Question: Self - Study Problem 4 . 9 Silja is a single taxpayer. She earned wages of $ 7 , 0 0 0 from a pert

SelfStudy Problem

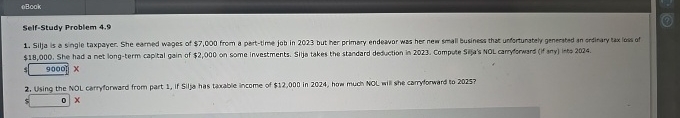

Silja is a single taxpayer. She earned wages of $ from a perttime job in but her primery endeavor was her new small business that unfortunately generated an sralinary lax ions of

$ She had a net longterm capital gain of $ on some investments. Sijjs takes the standard deduction in Compute Siga's NOL carnyfornars f anytos

X

Using the NOL carryforward from part If Silfa has tawable income of $ in how much NOL will she carrytorward to

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock