected transactions for Cullumber Corporation during September 2018, its first month in business, are presented below: Sept. 1 Issued common shares in exchange for $18,000 cash. 2 Paid $1,300 cash for rent for the month of September. 5 Purchased equipment for $9,700, paying $2,000 in cash and the balance on account. 8 Earned $6,900 in revenue, receiving $1,100 cash and $5,800 on account of services provided 12 Incurred $500 in advertising expense on account. 20 Paid $3,000 for repairs and maintenance expenses. 25 Paid $4,900 cash on balance owed for equipment, 27 Incurred and paid income taxes for the month amounting to $1,000. 30 Declared and paid a $600 cash dividend. Post the transactions to accounts.(Postestesia the order presented in the problem Accounts Receivable Equipment Accounts Payable Common Shares Dividends Declared Service Revenue Rent Expense Repairs and Maintenance Expense Income Tax Expense Advertising Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts