Question: SELF STUDY MODULES (SSM) Modules 5. 6. and 7 are designated as SSM. PURPOSE: Modules 5(CCA), 6(Business Income) and 7(Corporate Taxable income) are set as

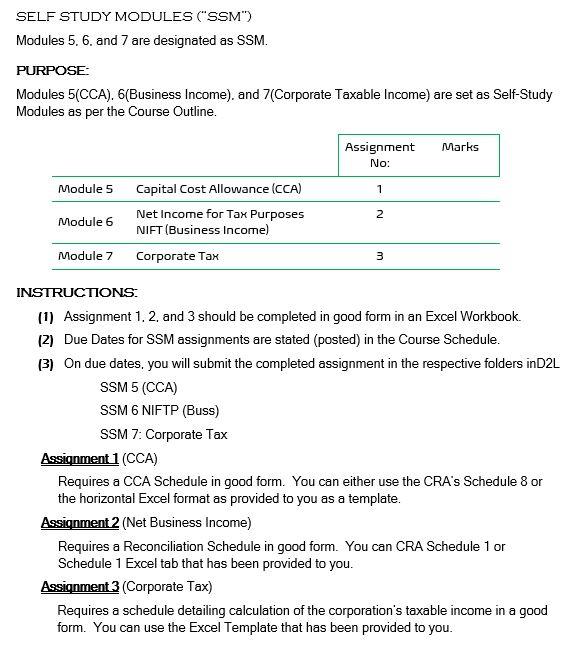

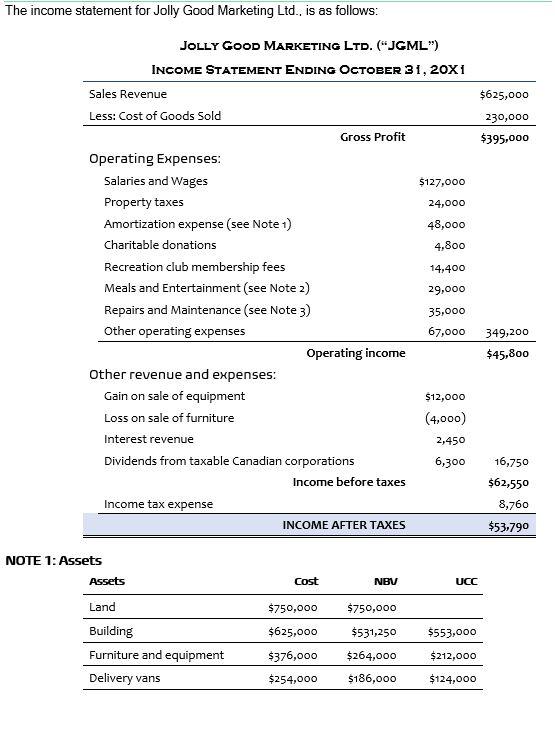

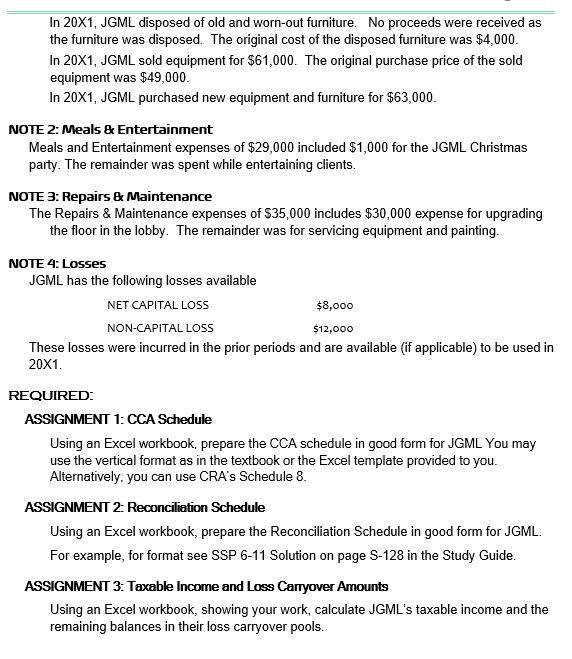

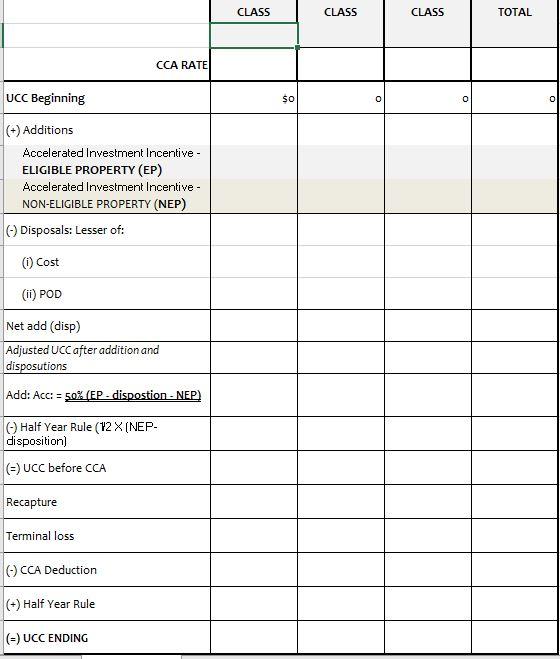

SELF STUDY MODULES ("SSM") Modules 5. 6. and 7 are designated as SSM. PURPOSE: Modules 5(CCA), 6(Business Income) and 7(Corporate Taxable income) are set as Self-Study Modules as per the Course Outline. Assignment Marks No: Module 5 1 2 Module 6 Capital Cost Allowance (CCA) Net Income for Tax Purposes NIFT (Business Income) Corporate Tax Module 7 3 INSTRUCTIONS: (1) Assignment 1, 2 and 3 should be completed in good form in an Excel Workbook. (2) Due Dates for SSM assignments are stated (posted) in the Course Schedule. (3) On due dates, you will submit the completed assignment in the respective folders inD2L SSM 5 (CCA) SSM 6 NIFTP (Buss) SSM 7: Corporate Tax Assignment 1 (CCA) Requires a CCA Schedule in good form. You can either use the CRA's Schedule 8 or the horizontal Excel format as provided to you as a template. Assignment 2 (Net Business Income) Requires a Reconciliation Schedule in good form. You can CRA Schedule 1 or Schedule 1 Excel tab that has been provided to you. Assignment 3 (Corporate Tax) Requires a schedule detailing calculation of the corporation's taxable income in a good form. You can use the Excel Template that has been provided to you. The income statement for Jolly Good Marketing Ltd., is as follows: $625,000 230,000 $395,000 JOLLY GOOD MARKETING LTD. ("JGML") INCOME STATEMENT ENDING OCTOBER 31, 20X1 Sales Revenue Less: Cost of Goods Sold Gross Profit Operating Expenses: Salaries and Wages $127,000 Property taxes 24,000 Amortization expense (see Note 1) 48,000 Charitable donations 4,800 Recreation club membership fees 14,400 Meals and Entertainment (see Note 2) 29,000 Repairs and Maintenance (see Note 3) 35,000 Other operating expenses 67,000 Operating income Other revenue and expenses: Gain on sale of equipment $12,000 Loss on sale of furniture (4,000) Interest revenue 2,450 Dividends from taxable Canadian corporations 6,300 Income before taxes Income tax expense INCOME AFTER TAXES 349,200 $45,800 16,750 $62,550 8,760 $53,790 Cost NBV UCC $750,000 $750,000 NOTE 1: Assets Assets Land Building Furniture and equipment Delivery vans $553,000 $625,000 $376,000 $531,250 $264,000 $186,000 $212,000 $254,000 $124,000 In 20X1, JGML disposed of old and worn-out furniture. No proceeds were received as the furniture was disposed. The original cost of the disposed furniture was $4.000. In 20X1, JGML sold equipment for $61,000. The original purchase price of the sold equipment was $49,000. In 20X1, JGML purchased new equipment and furniture for $63,000 NOTE 2: Meals & Entertainment Meals and Entertainment expenses of $29,000 included $1,000 for the JGML Christmas party. The remainder was spent while entertaining clients. NOTE 3: Repairs & Maintenance The Repairs & Maintenance expenses of $35,000 includes $30,000 expense for upgrading the floor in the lobby. The remainder was for servicing equi ent and painting. NOTE 4: Losses JGML has the following losses available NET CAPITAL LOSS $8,000 NON-CAPITAL LOSS $12,000 These losses were incurred in the prior periods and are available (if applicable) to be used in 20x1. REQUIRED: ASSIGNMENT 1: CCA Schedule Using an Excel workbook, prepare the CCA schedule in good form for JGML You may use the vertical format as in the textbook or the Excel template provided to you. Alternatively, you can use CRA's Schedule 8. ASSIGNMENT 2 Reconciliation Schedule Using an Excel workbook, prepare the Reconciliation Schedule in good form for JGML. For example, for format see SSP 6-11 Solution on page S-128 in the Study Guide. ASSIGNMENT 3: Taxable Income and Loss Carryover Amounts Using an Excel workbook, showing your work, calculate JGML's taxable income and the remaining balances in their loss carryover pools. CLASS CLASS CLASS TOTAL CCA RATE UCC Beginning so 0 0 (+) Additions Accelerated Investment Incentive - ELIGIBLE PROPERTY (EP) Accelerated Investment Incentive- NON-ELIGIBLE PROPERTY (NEP) (Disposals: Lesser of: (0) Cost (ii) POD Net add (disp) Adjusted UCC after addition and disposutions Add: Acc: = 50% (EP - dispostion - NEP) Half Year Rule (12 X (NEP- disposition) (=) UCC before CCA Recapture Terminal loss CCA Deduction (+) Half Year Rule (=) UCC ENDING SELF STUDY MODULES ("SSM") Modules 5. 6. and 7 are designated as SSM. PURPOSE: Modules 5(CCA), 6(Business Income) and 7(Corporate Taxable income) are set as Self-Study Modules as per the Course Outline. Assignment Marks No: Module 5 1 2 Module 6 Capital Cost Allowance (CCA) Net Income for Tax Purposes NIFT (Business Income) Corporate Tax Module 7 3 INSTRUCTIONS: (1) Assignment 1, 2 and 3 should be completed in good form in an Excel Workbook. (2) Due Dates for SSM assignments are stated (posted) in the Course Schedule. (3) On due dates, you will submit the completed assignment in the respective folders inD2L SSM 5 (CCA) SSM 6 NIFTP (Buss) SSM 7: Corporate Tax Assignment 1 (CCA) Requires a CCA Schedule in good form. You can either use the CRA's Schedule 8 or the horizontal Excel format as provided to you as a template. Assignment 2 (Net Business Income) Requires a Reconciliation Schedule in good form. You can CRA Schedule 1 or Schedule 1 Excel tab that has been provided to you. Assignment 3 (Corporate Tax) Requires a schedule detailing calculation of the corporation's taxable income in a good form. You can use the Excel Template that has been provided to you. The income statement for Jolly Good Marketing Ltd., is as follows: $625,000 230,000 $395,000 JOLLY GOOD MARKETING LTD. ("JGML") INCOME STATEMENT ENDING OCTOBER 31, 20X1 Sales Revenue Less: Cost of Goods Sold Gross Profit Operating Expenses: Salaries and Wages $127,000 Property taxes 24,000 Amortization expense (see Note 1) 48,000 Charitable donations 4,800 Recreation club membership fees 14,400 Meals and Entertainment (see Note 2) 29,000 Repairs and Maintenance (see Note 3) 35,000 Other operating expenses 67,000 Operating income Other revenue and expenses: Gain on sale of equipment $12,000 Loss on sale of furniture (4,000) Interest revenue 2,450 Dividends from taxable Canadian corporations 6,300 Income before taxes Income tax expense INCOME AFTER TAXES 349,200 $45,800 16,750 $62,550 8,760 $53,790 Cost NBV UCC $750,000 $750,000 NOTE 1: Assets Assets Land Building Furniture and equipment Delivery vans $553,000 $625,000 $376,000 $531,250 $264,000 $186,000 $212,000 $254,000 $124,000 In 20X1, JGML disposed of old and worn-out furniture. No proceeds were received as the furniture was disposed. The original cost of the disposed furniture was $4.000. In 20X1, JGML sold equipment for $61,000. The original purchase price of the sold equipment was $49,000. In 20X1, JGML purchased new equipment and furniture for $63,000 NOTE 2: Meals & Entertainment Meals and Entertainment expenses of $29,000 included $1,000 for the JGML Christmas party. The remainder was spent while entertaining clients. NOTE 3: Repairs & Maintenance The Repairs & Maintenance expenses of $35,000 includes $30,000 expense for upgrading the floor in the lobby. The remainder was for servicing equi ent and painting. NOTE 4: Losses JGML has the following losses available NET CAPITAL LOSS $8,000 NON-CAPITAL LOSS $12,000 These losses were incurred in the prior periods and are available (if applicable) to be used in 20x1. REQUIRED: ASSIGNMENT 1: CCA Schedule Using an Excel workbook, prepare the CCA schedule in good form for JGML You may use the vertical format as in the textbook or the Excel template provided to you. Alternatively, you can use CRA's Schedule 8. ASSIGNMENT 2 Reconciliation Schedule Using an Excel workbook, prepare the Reconciliation Schedule in good form for JGML. For example, for format see SSP 6-11 Solution on page S-128 in the Study Guide. ASSIGNMENT 3: Taxable Income and Loss Carryover Amounts Using an Excel workbook, showing your work, calculate JGML's taxable income and the remaining balances in their loss carryover pools. CLASS CLASS CLASS TOTAL CCA RATE UCC Beginning so 0 0 (+) Additions Accelerated Investment Incentive - ELIGIBLE PROPERTY (EP) Accelerated Investment Incentive- NON-ELIGIBLE PROPERTY (NEP) (Disposals: Lesser of: (0) Cost (ii) POD Net add (disp) Adjusted UCC after addition and disposutions Add: Acc: = 50% (EP - dispostion - NEP) Half Year Rule (12 X (NEP- disposition) (=) UCC before CCA Recapture Terminal loss CCA Deduction (+) Half Year Rule (=) UCC ENDING

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts