Question: Self Study Problem Two - 6 (Assessment Disputes) Mr. Norman Coffee has been one of your major clients for years. He is extremely wealthy and

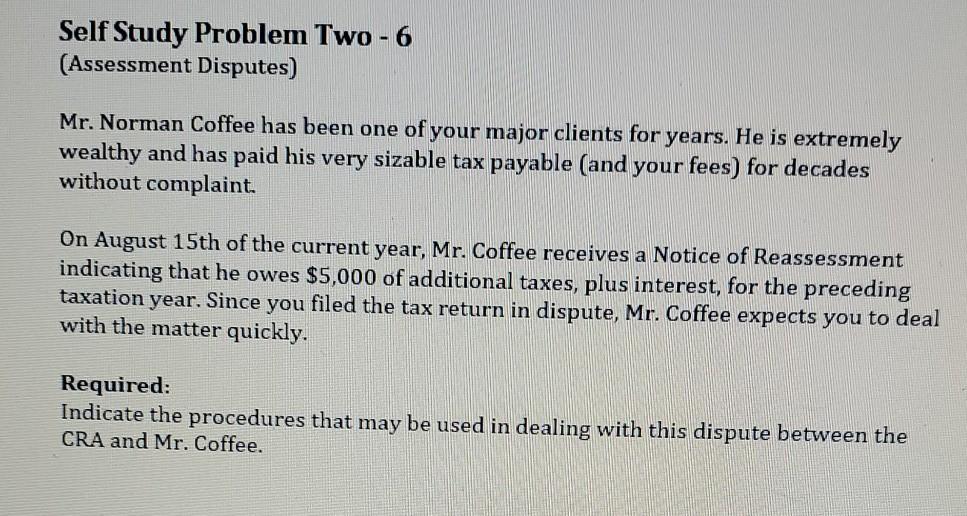

Self Study Problem Two - 6 (Assessment Disputes) Mr. Norman Coffee has been one of your major clients for years. He is extremely wealthy and has paid his very sizable tax payable (and your fees) for decades without complaint. On August 15th of the current year, Mr. Coffee receives a Notice of Reassessment indicating that he owes $5,000 of additional taxes, plus interest, for the preceding taxation year. Since you filed the tax return in dispute, Mr. Coffee expects you to deal with the matter quickly. Required: Indicate the procedures that may be used in dealing with this dispute between the CRA and Mr. Coffee. Self Study Problem Two - 6 (Assessment Disputes) Mr. Norman Coffee has been one of your major clients for years. He is extremely wealthy and has paid his very sizable tax payable (and your fees) for decades without complaint. On August 15th of the current year, Mr. Coffee receives a Notice of Reassessment indicating that he owes $5,000 of additional taxes, plus interest, for the preceding taxation year. Since you filed the tax return in dispute, Mr. Coffee expects you to deal with the matter quickly. Required: Indicate the procedures that may be used in dealing with this dispute between the CRA and Mr. Coffee

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts